A cryovial containing processed umbilical cord lining segments. Photo: CompanySINGAPORE-LISTED CORDLIFE GROUP, a pioneer in its industry in the region, has entered into an alliance to offer umbilical cord tissue banking services in China.

A cryovial containing processed umbilical cord lining segments. Photo: CompanySINGAPORE-LISTED CORDLIFE GROUP, a pioneer in its industry in the region, has entered into an alliance to offer umbilical cord tissue banking services in China.

Cordlife brings to the table its expertise in tissue banking and storage, as well as experience in Asian markets outside the PRC.

Its partner, CordLabs Asia, is a Singapore stem cell research and development company founded in 2002.

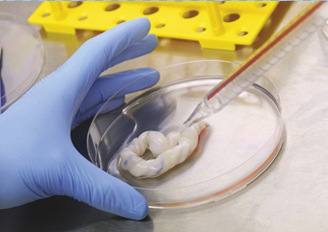

Together, they are exporting CordLabs' pioneering and patented technology in cord tissue banking to China by partnering China Cord Blood Corporation (CCBC), the largest cord blood bank operator in China. An umbilical cord being processed. Photo: CompanyCordlife will receive a cash royalty for customers whom CCBC, in which Cordlife owns a 10% equity stake, secures for the new cord tissue banking services.

An umbilical cord being processed. Photo: CompanyCordlife will receive a cash royalty for customers whom CCBC, in which Cordlife owns a 10% equity stake, secures for the new cord tissue banking services.

Cord tissue banking is complementary to cord blood banking, which New York-listed CCBC also offers in Beijing, Guangdong province and Zhejiang province where it has exclusive operating licences.

Mr Jeremy Yee, CEO of Cordlife, said: “This strategic alliance allows us to expand our geographical footprint -- ie, economies of scale -- as well as increase the scope of products and services that we provide -- ie, economies of scope.

"Overall, we remain focused on our key strategy to grow via economies of scale and scope through collaborative networks and strategic alliances."

He added that Cordlife has the distinction of being the only foreign company so far that has such a business exposure in China.

Indeed, Cordlife is working on getting more Singapore technologies relating to the mum-and-child industry to China and elsewhere, he added.

In cord blood banking, stem cells from the cord blood are preserved for possible use in future to treat blood-related disorders such as leukaemia. On the other hand, stem cells from cord tissue potentially can treat a different and wider set of afflictions, as explained in the section below: What diseases can be cured? As research is ever on-going and new discoveries are made ever so often, the renewable and replacement properties of stem cells hold the possibilities of treating a myriad of diseases, conditions, and disabilities including: • Parkinson’s and Alzheimer’s diseases • Spinal cord injury • Stroke • Burns • Heart diseases • Diabetes • Osteo-arthritis • Rheumatoid arthritis • Cancers What is the difference between cord blood and bone marrow stem cells versus cord lining stem cells? Cord blood and bone marrow stem cells form hematopoietic stem cells which forms all the blood cells in the body. These stem cells have the potential to treat blood-related disorders. Cord lining stem cells have the ability to obtain both mesenchymal and epithelial stem cells. These cells have the potential to forms all cell types in the body, thus providing opportunities for treatment of many more disorders than hematopoietic stem cells. Currently, cord lining stem cells can be expanded in number to form many more cells which is good for medical therapies while hematopoietic stem cells have limitations. -- Source: Cordlabs Asia |

In Singapore, private cord blood banking had a penetration rate in 2011 of about 19%, a rate that would have crept up since.

Cord tissue banking, being a new offering, would have a much lower rate. Cordlife introduced it to the Singapore market in Aug 2013.

However, the penetration rate in some markets is higher. In India, for example, a vast majority of cord-blood bank customers also take up cord tissue bank services, Mr Yee told NextInsight.

What is the potential for Cordlife and its alliance partners in their new cord tissue bank business?

It's early days but a relevant statistic is that in China last year, CCBC signed up about 72,000 customers for its cord blood banking service.

These are customers whom cord tissue banking service could also have been sold to.

Cordlife has a market cap of S$313 million and traded recently at $1.18 and a trailing PE of 15.6X. The trailing dividend yield is 1.7%.Chart: FT.com

Cordlife has a market cap of S$313 million and traded recently at $1.18 and a trailing PE of 15.6X. The trailing dividend yield is 1.7%.Chart: FT.comSuch new ventures and more to come are expected to grow Cordlife's revenue and profit.

In the first 6 months ended 31 Dec 2013, Cordlife's net profit increased 52.9% y-o-y to S$12.9 million on the back of healthy revenue growth, strong margins, a S$5.4 million fair value gain on a long-term investment and a S$6.2 million gain on transfer of investment in an associate to a long-term investment.

Revenue grew 31.3% to S$23.5 million due to contributions from newly-acquired entities and assets.

While Cordlife's share price has traded sideways since the start of this year, it has had a terrific run last year, up by 113%, on the Singapore Exchange where it listed in March 2012.

Cordlife was, in fact, the best-performing cord blood business in the world.

"I think we have done well for ourselves -- and for Singapore," said Mr Yee.

Recent story: CORDLIFE: Analysts are positive post-1HFY2014