Fu Shou Yuan offers western-style lawn burial grounds (top picture ) as well as horizontal tombs amidst lush greenery (bottom picture). Photos: Company IT'S GOT scarcity value as it's the only such major listco in China.

Fu Shou Yuan offers western-style lawn burial grounds (top picture ) as well as horizontal tombs amidst lush greenery (bottom picture). Photos: Company IT'S GOT scarcity value as it's the only such major listco in China. Its extensive landbank has growing value and its gross profit margin has stayed at the stratospheric 80% level in recent years -- and Citi Research expects it to stay up there over the next two years at least.

But, for whatever reason, it might give you the creeps to invest in the shares of Fu Shou Yuan International Group (1448.HK).

Note the inauspicious double four in its stock code.

The company is the largest cemetery operator and fourth-largest funeral services provider in China, and was listed on the Hong Kong Stock Exchange in Dec 2013.

It came to our attention after an avid investor sent this email with a Citi Research report: "Check out this company --- Fu Shou Yuan (1448 HK), the largest death-care company in China…. Sexy story. Look at the valuations given by the analyst, 1.2x PEG and 36x FY2015 PE."

(Citi was one of the 3 joint bookrunners and joint lead managers for the IPO.)

Even if there are investors who would steer clear of such a business, for whatever reason, there are many more who have embraced it -- which is why its stock price has floated to the heavens, from the IPO price of HK3.33 to HK$4.86 last Friday.

In fact, Fu Shou Yuan's IPO was red hot -- the retail portion was more than 681 times subscribed while the institutional tranche was "very significantly over-subscribed", a company filing said.

Private equity firm Carlyle Group LP owns a stake and was a pre-IPO investor.

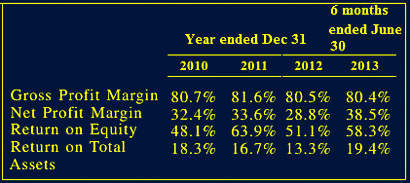

Fu Shou Yuan has demonstrated sterling financial metrics.

Fu Shou Yuan has demonstrated sterling financial metrics. Source: IPO prospectusAt HK$5.00, the stock is not cheap, trading at 47X its 2012 earnings as well as 47X forecast earnings in 2013.

Year 2013 is expected to show a slight decline in earnings per share due to the issue of new shares during the IPO but the core business is expected to generate a jump in earnings, going by Citi Research.

The research house values the stock at HK$6.50 based on discounted cash flow, using a discount rate of 8.1% and terminal growth rate of 2.2%.

The target price is equivalent to 2015E PE of 36x (on 31% earnings CAGR during 2012-15E) and price-earnings growth (PEG) rate of 1.2x.

This compares to global peers at PEG of 1.4x and weighted average PE of 15x (on 11% earnings CAGR during 2012-15E).

The target price is equivalent to 2015E PE of 36x (on 31% earnings CAGR during 2012-15E) and price-earnings growth (PEG) rate of 1.2x.

This compares to global peers at PEG of 1.4x and weighted average PE of 15x (on 11% earnings CAGR during 2012-15E).

Citi's HK$6.50 target price is at a 64% discount to the estimated HK$18.2/share market value of Fu Shou Yuan's land bank (based on historical ASP Rmb30,400 / sq m during 2010-1H13).

"This looks conservative compared with the average 50% discount to NAV among China mid-cap property stocks," said Citi.

According to Bloomberg data, AMTD also a 'buy' call -- but its target price is only HK$5.80.

On the other hand, CIMB has a 'hold' rating and a target price of HK$5.30.

Real-estate assets Fu Shou Yuan's IPO prospectus said its cemeteries and funeral facilities are located in eight major cities in the PRC.

The company owns and operates six cemeteries -- ie, two cemeteries in Shanghai and one cemetery each in Hefei in Anhui Province, Zhengzhou in Henan Province, Jinan in Shandong Province and Jinzhou in Liaoning Province.

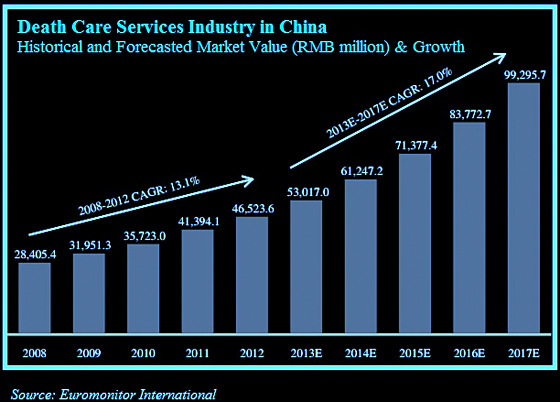

It operates five funeral facilities -- ie, two facilities in Chongqing and one funeral facility each in Shanghai, Hefei in Anhui Province, and Xiamen in Fujian Province. The industry outlook is good, with the its market value likely to almost double in size, to nearly 100 billion yuan, by 2017, according to a study by Euromonitor International (see chart above). |