Up 35% in 2013 and 53% in 2012, Tai Sin Electric stock has been among the better-performing small-cap stocks. Chart: FT.com

Up 35% in 2013 and 53% in 2012, Tai Sin Electric stock has been among the better-performing small-cap stocks. Chart: FT.com

| THE STRONG SHARE price gain of Tai Sin Electric in the past two years (see chart above) has reflected its improved business performance (net profit in FY11 ended June: $10.8 m, FY12: $18.8 m and FY13: 21.1 m). Along with the capital gains, shareholders also enjoyed higher dividends (1.60 cents, 2.10 cents and 2.25 cents, respectively).  Investors and analysts listening to the Tai Sin Electric story. Photo by Tang YibingGiven all that, it's no surprise that a roomful of analysts and fund managers turned up for a rare presentation by Tai Sin Electric's management -- Executive director Bobby Lim, CEO Bernard Lim, and Tan Yong Hwa (Senior Manager -- Group Corporate Development). Investors and analysts listening to the Tai Sin Electric story. Photo by Tang YibingGiven all that, it's no surprise that a roomful of analysts and fund managers turned up for a rare presentation by Tai Sin Electric's management -- Executive director Bobby Lim, CEO Bernard Lim, and Tan Yong Hwa (Senior Manager -- Group Corporate Development).But the business does face headwinds, mainly arising from the slowing down of the property market in Singapore. Tai Sin Electric's 1HFY14 sales were up 6.6% to $160 m and net profit attributable to shareholders was flat at $11.6 million. Here are some takeaways from the event and the Q&A session: |

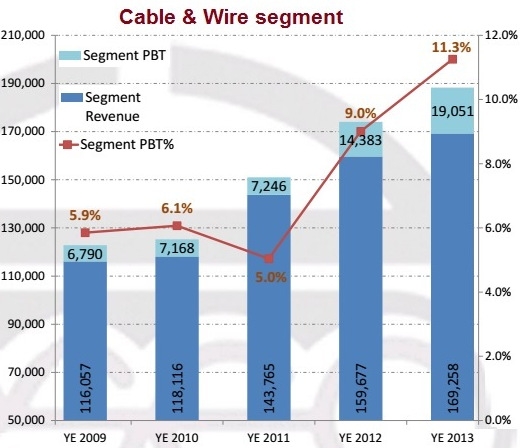

Tai Sin Electric manufactures electric cables in Gul Crescent. Photo by Leong Chan Teik1. Key revenue contributor: It's the manufacturing of cables and wires in Singapore.

Tai Sin Electric manufactures electric cables in Gul Crescent. Photo by Leong Chan Teik1. Key revenue contributor: It's the manufacturing of cables and wires in Singapore.

In FY13, this business segment contributed 57% of group revenue but 81% of the profit before tax.

Its profit margin has risen because as production volume went up, the marginal increase in labour cost did not rise in proportion.

CEO Bernard Lim said, however, the strategy is not to chase volume for its own sake but to target projects that required speedy delivery and offered stronger margins.

About 75% of the cost of goods sold is copper.

Tai Sin Electric does hedging in various ways, including buying supplies forward.

"As a guide, we hedge about 50% of our order book as the dates of delivery for some of the projects we deal with are uncertain," said Bernard.

"We review our projects on a monthly basis and will determine when to start hedging."

As a group, Tai Sin Electric maintains an inventory of about 1,200 tonnes of copper and 2,000 tonnes of cable -- which is about over a month's worth of consumption and sales.

The job of this monster of a machine that turns is to "armour" cables with steel wires to protect the inner core from external impact when cables are buried underground or located in external environments.

The job of this monster of a machine that turns is to "armour" cables with steel wires to protect the inner core from external impact when cables are buried underground or located in external environments.

Photo by Leong Chan Teik In this cable & wire segment, Tai Sin Electric has only 2 competitors in Singapore who are sufficiently big enough players to be able to afford the space to store the raw materials for production.

According to UOB Kay Hian's report issued this month, Tai Sin Electric has a 20-25% share of Singapore's low-voltage power cable market.

Its business has started to feel the impact of the Government's measures to cool demand in the property market. Tai Sin Electric's copper inventory is usually paid for in cash on delivery or on very short credit terms. This cash payment requirement of suppliers forms a high barrier to entry into this manufacturing business. Photo by Leong Chan TeikHowever, Bernard points to upcoming infrastructure projects such as Changi Airport's Terminal 4 and Project Jewel as projects that "we should benefit from."

Tai Sin Electric's copper inventory is usually paid for in cash on delivery or on very short credit terms. This cash payment requirement of suppliers forms a high barrier to entry into this manufacturing business. Photo by Leong Chan TeikHowever, Bernard points to upcoming infrastructure projects such as Changi Airport's Terminal 4 and Project Jewel as projects that "we should benefit from."

In the meantime, Tai Sin Electric is on the lookout for companies that it can add value to, buy a small stake initially, understand the business intimately and, later, perhaps offer to buy a controlling stake.

2. Test & inspection segment - This comprises CAST Laboratories, of which a 52.5% stake was acquired by Tai Sin Electric in early 2012.

It is the business segment to bank on for strong growth now.

It has been working through excess headcount and duplicate positions arising from CAST's acquisition of CPG Laboratories in June 2011.

One way was to let go of certain foreign workers when their contracts expired.

As at end-FY13, this division had 509 employees, or almost half of the entire group's headcount.

In FY13, this division had a $803K pre-tax loss but has turned around modestly in 1HFY14.

But it's not just about cutting jobs. It's about trying to secure more projects and raising revenue, said Bernard.

"We have the man-year entitlements, and this has intrinsic value. I dont have to buy qouta. Some contractors who get jobs don't have the man-year entitlements and then the cost to them is high because they have to sub-contract out. We don't sub-contract as we have the workers."

Aside from this segment, the electrical material distribution segment ($3.5 million pre-tax profit in FY13) is expected to continue to grow too.

3. Singapore the main contributor by region: It made up 78% of revenue in FY13, after stripping out the contribution by a NZ subsidiary that has since been sold.

Overseas markets offer lower profit margins.

4. Bad debts: The construction industry being vulnerable to slow payments and non-payments, Tai Sin Electric mitigates risks by diversifying its customer base such that no customer accounts for more than 8% of the company's revenue.

In addition, for some customers, Tai Sin Electric will require either personal or corporate guarantees or letters of credit.

In 1HFY2014, Tai Sin Electric provided for $612,000 of doubtful receivables which were more than 365 days old.

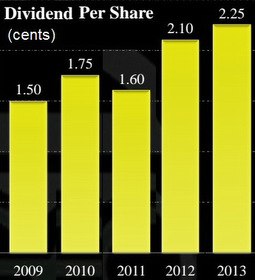

5. Steadily rising dividends: Thanks to its ability to generate positive free cashflow, the company has been paying dividends since its listing in 1998.

5. Steadily rising dividends: Thanks to its ability to generate positive free cashflow, the company has been paying dividends since its listing in 1998. An interim dividend of 0.75 cents for 1HFY14, unchanged from the previous year, has been declared.

The stock, at 35 cents recently, trades at a trailing yield of 6.4%.

UOB Kay Hian analyst Loke Chunying, the only one tracking this company currently, has a 43.5 cent target price for the stock.

Her forecast earnings per share of 4.7 cents translates into a forward PE of 7.4X.

Recent story: Initiation Reports: Buy STRACO CORP, Buy TAI SIN ELECTRIC