DBS Vickers expects hotel room rates to rise on room crunch

Analysts: Derek Tan, CA, and Rachael Tan

Hiap Hoe Limited's 4-star Ramada Hotel at Zhongshan Park in Balestier. NextInsight file photo.Supply risks not as high as previously thought. 2014 is shaping up to be better for hoteliers than previously thought.

Hiap Hoe Limited's 4-star Ramada Hotel at Zhongshan Park in Balestier. NextInsight file photo.Supply risks not as high as previously thought. 2014 is shaping up to be better for hoteliers than previously thought. New hotel completions, based on our channel checks, are expected to be fewer than expected, as almost one-third of the planned hotel pipeline or c.987 rooms may be delayed till 2015.

This means that actual supply growth may only be c.3.5% y-o-y, with openings mainly skewed towards the end of 2014.

Coupled with optimistic projections from the Singapore Tourism Board (STB) that visitor arrivals would reach 16.3m-16.8m in 2014 (+5.0%-8.0% y-o-y), we believe that the hospitality industry may be faced with a room crunch in 2014.

RevPAR (revenue per available room) growth could accelerate till end 2014.

Recent industry statistics reveal that hotel performance for Jan-Feb’14 is firming up well with average RevPAR rising by c.4% y-o-y to S$244/night.

The luxury segment (+6.0% y-o-y) and upscale hotel segment (+4.0% y-o-y) continue to lead the way, which we attribute to a rebound in corporate travel volumes underpinned by a return of biennales held in 1Q14.

We believe that forward visibility will improve and RevPAR growth should accelerate as we head towards the peak travel seasons of 2Q/3Q.

With an activity-packed conference and events pipeline throughout the year, coupled with lower supply risks, we believe there is upside to our originally estimated c.3% y-o-y growth in RevPARs.

(This morning's news is that StarHub and other telcos have retracted their 4G price plans. Still, it's interesting to read the following analyst report, published on Apr 21, on how StarHub might benefit from its 4G price plan)

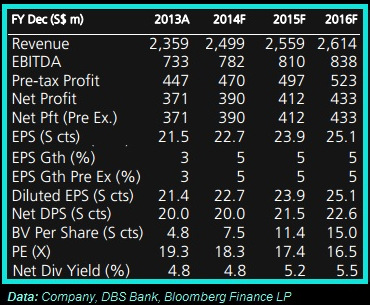

DBS Vickers upgrades StarHub to 'buy' and S$4.50 target.

Analyst: Sachin Mittal (left)

Analyst: Sachin Mittal (left)If 4G prices were to rise to S$10.70, FY15F earnings could increase by 30%.

StarHub will start charging S$2.14 for its 4G service from June 2014 onwards versus its current promotional free offer.

The company may further raise the extra charge for 4G to S$10.70 at a later unspecified date.

Meanwhile, M1 offers free 4G services till Dec 2014 with regular price for 4G advertised as S$10.70.

Elsewhere, SingTel has yet to indicate any intent of following suit. We like to point out that StarHub charges S$8.56 per GB for excess data usage versus S$10.70 by both SingTel & M1.

Elsewhere, SingTel has yet to indicate any intent of following suit. We like to point out that StarHub charges S$8.56 per GB for excess data usage versus S$10.70 by both SingTel & M1. Additionally, StarHub offers extra data-allowance of 1GB than peers on mid- to high-end plans.

Even if peers do not follow its premium pricing, we believe StarHub’s 4G plans remain competitive.

StarHub to benefit most from subsidies for SMEs. The government will subsidise SMEs by S$500m over 2014-17 for fibre broadband connections of over 100Mbps.

We estimate that Corp. fixed line (~17% of service rev) may grow by single digits to offset the weakness in prepaid mobile (~10% of service rev) and fixed broadband segments (~10% of service rev).

Corp fixed line reaps highest EBITDA margins, which we estimate to be 36% versus 20% for pay TV & broadband, and 35% for mobile.

Committed to a fixed 5-Sct DPS each quarter. This translates into a payout ratio of 88%.

With FY14F net debt-to-EBITDA of 0.5x versus 0.7x for M1 and 0.9x for SingTel, one should expect dividends to rise in FY15F.