CIMB initiates coverage of HanKore with a 15.6-c target

Analysts: Roy Chen & Gary Ng

Analysts checking out a facility of HanKore. File photo.HanKore’s revenue and earnings should expand in FY14-16 on the back of both capacity expansion and higher water tariffs.

Analysts checking out a facility of HanKore. File photo.HanKore’s revenue and earnings should expand in FY14-16 on the back of both capacity expansion and higher water tariffs.The RTO of China Everbright International’s water business, once sealed, should further improve its contract clinching and project financing.

With the deal currently at the due diligence stage, our preliminary SOP valuation indicates a target price of S$0.156.

Environmental problems spur investment: After years of rapid economic growth at the expense of the environment, the public is getting increasingly concerned about the environmental problems that have cropped up.

As part of its 12th five-year plan, the Chinese government plans to invest Rmb430bn in wastewater treatment.

Given the vast opportunities ahead and a relatively fragmented market, the water treatment industry outlook is bright over the next decade.

Strong capacity expansion and rising water tariffs: Out of HanKore’s total designed capacity of 1.57m tonnes/day, 0.56m is currently in operation.

We expect the full 1.57m designed capacity to come online within the next 2-3 years.

We expect the full 1.57m designed capacity to come online within the next 2-3 years.Besides the capacity expansion, a number of HanKore’s water facilities are undergoing discharge standard upgrading. After such an upgrade, a 40-60% increase in tariff is not uncommon.

CEI deal a game changer: After the deal, CEI will own over 60% of HanKore. The benefits to HanKore include:

1) it can leverage CEI’s SOE background in clinching contracts;

2) it could enjoy lower borrowing cost (HanKore: 7.5-8.5%, CEI: 5.0-5.5%);

3) the duo's geographical overlap will lead to stronger presence in certain regions of China.

Our SOP-based target price of S$0.156 implies a CY15 P/E of 17.3x, less demanding than its peer average of 19.6x.

Key risks include: 1) the CEI deal does not go through (an unlikely scenario), and 2) the management fails to ramp up financial leverage to improve the group’s profitability.

Recent story: HANKORE: Reaching Out To Top Funds As Investor Relations Team Wins Award

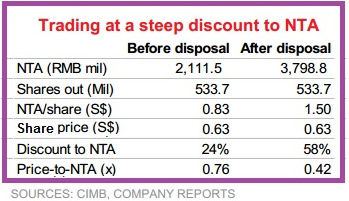

CIMB highlights SunVic Chemical's low price/NTA valuation.  Analyst: Gary Ng (left) Analyst: Gary Ng (left)Is the market mispricing sum of the parts? A case for asset spin-offs: Sunvic Chemical’s (SVC) recent stellar earnings and asset sales (double its market cap) have opened up a Pandora’s box of a potential (severe) market mispricing of S-chips. In our view, the biggest testament to the “realness” of this company is its string of asset sales to the world’s leading chemical producer, Arkema.  As SVC is in a mature business, its P/E valuations have always been undemanding. As SVC is in a mature business, its P/E valuations have always been undemanding. As such, we believe that P/NTA offers a better valuation metric. After its transaction, SVC’s NTA should be c.S$1.50. The market used to price SVC at above 0.9x P/NTA (1 s.d. above its mean since listing) in seasonally stronger years, such as in FY10-11 when SVC had smaller capacity and enjoyed record earnings due to favourable commodity prices. Its current valuation of 0.4x FY14 P/NTA is its lowest since listing.  While Sunvic has agreed to sell its plant in Taixing to French company Arkema, it will keep its other plant which is located in Yancheng, Jiangsu Province (above). The latter plant has an annual Acrylic Acid (AA) and Acrylate Esters (AE) production capacity of 205,000 and 250,000 tonnes, respectively. Photo: Company While Sunvic has agreed to sell its plant in Taixing to French company Arkema, it will keep its other plant which is located in Yancheng, Jiangsu Province (above). The latter plant has an annual Acrylic Acid (AA) and Acrylate Esters (AE) production capacity of 205,000 and 250,000 tonnes, respectively. Photo: CompanyRecent story: CIMB: Sunvic attractive on buyout; Nam Cheong has good 2014 start |

I was researching on Google for something else,

Anyways I am here now and would just like tto say many thanks for a incredible post and a all round entertaining

blog (I allso love the theme/design), I don'thave time to look over it all

at the minute but I have book-marked it and also added in yyour RSS feeds, so when I have time I will be back to read more, Please do keep up the excellent job.