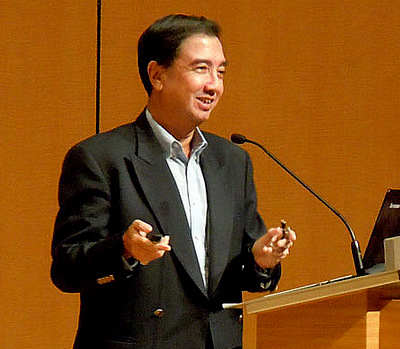

Kevin Scully, executive chairman of NRA Capital. Photo: NRAThe Xinhua News Agency reported on Tuesday that China's State-Owned Assets Supervision and Administration Commission wanted to merge both China CNR and CSR Corp - China's two state-owned railcar makers together. At the entities named above have refused to comment.

Kevin Scully, executive chairman of NRA Capital. Photo: NRAThe Xinhua News Agency reported on Tuesday that China's State-Owned Assets Supervision and Administration Commission wanted to merge both China CNR and CSR Corp - China's two state-owned railcar makers together. At the entities named above have refused to comment. I contacted Midas CEO Patrick Chew and asked for his views on the proposed merger.

He felt that was no negative impact on Midas but there could be some upside as it could be easier to do business with a single entity.

He also felt that an enlarged railcar maker in China could also be a more serious bidder and supplier of railcars in overseas projects.

It's an interesting view as Midas has supplied to both parties. But as of now its only a rumour but the impact on Midas is likely to be neutral the positive in the medium term.

Last week Midas announced a number of new contracts:

a) RMB257mn to supply aluminium alloy extrusion profiles to two major European train projects. The contracts will commence in 2014 to 2021.

b) RMB78.7mn municipal traim component parts contract from its jv company NPRT.

c) RMB897mn to its jv company NPRT for a metro train contract for the Nanjing Metro Ninghe Intercity line to be delivered between 2015 to 2016.

It seems that getting contracts is no longer a problem for Midas - we are however still awaiting more high speed train contracts. I asked Patrick what is the status of this. He indicated that both CSR and CNR were awarded high speed contracts in the 3rd week of September 2014 - this would not be dished out so soon.

The company is in the midst of finalising its Q3-2014 results. Top line and gross profit numbers are okay but there are large increases in interest expenses and other costs from its new ventures which are hurting the bottom line.

I am hopeful that it should be awarded more high speed contracts which together with a reduction in losses from its new business should help see some improvement in margins.

I still like the macro picture which is evidenced by the contracts they are winning. I guess the market wants to see an improvement in margins which seems to be lagging.

I also asked Patrick about whether he was aware whether there was institutional selling of Midas shares which accounted for the recent weakness in the share price. He said he has stopped asking for the shareholder list from CDP as it's expensive given that Midas has close to 17,000 shareholders.

My guess is that the Q2 results and maybe some asset allocation out of Asia to the US and EU markets contributed to the weakness in Midas shares but I won't be able to confirm this until its annual report is out in February 2015.

Recent story: MIDAS: Buy, 50-c target; CENTURION: Falling occupancy to come