Excerpts from analysts' reports

UOB Kay Hian starts off with buy and $1.14 target for Riverstone Holdings

Analyst: Andreas Isabel Co, CFA

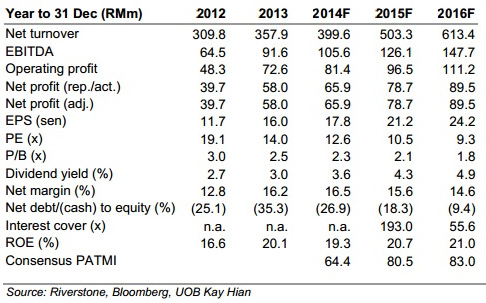

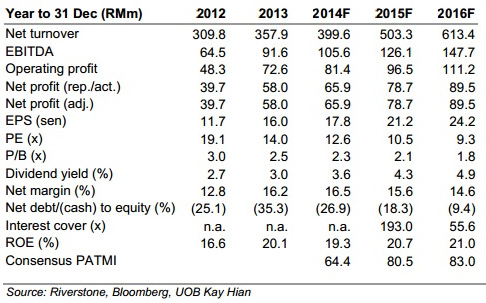

• Initiate coverage with a BUY; target price of S$1.14 represents 32.6% upside. Our target price is pegged at the sector’s historical mean PE of 14x applied to our 2015F EPS estimate of 8.2 S cents.

Riverstone chairman Wong Teek Son (seated) speaking with analysts and fund managers. NextInsight file photoThe stock currently trades at an attractive 10.5x PE despite the group’s higher margins and comparable ROE vs its peers. We project a conservative 3-year earnings CAGR of 15.6% and dividend yield of 3.6-4.9% based on a 45% payout.

Riverstone chairman Wong Teek Son (seated) speaking with analysts and fund managers. NextInsight file photoThe stock currently trades at an attractive 10.5x PE despite the group’s higher margins and comparable ROE vs its peers. We project a conservative 3-year earnings CAGR of 15.6% and dividend yield of 3.6-4.9% based on a 45% payout. • Global leader in high-tech cleanroom gloves that are mainly supplied to electronics manufacturers. Due to the advanced technical capabilities involved, the segment has high barriers to entry and commands ASPs that are 2.5-3x higher than healthcare gloves’.

Riverstone’s long-standing, blue-chip customers include Western Digital, Seagate and Hitachi, some of whom source their needs solely from the group.

Riverstone’s long-standing, blue-chip customers include Western Digital, Seagate and Hitachi, some of whom source their needs solely from the group.

• Higher margins due to niche in cleanroom and customised healthcare gloves. Excluding Hartalega, Riverstone posted the highest EBIT and net margins of 20% and 16% respectively in FY13 vs the peer-averages of 13% and 10%. Cleanroom gloves contribute 50% to Riverstone’s total glove sales but account for 70% of gross profit with gross margins of over 30% vs healthcare gloves’ 15-20%.

• Resilient demand from healthcare; strong take up from tablet and mobile contractors... Demand for gloves from the healthcare sector is likely to remain resilient driven by rising affluence, an ageing population, growing healthcare expenditure and greater hygiene awareness.

On the other hand, the cleanroom segment will be driven by higher penetration into the tablet and mobile segment, which now contributes 30% to the group’s cleanroom sales from 20% as at end-13.

On the other hand, the cleanroom segment will be driven by higher penetration into the tablet and mobile segment, which now contributes 30% to the group’s cleanroom sales from 20% as at end-13.

• ... to absorb 5b capacity expansion. Incoming new capacity will be taken up by bigger orders from existing healthcare customers. Growth in tablet and mobile supply will maintain the production mix at 70% for healthcare and 30% for cleanroom gloves. Phase one (1b gloves) will be commissioned progressively beginning Jul 14 while phase two (1b) is targeted to be operational by 3Q15.

• No debt, strong cash flows. With over RM100m in cash and RM80m in operating cash flow, we think phases 1-2 of the RM400m new factory will be funded internally.

Subsequently, we estimate the group will need to borrow funds at 5% and its gearing to be capped at 10% in 2015-16.

Recent story: RIVERSTONE: 1Q record profit of RM16.0 m, new factory to provide boost

Recent story: RIVERSTONE: 1Q record profit of RM16.0 m, new factory to provide boost