This article was recently published on www.sharesinv.com, and is reproduced with permission. Chart: Yahoo Finance.

Chart: Yahoo Finance.

EVERY ONE OR two years, vehicle owners in Singapore would receive a letter from the Land Transport Authority notifying them to send their vehicles for a mandatory inspection.

Thus, as one of the duopoly in Singapore’s vehicle inspection market,Vicomis a name that should not be unfamiliar to local vehicle owners.

Vicom’s businesses can be separated into two broad segments: Firstly, the vehicle inspection and testing segment that encompasses vehicles inspections, assessments and other related services.

Secondly, the non-vehicle inspection and testing segment, which mainly engages in commercial/industrial testing for various industries carried out under its wholly-owned subsidiary SETSCO Services.

Since 2012, the company has switched to reporting both segments as a single entity in its financial reports. However, from past figures, the vehicle inspection and testing segment contributes roughly half of net profit, and this segment will be where I place my focus on.

Stable, Resilient Business

Vicom’s businesses seem to be rather recession proof, in particular its vehicle inspection segment since inspections are mandatory by law.

Inspections have to be carried out at one of the nine inspection centres. Vicom owns five centres with a majority stake in two others. Clearly, Vicom is the market leader.

From a financial perspective, Vicom appears to have survived the period post financial crisis and Eurozone crisis unscathed.

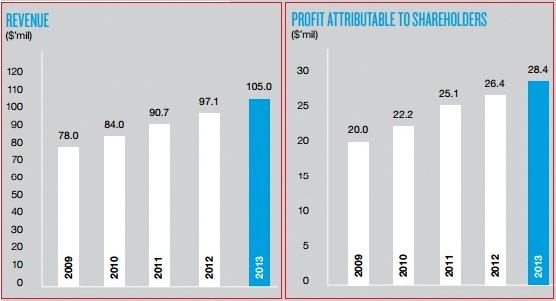

Revenue and net profit have been increasing steadily in the past five years at compound annual growth rates of 6.1 percent and 7.3 percent, respectively. In FY13, Vicom posted $105 million and $28.4 million in turnover and bottom line.

Examining Vicom’s share price for the past five years reveals a gradual, consistent growth that looks pretty impressive.

The capital appreciation in terms of share price gains over the years would make it a stock that value investors would dream to own, it traded at $2.93 at the end of 2010 and last closed at $6.65 on 29 July 2014.

COE Prices Up, Number Of Cars Down Source: Vicom annual reportVicom has benefited from the government’s policy of reducing the number of new Certificate of Entitlement (COE) issued that aimed to tackle congestion problems in Singapore in recent years

Source: Vicom annual reportVicom has benefited from the government’s policy of reducing the number of new Certificate of Entitlement (COE) issued that aimed to tackle congestion problems in Singapore in recent years

As the costs of owning a new car skyrocketed, vehicle owners kept their vehicles for a longer period. At the same time, purchases of second-hand vehicles have also increased.

Singapore’s law states that motor cars are required to undergo an inspection once every two years once the vehicle is older than three years. This creates a recurring customer base for Vicom.

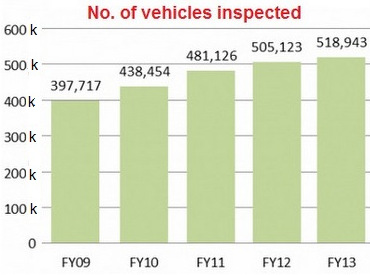

In fact, the number of vehicles passing through Vicom’s inspection lanes has increased steadily in the past five years.

However, I suspect that this trend might reverse in the next two to three years.

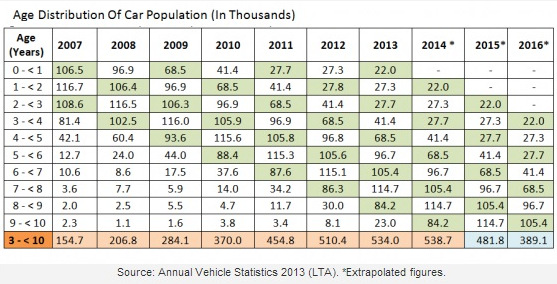

Looking at the age distribution of Singapore’s car population, a noticeable difference in the past five years is the significant dip in the number of new cars. The decrease is in line with the government’s policy as mentioned above.

While the government’s policy to reduce the number of new cars has worked to the benefit of Vicom in the past years, the same policy could have a negative impact on Vicom in the next few years.

As the number of new cars declined dramatically since 2009, it would translate to a shrinking pool of cars that are over three years old in the next few years.

I extrapolated the figures of the age distribution of the car population for the current and next two years (by simply rolling over the figures from the previous year down one row of the table).

Notice that the expected drop in the pool of cars above three years is likely to be prominent starting in 2015.

The downtrend is attributable to the large pool of cars that are between five to nine years as of 2013. Most vehicle owners are unlikely to opt for the extension of COE for their vehicles after 10 years as it a rather expensive option.

This downtrend does not bode well for Vicom as I would expect the demand for its services to weaken as its pool of potential customers shrinks.

The downtrend would be observable in the next two years, even if the number of new cars starts to increase.

SI Research Takeaway

The possible downtrend in Vicom could probably be testament to the idiom “What goes up must come down”, unless Vicom can find a way to navigate itself out of a potential downturn in its business cycle.

But given that Vicom has proved itself as a relatively resilient business in the past years, I would expect the management to have other plans that could possibly diversify its services that may help tide it through the downtrend.

There is still time for precautions as the projected downtrend seems to be more prominent only towards the end of 2015.

At the same time, if the government were to increase the number of new vehicles on the roads in the coming few years, it would be a positive sign for Vicom’s business somewhere further down the road.

Previous stories:

BIOSENSORS to privatise? VICOM target $6.28

VICOM: A Rare 5-Bagger In 5 Years But....Would You Buy It Now?