OSK: Maintaining ‘Buy’ Call on VST HLDGS

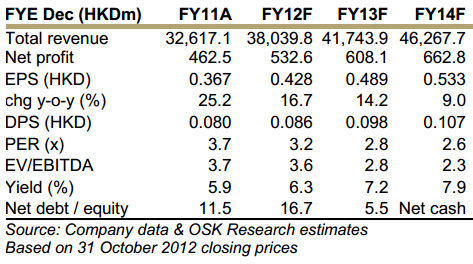

OSK Investment Research said it is keeping its “Buy” recommendation on IT products distributor VST Holdings (HK: 856) with a target price of 2.45 hkd (recently 1.63 hkd). VST Holdings Chairman and CEO Li Jianlin (second from left) presents the IT distributor's results while other company executives listen in. Photo: Aries Consulting

VST Holdings Chairman and CEO Li Jianlin (second from left) presents the IT distributor's results while other company executives listen in. Photo: Aries Consulting

OSK said the legal “overhang” was gone from an anticipated court decision.

Subsequent to Li Jianlin’s (VST’s chairman and CEO) conviction of price rigging and failure to disclose trading of own shares (22 October 2012), the court sentenced Mr. Li to a seven month jail term, suspended for one month, and barred him from holding directorship in any company for 12 months.

VST announced that Tay Eng Hoe (Non-Executive Director) and Chow Ying Chi (Operations Director) will become the new chairman and acting CEO, respectively, with immediate effect.

“Replacements are well planned and suitable. As we noted before, VST’s management had previously related to us that succession plans were in place and well thought out considering the prompt announcement of the replacements.

“We also believe the replacements are suitable for the role,” OSK said.

Mr. Tay, the new Chairman, is a non-executive director of VST and also one of the founders of VST’s subsidiary, ECS Holdings (ECS SG, NR).

He has over 25 years of experience in the IT business and strong relationships with major vendors such as Dell, HP and Lenovo.

Ms. Chow, the acting CEO, was responsible for VST’s business operations and management.

She has over 16 years of experience in the field and is highly knowledgeable in the distribution and ERP solutions market in China.

“Mr. Li’s resignation as CEO and Chairman was within our expectations and removes a huge overhang in our view. We believe Mr. Li’s court case has been a major share price overhang over the past few years despite it having no noticeable impact on VST’s operations,” OSK added.

The research house said that as the case has finally come to a close, it expects investors to refocus on the company’s improving profitability, deep distribution platforms and strong cash conversion cycle.

VST Holdings is currently trading at 2.8x FY13F PE, and OSK recommends investors “buy into weakness.”

“We believe that the removal of the share price overhang will have a positive impact on VST’s share price, which we note closed 3% higher after Mr Li’ recent sentencing. We believe shares of VST are extremely undervalued.

“We suggest investors to buy into any share price weakness.”

VST is a leading consumer electronics distributor in China and South East Asia with over 70% of its revenue from China. The company has long-standing relationships with vendors such as Lenovo, HP, and Seagate. VST also has master distribution rights to Apple’s iPad and iPhone in China.

See also:

VST CHAIRMAN: ‘IT Gadgets Already Life Necessity’

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%

VST Holdings: IPads, China Market Propel 1H Sales

Bocom believes Lenovo’s growth momentum will continue in the coming quarters and it will overtake HP as the market leader. Photo: Company Bocom: Maintaining ‘Buy’ Call on LENOVO

Bocom believes Lenovo’s growth momentum will continue in the coming quarters and it will overtake HP as the market leader. Photo: Company Bocom: Maintaining ‘Buy’ Call on LENOVO

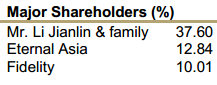

Bocom International said it is keeping its “Buy” recommendation on China’s top PC maker Lenovo Group (HK: 992), with a target price of 7.90 hkd (recently 6.96 hkd).

“We maintain our rating on a strengthening of Lenovo’s market position as it continued to outperform the sector average and its major competitors in the global PC market,” Bocom said.

In the July-September quarter, Lenovo delivered PC shipments of 13.8 million units, which represented an 8% quarter-on-quarter growth and significantly outpaced the sector growth by 5.3 ppts.

“It allowed Lenovo to expand its market share by 0.7 ppt to 15.7%, merely 0.2 ppt behind HP. Together with a great achievement in the smartphone segment, Lenovo delivered better-than- expected quarterly results.”

Bocom added it believes Lenovo’s growth momentum will continue in the coming quarters and it will overtake HP as the market leader.

