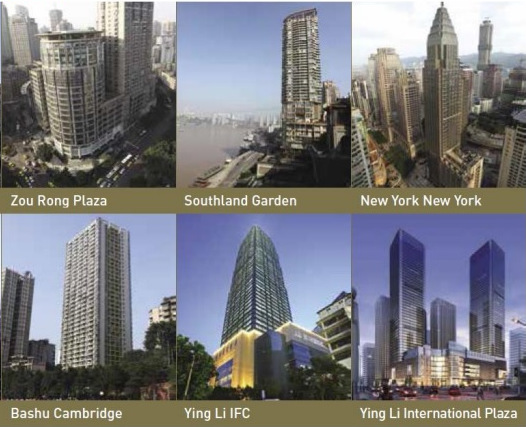

Excerpts from analysts' report CIMB analysts: Roy Chen (left) & William Tng, CFA (right) CIMB analysts: Roy Chen (left) & William Tng, CFA (right) Given its focus on high-end commercial development in Chongqing, Ying Li is expected to benefit from China’s Great Western Development Strategy. China Everbright (CEL)’s strategic investment into Ying Li could improve Ying Li’s Outlook. Given its key investments locations in the core CBD area of Chongqing, Ying Li is likely to be a prime beneficiary of Chongqing’s endeavours to become the financial centre of Western China. CEL’s strategic investment in Ying Li has significantly improved its outlook. We estimate that Ying Li is worth S$0.23-0.25, based on 40-45% discount to CY14 RNAV.  Some of the completed projects of Ying Li. Some of the completed projects of Ying Li. |

|

Boost from CEL CEL has become Ying Li’s second largest shareholder by subscribing to 381m new shares (14.9% stake). CEL may become the largest shareholder once its S$185m capital securities are converted. The transaction proceeds of Rmb1.37bn has provided Ying Li with ammunition for future expansion and lowered its net gearing ratio from 84% to 32%. Ying Li could capitalise on its strategic partnership with CEL by using CEL’s network to venture into other tier 1-2 cities in China or overseas markets like Hong Kong and Singapore. Presence in Gateway to West China Ying Li has a track record in Chongqing for high-end offices and retail real estates. Its completed developments such as New York New York and the International Financial Centre have become landmarks in Chongqing’s core CBD, which now resembles Raffles Place, Singapore and Lujiazui, Shanghai. We like Ying Li’s property portfolio for the scarcity of its prime locations. Chongqing’s GDP growth of 12.3% in 2013 is one of the fastest in China, thanks to its position as a gateway to Western China. Western China posted average GDP growth of 11% in 2013, above the nation’s average of 7.7%. Eye on JVs with CEL It would take time for Ying Li to unlock shareholders’ value. We estimate that Ying Li’s RNAV per share is S$0.42, including the dilution impact from the placement to CEL (at S$0.26) but excluding the impact from potential partnerships for new projects. We think Ying Li could be worth S$0.23-0.25, based on 40%-45% discount to RNAV. Given Ying Li’s development plans, shareholders are unlikely to receive dividends in the next 2-3 years. Potential re-rating catalysts include strategic JVs with CEL for a possible future REIT listing. Recent story: YING LI: China Everbright Ltd management commit to growth |

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

YING LI: Valued at 23-25 c on 40-45% discount to RNAV

- Details

You may also be interested in:

|

YING LI: Consolidating nicely around $0.14+, before the next up-move? |

|

YING LI: "Low downside makes for worthwhile investment" |

|

YING LI: All SOHO units in project's Tower 1 sold on Day 1 |

|

YING LI: 2016 will be a better year |

|

YING LI: Patience means profit |

|

YING LI’s current share price is lower than during GFC! |