Main reference: Story in Dongfang Daily

THE 2012 REPORTING season for annual results has come and gone for A-share listed firms.

But several have been singled out for having “problematic results.”

Shanghai Nine Dragon Tourism Co Ltd (SHA: 600555) has been hit by the bird flu outbreak in Eastern China. Photo: CompanySo who’s attracting negative attention and what’s the problem?

Shanghai Nine Dragon Tourism Co Ltd (SHA: 600555) has been hit by the bird flu outbreak in Eastern China. Photo: CompanySo who’s attracting negative attention and what’s the problem?

As April gives way to May, the number of Shanghai- and Shenzhen-listed firms attracting such negative attention from the China Securities Regulatory Commission and both of the country’s capital markets is now just south of 90.

On the oversight side of things, two leading accountant firms were singled out for auditing inconsistencies.

RSM China Certified Public Accountants -- China’s top CPA firm with over 3,600 staff – as well as Union Power -- were both mentioned by name.

This has sent a palpable shiver through investing circles just as China’s equity markets seem to be gaining traction again.

When accounting firms garner negative attention from regulators it is difficult to predict how extensive or endemic the problem is as CPAs are themselves chiefly responsible for verifying the veracity and accuracy of listed firms’ financial reports.

Some investors have voiced concerns that the growing list of problematic results may spread to a whole host of sectors.

Though 87 “problematic firms” seems high, it represents just 3.5% of the 2,468 total A-share listed firms in China, and the number is consistent with 2011 levels.

One firm in particular, Guangxi Guitang (Group) Co Ltd (SZA: 000833), saw its annual results receive a particularly negative assessment from an oversight body.

Guitang, listed on the ChiNext board or “China’s Nasdaq,” is a major paper manufacturer based in South China.

But the news couldn’t be all bad as its shares closed up 4.1% on Monday at 6.14 yuan.

The oversight body said in a note that investors should be particularly wary of “exaggerated business operations or output” as well as “questionable asset restructuring” among A-share listed firms, especially as stated in their 2012 annual reports.

Auditors said that trouble ranged from incomplete, delayed and erroneous data in this year’s crop of financial earnings statements, with three firms in particular being more egregious among the non-compliers.

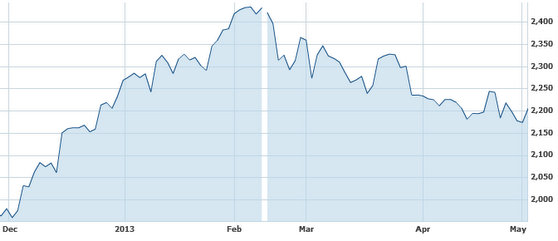

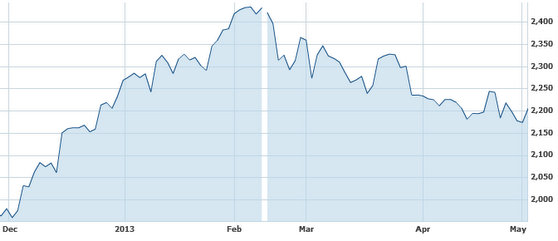

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

Of the 87 firms mentioned in the note, 69 failed to provide sufficient information for auditors to formulate a full assessment of their annual reports’ authenticity.

In particular, Shenzhen China Bicycle (Holdings) Co (SZA: 000017), Qinghai Sunshiny Mining Co Ltd (SHA: 600381) and Shanghai Nine Dragon Tourism Co Ltd (SHA: 600555) were noted for inconsistencies.

Sunshiny Mining has been hit hard of late by heightened volatility in prices for mined commodities like coal, copper, alumina and iron ore while Shanghai Nine Dragon has taken it on the chin by being located in the hot zone for the latest outbreak of bird flu in Eastern China.

Other issues cited among the problematic listcos include inconsistencies or errors with company restructuring, tax and customs issues as well as non-viable suppliers.

IT play Shenzhen Hirisun Technology Incorporated (SZA: 300277) also made the list despite recently stating it had “corrected” various accounting errors having to do with its outsourcing costs, year-end bonuses and receivables.

Investors should bear in mind that listcos on the three-year-old ChiNext board are disproportionately represented among the mentioned firms, and their share price volatility and high P/E ratios invariably come with higher risk.

See also:

CHINA SHARES: No Bull, But Still Good Buys

Shanghai Nine Dragon Tourism Co Ltd (SHA: 600555) has been hit by the bird flu outbreak in Eastern China. Photo: CompanySo who’s attracting negative attention and what’s the problem?

Shanghai Nine Dragon Tourism Co Ltd (SHA: 600555) has been hit by the bird flu outbreak in Eastern China. Photo: CompanySo who’s attracting negative attention and what’s the problem? Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance NextInsight

a hub for serious investors

NextInsight

a hub for serious investors