Revenue in the July-September period climbed by 8% quarter-on-quarter to 8.67 billion usd, the highest level in the company’s history, mainly driven by the China market (8.6% growth) and EMEA market (13.2% growth).

The gross margin improved slightly by 0.1 ppt quarter-on-quarter to 12.1%.

As a result, net profit increased by 15% sequentially to US$162m.

Operating margin for the PC business in the China and North American markets dropped by 0.6 ppt and 0.3 ppt, respectively, largely due to seasonality (more promotion required in the quarter).

On the other hand, operating margin in the APLA and EMEA markets improved by 0.8 ppt and 0.6 ppt, respectively.

An interim dividend of 4.5 HK cents was declared for the first half, implying a payout ratio of 20%.

Smartphone segment

Lenovo managed to achieve “great progress” in its smartphone business within a short time, Bocom said.

“In the September quarter, Lenovo delivered smartphone shipments of 7 million units, which allowed Lenovo to seize the second position in China’s smartphone market with 14.2% market share, merely 1.1 ppt behind Samsung.

As a result, the MIDH business accounted for 8.3% of total revenue (previous quarter: 7.3%).

“The MIDH business is still on its way to profitability. Nonetheless, the operating loss margin of the MIDH business narrowed by 0.7 ppt to 3.3%, in our estimate.

“Management expects the MIDH business to turn profitable in a couple of quarters, which, if achieved, would significantly boost the company’s earnings,” Bocom said.

Overall, Bocom said it considers the quarterly results "satisfactory," confirming its positive view on Lenovo’s competitiveness in the global PC market and the promising outlook of the MIDH segment.

See also:

ELECTRONICS ‘Outperform’

Why LENOVO Isn't Celebrating Being No.1

Focused on Growth: BlueFocus Deputy General Manager Xu Zhiping (center) breaks down the PR firm's expansion plans. Photo: Andrew Vanburen

Focused on Growth: BlueFocus Deputy General Manager Xu Zhiping (center) breaks down the PR firm's expansion plans. Photo: Andrew Vanburen

Goldman Sachs: BLUEFOCUS Kept ‘Buy’

Goldman Sachs said it is maintaining its “Buy” recommendation on Beijing-based PR firm BlueFocus Communication (SZA: 300058) with a target price of 26.94 yuan (recently: 22.50 yuan).

However, Goldman Sachs said it is removing BlueFocus from its Conviction List (CL) given limited upside potential, but maintains the ‘Buy’ rating as it “likes the company’s long-term prospects as a marketing conglomerate.”

“Since we added BlueFocus to our Conviction List on August 10, 2011, the stock has risen 95%, while the Shanghai A-share index has fallen 16% over the same period.

We believe this outperformance was primarily due to the company’s earnings growth and M&A execution, which exceeded market expectations.”

Goldman Sachs said it continues to favor the firm’s “solid organic and M&A growth” as it transforms into a large marketing group.

Management guided 1Q-3Q 2012 net profit to grow 105%-115% y-o-y.

“We believe organic growth will account for approximately 50% of the aforesaid guidance, while the remainder will be contributed by M&As,”

Goldman Sachs’ 2012E EPS of Rmb0.63 is 6% above market research consensus, despite the recent upward revision of consensus estimates.

“We believe the market may be underestimating the strength of BlueFocus’ organic growth.”

Goldman Sachs said its 2013E EPS of 0.84 yuan does not factor in the announced (pending board approval) acquisition of Time Share Media.

Summer has been kind to BlueFocus shares

Summer has been kind to BlueFocus shares

“We believe the deal, if successful, would raise 2013E EPS 16% to 0.97 yuan (54% y-o-y growth), according to Time Share’s net profit guidance.

“BlueFocus’ PR business is growing rapidly and it has acquired many leading advertising companies in fast-growing niche markets.”

Excluding future acquisitions, Goldman Sachs said it believes BlueFocus could maintain an organic growth of 25%-30% annually until 2014-2015.

“However, this does not mean the firm will slow its pace of acquisitions, which is part of its development strategy. BlueFocus’ string of M&As since its IPO indicates strong execution and we believe earnings may continue to outpace market expectations.”

See also:

BLUEFOCUS: Asia’s No.1 PR Firm Just Won’t Slow Down

BLUEFOCUS: PR/IR Play Reaped 100% Gain In Net Profit To 121 M Yuan

China IR Firm BlueFocus Nearly Triples Its 3Q Revenue

BLUEFOCUS: China PR Firm Share Price Up Over 56% Since End-Feb Debut!