Main reference: Story in Sinafinance

THE STOCK MARKET can be a seductress for many investors.

Here’s a telling and cautionary tale of a government official who gambled, and lost, his parents’ pension in the market.

Our hapless investor put 200,000 yuan into share buys, with over half of that having already disappeared.

Conspicuous Consumption: Some investors, like the hapless civil servant featured here, feel increasing pressure to keep up with the success of peers. Photo: Chow Sang Sang

Conspicuous Consumption: Some investors, like the hapless civil servant featured here, feel increasing pressure to keep up with the success of peers. Photo: Chow Sang Sang

Though 200,000 yuan may not seem like a headline-making amount – around 30,000 usd at current exchange rates – for many retired civil servants, it represents a comfortable nest egg on which to live out one’s golden years.

Those looking for a scandal needn’t read further because this government official’s investment capital was not ill gotten or illegally procured.

Instead, it was “donated” to him by his doting parents, who turned over their pension fund in the hopes of riding a long-expected bull run in China’s A-share markets.

The parents aren’t entirely to blame for the willingness to treat their retirement cash like poker chips.

It turns out that the son was well-beyond collegiate years but still lived under his parents’ roof, and he promised them that he would use his anticipated stock market earnings to cover the down payment on a home of his own.

Thus, not only is this a commentary on the red-hot property sector in China at present, but also the volatility in the country’s share market.

Perhaps readers at this point think this story is nothing out of the ordinary in China’s current development stage.

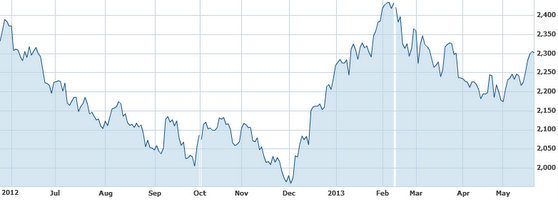

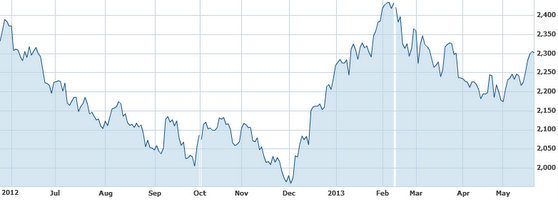

One civil servant began buying shares a year ago... a very poor choice of timing as the above 12-month China share performance chart shows. Source: Yahoo Finance

One civil servant began buying shares a year ago... a very poor choice of timing as the above 12-month China share performance chart shows. Source: Yahoo Finance

But despite the relatively small investment he made – with his parents’ money no less – his failure should serve as a cautionary tale for investors of all scales and walks of life.

He himself is a low-level public servant, just as his parents were, and he moved with them from the countryside to the big city several years ago.

“My job was secure but my salary was stagnant. Moving to the city, I suddenly became aware of just how many fellow Chinese were far ahead of me in terms of their living standards and this highlighted my own deficiencies and anxieties.

“Also, prices in the big city were rising far faster than my take-home pay which put even greater pressure on me to find a quick fix,” he said.

In May of 2012, the benchmark Shanghai Composite Index began a mini bull run of several consecutive winning days.

“That changed my thinking, and I suddenly wanted into the market. But as I had no real money of my own, I decided that the only way was to put my parents’ pension on the table, which they also agreed to given the bullish market sentiment at the time.”

His original plan was to make just enough for the down payment on his own place and then cash in his chips before returning the original amount to his parents.

“But I lost myself and I got greedy. When the market kept going up day after day, I upped my goal to earning 50,000 yuan before pulling up stakes, and this quickly was reset to 100,000.”

Our unlucky investor’s travails are regrettable, but also understandable given the temptation to make a quick buck to cover soaring costs of living.

China shares are currently down around 5% from year-earlier levels and were flirting with a 20% decline late last year, so from a market perspective it is easy to see how a few poor picks could lead to his parents’ pension drying up rather quickly.

See also:

Five Factors Threatening 'China's Nasdaq'

Conspicuous Consumption: Some investors, like the hapless civil servant featured here, feel increasing pressure to keep up with the success of peers. Photo: Chow Sang Sang

Conspicuous Consumption: Some investors, like the hapless civil servant featured here, feel increasing pressure to keep up with the success of peers. Photo: Chow Sang Sang One civil servant began buying shares a year ago... a very poor choice of timing as the above 12-month China share performance chart shows. Source: Yahoo Finance

One civil servant began buying shares a year ago... a very poor choice of timing as the above 12-month China share performance chart shows. Source: Yahoo Finance NextInsight

a hub for serious investors

NextInsight

a hub for serious investors