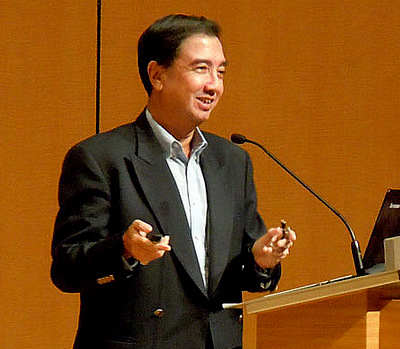

Kevin Scully, executive chairman of NRA Capital. Photo: CompanyYESTERDAY (Mar 24), I had an interview in my usual slot at 8.10am. If you didn't catch the interview - I append below the questions and my answers:

Kevin Scully, executive chairman of NRA Capital. Photo: CompanyYESTERDAY (Mar 24), I had an interview in my usual slot at 8.10am. If you didn't catch the interview - I append below the questions and my answers: Q1. Last week, Fed chief Janet Yellen said rates could begin rising "around six months" after the end of the central bank's stimulus program. Was that just a rookie mistake or perhaps an inadvertent disclosure of FOMC thinking?

I don’t think its either. Since May 2013 when previous Fed Chairman Ben Bernanke mentioned “tapering”, global markets went into wild swings.

I suspect that the new Fed Chairman wants to give markets more guidance on future Fed policy by setting certain macro indicator targets which are guiding Fed policy.

This should theoretically, in the medium term, lead to more market stability as short term comments will be placed in the context of the macro targets.

Q2. Is a rate hike necessarily bad for equity markets?

In the absence of cost push commodity inflation, I see the rate hike as positive as it signals an improvement in the health of the US economy and consumption leading to mild and healthy inflation of 2-4%.

In the medium term, we are heading back to normal interest rates as the liquidity is slowly dried up.

Q3. The S&P 500 has carved out new records in 2014, but why is the market struggling to match the big strides made last year?

2014 started in a volatile manner following the second US$10bn “Tapering” in January 2014 and the Russian invasion of Ukraine.

On current forecast, the US markets are trading at 15 times historic earnings but with earnings growth of 5-10% in 2014 and 2015.

Further “tapering” and a hike in US interest rates in early 2015 is likely to lead to further US$ strength in the medium term. Both the better corporate earnings and the expected strength of the US$ are likely to see the US market continue its bull run for another two years.

Q4. Turning to the Singapore stock market, the STI is currently trading at a historical Price to Earnings ratio of 13.4 times. Is the market expensive and where is the support for the STI? 13.4 times PER for Singapore is 10-15% below fair value but analysts are forecasting an earnings decline in 2014.

I expect the market to have more downside risks in the medium term as the funds flow out of emerging markets to the US and to a lesser extent the EU to continue.

2900 not 3000 is the key support for the STI Index. [Yesterday's strong gains seem to go against my view but I noticed some specific buying on the STI Index stocks in the hope of a special stimulus package from China - but not enough volume to convince me that emerging markets are back in favour again - it's too soon.]

Q5. Last week, CapitaLand divested its stake in Australand. What's your call on the stock after it hit a 21-month low on Friday? |

nowadays.