|

With that, Beijing Toread now owns a hefty 21.22% stake. |

Beijing Toread spokesperson and rocker Wang Feng sings the praises of the adventure equipment firm. Photo: Beijing ToreadListed on the Shenzhen Stock Exchange, Beijing Toread develops and sells outdoor products including tents, hiking boots, all-weather jackets and protective gear.

Beijing Toread spokesperson and rocker Wang Feng sings the praises of the adventure equipment firm. Photo: Beijing ToreadListed on the Shenzhen Stock Exchange, Beijing Toread develops and sells outdoor products including tents, hiking boots, all-weather jackets and protective gear.

Its customers are young and active and inclined to travel by booking arrangements online.

Beijing Toread's business model relies on third-party manufacturers to produce its products. But it directly manages some retail stores and mostly grows its retail network via franchising.

As of last year, it had 1,535 points of sales in China and close to 20 million retail customers. It also has a strong online presence with multiple brands. (See: BEIJING TOREAD: Outdoor Products Play Eyeing Higher Peaks)

In its February announcement of its 1Q14 result, Asiatravel.com said it was formulating a "holistic China outbound strategy with our strategic shareholder to target the huge China outbound travel market."

Our guess is that Beijing Toread would help cross-sell Asiatravel.com to its customers.

Though it's an online operation, Asiatravel.com also has ground presence in five cities -- Guangzhou, Shanghai, Beijing, Chengdu and Nanjing -- catering to outbound travellers.

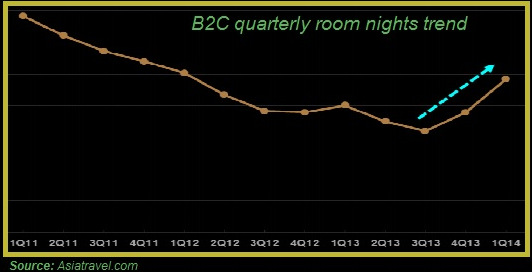

Asiatravel.com has achieved two consecutive quarters of revenue and room nights growth with 1QFY2014 reaching the level last seen in 1QFY2012. Asiatravel.com is optimistic that the recovering trend will drive its turnaround in profitability.

Asiatravel.com has achieved two consecutive quarters of revenue and room nights growth with 1QFY2014 reaching the level last seen in 1QFY2012. Asiatravel.com is optimistic that the recovering trend will drive its turnaround in profitability.

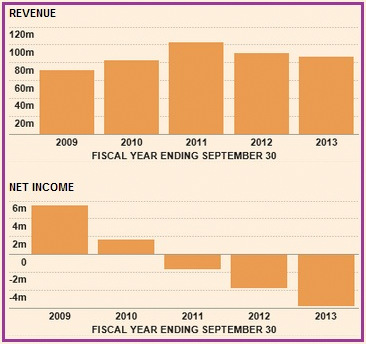

Up to the latest financial quarter, Oct-Dec 2013 (1QFY14), Asiatravel.com still had yet to recover its profitability, reporting a net loss attributable to the owners of the company of S$1.28 million, compared to S$0.92 million in 1QFY13.

But revenue did go up, by 10.1% y-o-y, to S$26.00 million, as did room nights (20% increase), reversing a trend that started in 1QFY11.

It didn't help that one of Asiatravel.com's top-selling hotels had closed for rebuilding, resulting in a $1.44 million decrease in revenue from its offline wholesale business.

Asiatravel.com is optimistic about a sustained recovery in its revenue in the coming quarters despite the industry having turned intensively competitive as more players muscle their way in.

The advertising and promotion budget is cash-draining: In its February announcement of its 1Q14 result, Asiatravel.com mentioned a S$20-m budget for A&P in FY2014. It's a massively huge sum compared to the S$2 million that it had spent annually on A&P in recent years.

It did not say how the 2014 A&P budget would be funded. The fact is, it had only S$11.1 million cash as at end-1Q14 and has been experiencing negative operating cashflow for the past year.

A key target of its spending is the recently launched brand – www.thehotels.com -- to spearhead its business in worldwide hotel reservation. "This site will be promoted heavily in the coming financial year."

|

|

Comments

experts of this sector do not realize this. You must proceed your writing.

I'm sure, you have a huge readers' base already!