Excerpts of recent analysts' reports...

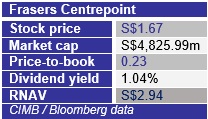

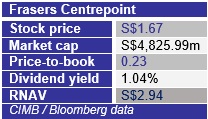

Frasers Centrepoint undervalued, target price is $2.06

Frasers Centrepoint undervalued, target price is $2.06

Analyst: Donald Chua, CIMB

Frasers Centrepoint is one of the top three residential developers in Singapore. It also has interests in and manages retail malls, offices and business parks globally.Frasers Centrepoint (FCL) is a property developer and investor with a gross annual value (GAV) of S$10.5bn.

Frasers Centrepoint is one of the top three residential developers in Singapore. It also has interests in and manages retail malls, offices and business parks globally.Frasers Centrepoint (FCL) is a property developer and investor with a gross annual value (GAV) of S$10.5bn.Its stock price discount to RNAV is much greater than the sector average of 34%.

At current share prices, we view FCL as substantially underpriced relative to Fraser and Neave on a pre-demerger basis.

We believe the market has not attached any value to the following 3 factors:

1) S$3.2bn unbooked presales

Its timing of the Singapore housing market has been good (mostly sold) and it made an early entry into its core overseas markets (Australia and China).

FCL exited FY13 with over S$3.2bn of presales yet to be recognised (72% of its revenue in FY14-15).

FCL exited FY13 with over S$3.2bn of presales yet to be recognised (72% of its revenue in FY14-15).

2) Potential development and asset enhancement upside

We think there is considerable redevelopment or asset enhancement initiative (AEI) potential for its existing Singapore commercial properties (54% of GAV), many of which are dated and under-rented but in prime locations.

3) Asset recycling / AUM platform

With TCC on board and the right blend of income-producing and development assets, we believe there is considerable capacity for FCL to expand its asset recycling/ assets under management (AUM) platform.

A new hospitality REIT is a real possibility for 2014 while more mature malls could be recycled with proceeds re-invested in developments and/or AEIs, or simply returned back to shareholders.

A new hospitality REIT is a real possibility for 2014 while more mature malls could be recycled with proceeds re-invested in developments and/or AEIs, or simply returned back to shareholders.

Free float to rise over time

The stock’s low free float is still prohibitive for large investors but we think this will change over time. We believe that Thai Bev and/or TCC will do more to increase FCL’s free float. This will help improve investor participation and narrow the valuation discount, in our view.

Downside risks

Weaker-than-expected demand for REITs and commercial/retail rents.

We begin coverage on the stock with an “Add” rating and a target price of S$2.06, set at a 30% discount (1x P/BV) to RNAV.

Del Monte Pacific price correction overdone

Analyst: James Koh, Maybank Kim Eng

On 11 Oct 2013 when Del Monte Pacific announced its US$1.675bn deal to acquire the consumer food business of Del Monte Foods, Del Monte Pacific's stock price was 91 cents. The stock closed at 63 cents on Mon. Bloomberg data

On 11 Oct 2013 when Del Monte Pacific announced its US$1.675bn deal to acquire the consumer food business of Del Monte Foods, Del Monte Pacific's stock price was 91 cents. The stock closed at 63 cents on Mon. Bloomberg dataDel Monte Pacific’s (DMPL) share price has corrected sharply by 25% in the past two months after the company announced a USD1.675b deal to acquire the consumer business of Del Monte Foods (DMF).

We believe the slide can be attributed to the overhang of impending equity-raising exercises. Fresh financing details disclosed suggest that share dilution may be steeper than earlier expected. Even so, the correction is overdone in our view, considering the deal is still earnings accretive.

We believe the slide can be attributed to the overhang of impending equity-raising exercises. Fresh financing details disclosed suggest that share dilution may be steeper than earlier expected. Even so, the correction is overdone in our view, considering the deal is still earnings accretive.

Del Monte Pacific owns the Del Monte brand, the leading brand in the Philippines for canned pineapple juice and juice drinks, canned pineapple and tropical mixed fruits, tomato sauce, spaghetti sauce and tomato ketchup.

Del Monte Pacific owns the Del Monte brand, the leading brand in the Philippines for canned pineapple juice and juice drinks, canned pineapple and tropical mixed fruits, tomato sauce, spaghetti sauce and tomato ketchup.Deal expected to close by 1Q14

We understand that the transaction is progressing well and an EGM is expected to be held next month.

This means the accounts would be consolidated from 2Q14 onwards. We expect financing to be carried out in two stages, with the second stage occurring 3-6 months after the purchase transaction closes.

More concrete financing details

The positive news is the lower-than-expected debt cost, with the major syndicated loan portion now upsized to USD970m on strong subscription (from USD930m).

This is a testament to the level of confidence in DMF’s consumer business, a market leader in the US. The negative news is there will now likely be a rights issue in the second stage of the transaction, representing some dilution to earnings.

Buy into weakness

Overall, we view the deal positively and expect meaningful earnings accretion to ensue.

With the new developments, we lower our target price to SGD1.00, pegged at 12.5x FY15E post-deal EPS, a 20% discount to its global peers on account of higher gearing and execution risk.

DMPL’s share price is likely to do better after the successful conclusion of the transaction.

With the new developments, we lower our target price to SGD1.00, pegged at 12.5x FY15E post-deal EPS, a 20% discount to its global peers on account of higher gearing and execution risk.

DMPL’s share price is likely to do better after the successful conclusion of the transaction.