Main reference: Story in Sinafinance

WANG YAWEI has earned his nickname as “China’s Warren Buffett” for his uncanny ability to see opportunities where others see only risk.

He apparently netted a cool 140 million yuan in investment profits last month, and seems to be benefiting heavily from China’s environmental sector bonanza.

Investor Wang Yawei.

Investor Wang Yawei.

Photo: SinafinanceSince parting ways with China’s top asset management firm last year, Wang has completely shaken off his public persona and has since become a decidedly private individual – both in terms of his media availability and his investment strategy – as a private investor.

Therefore, post-AMC Wang has been somewhat of a mystery, with no access to any changes to his personal wealth, investment portfolio makeup, or any meaningful insights into his market takes thanks to no interviews being granted in months.

He’s also maintained a very low key virtual existence of late, with no personal website or online public utterances to let us all know if he’s still quietly bolstering his nest egg or not.

However, “China’s Buffett” could not hide his latest dealings from the disclosure requirements of A-share listed firms.

In the recent flurry of first quarter results being issued by Shanghai- and Shenzhen-listed enterprises, it was revealed that Wang has been very active of late in investing in the restructuring and consolidation of China’s environmental sector.

At the same time, he is heavily involved in long-term blue chip plays as a hedge against the potential volatility of emerging sector themes like solar and pollution control technologies.

A private investment firm which he has recently taken hold of the reins at has appeared on the “most active shareholder” lists of 27 A-share firms.

Among these firms, a whopping 22 have bested the benchmark Shanghai Composite Index since the beginning of April, bringing an additional 140 million yuan in investment earnings into the pockets of “China’s Buffett.”

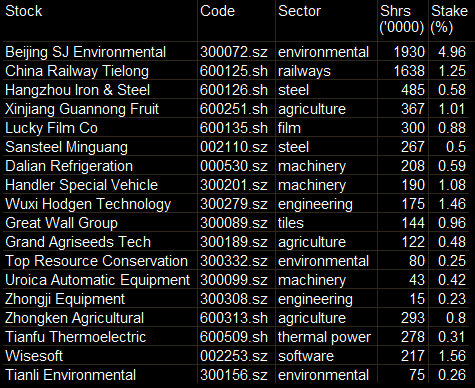

Wang Yawei's top early-May China picks. Source: Shanghai Youth Daily

Wang Yawei's top early-May China picks. Source: Shanghai Youth Daily

Up until mid-March, Wang’s average rate of return from A-share investing was an enviable 13%, and following his April gains this likely increased, said an insider with knowledge of the situation.

A Guangzhou-based private equity consultant said that Wang’s new firm has likely enjoyed an average ROI of around 20% since its founding last year.

“It’s much better than the overall market,” he added.

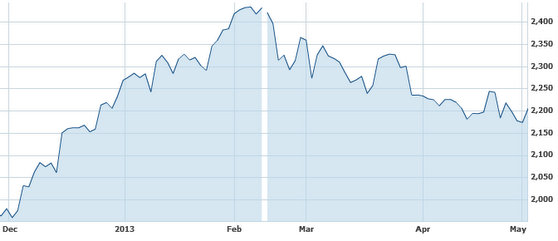

At around 2,250 now, the Shanghai Composite Index is down around 5.5% from year-earlier levels, but is still comfortably higher than the 12-month low of 1,949 set in December.

First quarter financial earnings reports from A-share firms, when looked at collectively, reveal that Wang’s total shareholding value at present in domestic equities stands at around 1.04 billion yuan at the very least.

Reports have his total firm’s investments in A-shares at around two billion yuan, which would correlate to some 52% of total assets potentially tied up with the abovementioned 27 listcos.

Worthy of note is that of these 27 firms, four were major targets of China AMC – Wang’s previous employer.

They are ceramics play Great Wall Group (SZA: 300089), China Railway Tielong Container Logistics (SHA: 600125), Hangzhou Iron & Steel (SHA: 600126) and Lucky Film Co (SHA: 600135).

The new national leadership that took power in Beijing has repeatedly called for both a stronger, more viable and leaner new energy and environmental protection industry sector.

'China's Buffett' has seen his picks well outperform A-shares (above) of late.

'China's Buffett' has seen his picks well outperform A-shares (above) of late.

Source: Yahoo Finance

That means that less competitive listed firms saw their share prices under attack earlier this year, which sent Wang and his team of bargain hunters on a shopping spree.

These aggressive moves for new energy plays were also a major reason for Wang’s “April surprise.”

At the beginning of this month, Wang’s top holding was Beijing SJ Environmental Protection and New Material Co Ltd (SZA: 300072) in which he held 19,300,000 shares for a nearly 5% stake.

Beijing SJ Environmental -- an industry peer of Singapore-listed China Environment Ltd (SGX: CENV) -- said at the time it expects first quarter net profit to increase by between 90% and 113.4% (8-9 million yuan).

Its products include desulfurization purifying agents, sewage treatment services and natural gas technologies and its environmentally-themed operations are cleanly in line with many of the sustainable development themes being trumpeted of late by the new Chinese national leadership.

Wang’s private investment fund is estimated to be worth around 2.4 billion yuan at present, having enjoyed an average ROI of around 20% for the past few months.

That’s even more impressive considering that the benchmark Shanghai Composite Index is down around a full percentage point from the beginning of the year.

It’s becoming clearer why Wang Yawei is often called “China’s Buffett.”

See also:

'China's Buffett' Going Green