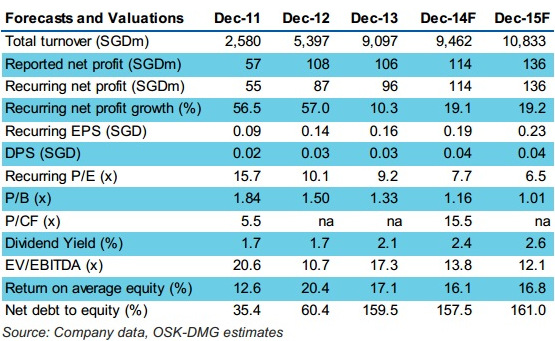

Excerpts from analysts' reports

OSK-DMG initiates coverage of CWT with $1.90 target

Analyst: Shekhar Jaiswal

CWT, Asia’s leading logistics service provider, has a rapidly growing commodity marketing business and proven growth track record, with profit growing 30% annually over 2009-2013.

A rebound in logistics business revenue (51% of profit), new commodities added to its highly scalable commodity marketing business (31% of profit) and a 50-60% discount to its peer valuation should re-rate the stock.

Resuming coverage on CWT with a BUY and SGD1.90 TP.

OSK-DMG initiates coverage of CWT with $1.90 target

Analyst: Shekhar Jaiswal

CWT, Asia’s leading logistics service provider, has a rapidly growing commodity marketing business and proven growth track record, with profit growing 30% annually over 2009-2013.

A rebound in logistics business revenue (51% of profit), new commodities added to its highly scalable commodity marketing business (31% of profit) and a 50-60% discount to its peer valuation should re-rate the stock.

Resuming coverage on CWT with a BUY and SGD1.90 TP.

Steady growth in logistics business. Logistics is the most profitable business, where revenue is the most stable and predictable source of overall earnings.

CWT has just constructed two oil storage tank facilities in Mongolia to facilitate its supply chain management activities.

CWT has just constructed two oil storage tank facilities in Mongolia to facilitate its supply chain management activities.

Photo: annual reportLogistics revenue, which fell by 1% first time ever in 2013, is expected to rebound, aided by recovering global trade flows, especially in Asia and Singapore’s rapid rise as a global trading hub.

CWT has just constructed two oil storage tank facilities in Mongolia to facilitate its supply chain management activities.

CWT has just constructed two oil storage tank facilities in Mongolia to facilitate its supply chain management activities. Photo: annual reportLogistics revenue, which fell by 1% first time ever in 2013, is expected to rebound, aided by recovering global trade flows, especially in Asia and Singapore’s rapid rise as a global trading hub.

Highly scalable growth from commodity marketing. Despite being a low-margin business, income from commodity marketing unit quadrupled to SGD40m in 2013.

Its revenue is highly scalable as volumes are small compared with that of its global peers, on top of the fact that CWT trades only in a few commodities.

CWT, which currently trades base metal, naphtha and diesel, looks to grow its naphtha volume and add gasoline and fuel oil to its existing portfolio over the next 1-2 years.

Its revenue is highly scalable as volumes are small compared with that of its global peers, on top of the fact that CWT trades only in a few commodities.

CWT, which currently trades base metal, naphtha and diesel, looks to grow its naphtha volume and add gasoline and fuel oil to its existing portfolio over the next 1-2 years.

Potential for unlocking value from warehouse assets. It uses the sale-and-leaseback model to recycle capital from its warehouses. Since 2006, it has securitised 5.2m sqf of warehouse space worth SGD817m, gaining SGD270m.

By end-2014, it will have 4.5m sqf of warehouse space in Singapore, valued at SGD564m, available to be securitised.

By end-2014, it will have 4.5m sqf of warehouse space in Singapore, valued at SGD564m, available to be securitised.

Debt is high but is manageable. Commodity marketing business requires high working capital to grow revenue. Commodities are traded under back-to-back purchase and sales agreements, and are funded by trade facilities, which are self-liquidating in nature. Excluding such trade facilities worth SGD910m, CWT’s 2013 net debt to equity stands at 28%.

SGD1.90 TP offers a 30% upside. We value CWT at 10x 2014F P/E. Listed logistics players are trading at an average 17.5x 2014 P/E, while supply chain managers are trading at an average 13.9x 2014 P/E.