Kingwell Managing Director Kam Kit (left) addresses investors alongside Aries Consulting's Benny Yu. Photo: Aries ConsultingKINGWELL GROUP LTD (HK: 1195) read the tea leaves last year and decided to transform itself out of the loss-making printed circuit board business and into the much higher-growth gold mining and processing sector.

Kingwell Managing Director Kam Kit (left) addresses investors alongside Aries Consulting's Benny Yu. Photo: Aries ConsultingKINGWELL GROUP LTD (HK: 1195) read the tea leaves last year and decided to transform itself out of the loss-making printed circuit board business and into the much higher-growth gold mining and processing sector.

Executives hosted a dinner in Hong Kong to explain to analysts and investors why they believed they’ve struck gold.

Last year was a challenging one for Kingwell due to plummeting selling prices for flexible printed circuit boards (FPCBs).

The global economic turmoil continued to bring challenges to the electronics industry in 2012 and consumer demand for electronic products has largely declined leading to a significant decrease in sales orders.

But thanks to exhaustive market research and the gift of foresight, Hong Kong-based Kingwell has now successfully transformed itself into a significant player in the gold mining and processing business.

It is now mainly engaged in gold resources project investments and gold supply chain development.

Kingwell wins a gold medal for hosting a fun-loving investor gathering. Photo: Aries Consulting

Kingwell wins a gold medal for hosting a fun-loving investor gathering. Photo: Aries Consulting

In August of last year, Kingwell acquired a 51% stake in a gold mine in the Amur Region of Russia with gold sand resources of over 35 tons and a monthly production target of 30 kilograms (1,058 ounces) of sand gold.

The Russian gold mine has an area of 309 sq km, approximately one-third the size of Hong Kong, and the facility enjoys low production costs and a simple production process.

Investors verify their gold medals during a trip to Kingwell's Shandong facilities.

Investors verify their gold medals during a trip to Kingwell's Shandong facilities.

Photo: Aries Consulting

Production is expected to begin in the first half of this year with an estimated monthly output of over 1,100 ounces of pure gold.

Kingwell is also targeting the acquisition of a 100% stake in Port First Ltd which indirectly owns 70% beneficial interests in three gold mines with refinery facilities in the Northern China province of Shandong.

Kingwell will acquire 70% equity interests in Jinxin Co and Jinhui Co for a consideration of 370 million yuan.

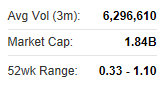

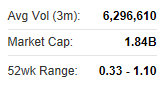

Kingwell recently 1.03 hkdJinxin holds the license for mine exploration and exploitation of Shanchakou Mine and Jinjiling Mine in Shandong, a gold washing plant and gold refinery plant.

Kingwell recently 1.03 hkdJinxin holds the license for mine exploration and exploitation of Shanchakou Mine and Jinjiling Mine in Shandong, a gold washing plant and gold refinery plant.

Phillip Securities recently initiated gold mining play Kingwell with a “Buy” recommendation and a target price of 1.30 hkd (recent share price 1.03).

After the transformation, Phillip Securities expects Kingwell’s earnings will see significant growth, with the international gold price remaining near 1,400 usd/ounce, coupled with the advantages of domestic production costs helping matters greatly.

With continued strong global gold demand and Kingwell’s advantages in production costs, the research house said it expects Kingwell’s 2013 earnings to be between 100 million to 150 million yuan.

Kingwell was formerly known as Sinotronics Holdings Ltd and changed its name in February 2010 to better reflect its growing operational diversity and began engaging in property investment at the time.

Kingwell was founded in 1996 and is headquartered in Tsim Sha Tsui East, Hong Kong.

See also:

'Chinese Dream' To Wake Up China Shares?

Kingwell Managing Director Kam Kit (left) addresses investors alongside Aries Consulting's Benny Yu. Photo: Aries ConsultingKINGWELL GROUP LTD (HK: 1195) read the tea leaves last year and decided to transform itself out of the loss-making printed circuit board business and into the much higher-growth gold mining and processing sector.

Kingwell Managing Director Kam Kit (left) addresses investors alongside Aries Consulting's Benny Yu. Photo: Aries ConsultingKINGWELL GROUP LTD (HK: 1195) read the tea leaves last year and decided to transform itself out of the loss-making printed circuit board business and into the much higher-growth gold mining and processing sector. Kingwell wins a gold medal for hosting a fun-loving investor gathering. Photo: Aries Consulting

Kingwell wins a gold medal for hosting a fun-loving investor gathering. Photo: Aries Consulting Investors verify their gold medals during a trip to Kingwell's Shandong facilities.

Investors verify their gold medals during a trip to Kingwell's Shandong facilities. Kingwell recently 1.03 hkdJinxin holds the license for mine exploration and exploitation of Shanchakou Mine and Jinjiling Mine in Shandong, a gold washing plant and gold refinery plant.

Kingwell recently 1.03 hkdJinxin holds the license for mine exploration and exploitation of Shanchakou Mine and Jinjiling Mine in Shandong, a gold washing plant and gold refinery plant. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors