Photo: Aries Consulting

Phillip: NEW OCEAN Target Hiked

Phillip Securities said it is raising its target price on New Ocean Energy Holdings Ltd (HK: 342) to 3.81 hkd from 2.16 (recent share price 3.05) while maintaining a “Buy” recommendation on the liquefied petroleum gas (LPG) powerhouse.

New Ocean Energy is the largest LPG operator in South China.

The company is mainly engaged in LPG importing, wholesale and retail sales as well as sales of electronic products.

New Ocean announced in June 2012 it would cooperate with Sinopec (Guangdong unit) to expand its business scope to oil products and natural gas.

The company’s retail dealership covers Guangdong Province, Hong Kong and Macao, and will gradually expand nationwide.

“The successful acquisition of Lianxin Energy is expected to bring considerable growth in the year-round performance of New Ocean. The company held a 100% equity stake in Lianxin Energy, and took over operation of 17 automotive LPG stations in Guangzhou in January 2012.

“The business is currently steady, and daily average sales amounted to some 655 tonnes, since which an additional 1.6 billion yuan operating income is expected for this year,” Phillip said.

New Ocean management said it had successfully obtained relevant licenses for LPG distribution in Guangzhou, and the company is expected to supply 2.6 million tons of LPG to the port in 2013, bringing nearly 700 million yuan in income and over 200 million yuan in profit, becoming the port’s third largest LPG supplier.

“New Ocean will complete construction of a 70 kiloton oil product depot on Gaolan Island in Zhuhai by the end of 2012. Meanwhile, it will expand LPG sales to industrial users, and will provide capital and technical support to assist industrial users in oil-to-gas projects in exchange for long-term LPG supply contracts, to bring new business growth drivers into play,” Phillip added.

The research house said it believes LNG can hardly replace LPG in the following few years, and LPG application percentage in the car market will further expand.

“The company’s end market sales are still expected to increase substantially.”

Phillip said that New Ocean is currently in a “rapid development phase” and successive operation of several under-construction projects will bring considerable growth for future performance based on rapid growth of performance.

“Although the share price has reached our preset target price in advance, and the P/E has risen from 6 times to 12 times, it is still lower than the peer average of 17 times. From the business structure, its profitability is still in the industrial leading position,” Phillip added.

“Therefore, we have optimistic expectations about the company’s future valuation, and raise its six-month target price.”

See also:

Stepping On The Gas: NEW OCEAN ‘Buy’, CNOOC/KUNLUN Top Picks

SINOPEC, NEW OCEAN ENERGY: Heading In Opposite Directions

Mirae Asset: HILONG Expected to ‘Outperform’

Mirae Asset Securities said it is bullish on oilfield equipment supplier Hilong (HK: 1623).

“Trading at sharp discounts versus the bigger cap leaders, we believe Hilong’s stock could outperform, driven by long-term valuation re-rating and earnings growth from a smaller base,” Mirae said.

BP’s oil spill in the US and the rush for oil companies to spend more on higher quality equipment could spell positive earnings surprises ahead for those services providers offering superior technologies in the right markets.

“In fact, Warren Buffet’s recent investment in National Oilwell Varco (NOV) has affirmed our view that the superior earnings growth in the oil field services sector will continue amid sustained high oil prices,” Mirae added.

While NOV, Cameron, and FMC Technologies are the global market leaders, privately-owned Hilong has the highest market share in China, specializing in drill pipes (over 30% market share) and coating materials (over 60% market share).

Existing working relationships with major oil producers like PetroChina and services firms like Schlumberger will provide Hilong with opportunities to expand into drilling and cementing services too in the long term.

Listed in Hong Kong since April 2011, the stock is trading at 32% below its IPO price of 2.6 hkd/share with an average daily turnover (three-month average) of 0.4 million usd and little sell-side coverage.

See also:

NEW OCEAN ENERGY: H1 Profit Soars 39% On Strong China Sales

LPG Fuelling Furious Growth For NEW OCEAN ENERGY

Bocom: Stays ‘LT-Buy’ on PETROCHINA

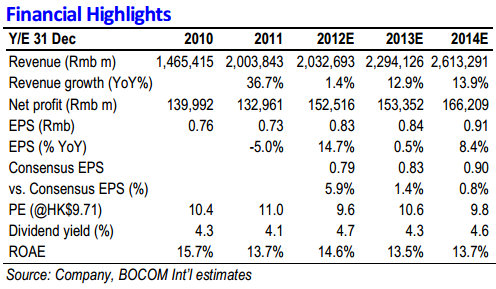

Bocom International said it is maintaining its “LT-Buy” recommendation on Petrochina (HK: 857) and target price of 12.60 hkd (recently 10.80).

“Third quarter results showed downstream operations still dragging on profit,” Bocom said.

PetroChina’s Q3 results came out with stable revenue at 551.6 billion yuan, up 5.9% q-o-q and 3.9% y-o-y.

Operating profit and net profit came in at 42.02 billion yuan and 24.9 billion, improving 9.9% and 9% q-o-q, respectively, but still a major drag, down 12.5% and 33% y-o-y.

Net income for Q1-Q3 totaled a less-than-stellar 64% of consensus FY estimate, and 57% of Bocom’s forecast.

E&P operating profit in Q3 was 49.5 billion yuan.

In Q1-Q3, crude price remained stable, down 0.2% over the same period in 2011 and crude production was up 2%, while average natural gas prices were up 5.5% and production was up 8.3%, bringing total operating profit to a 1.6% increase.

Downstream improving but hasn’t turned a corner

PetroChina’s refining loss halved from 12.9 billion yuan in Q2 to 6.7 billion in Q3 and its chemicals loss also more than halved from 5.15 billion yuan in Q2 to 1.81 billion in Q3.

“However, this is less stellar than Sinopec’s downstream. Whereas Sinopec refining had turned positive to a gain of US$1.1/bbl, but PetroChina’s refining lost US$3.9/bbl,” Bocom said.

Natural gas and pipeline gathered more loss from imported gas as expected.

“We still see risks in its downstream refining and chemicals segments as well as the loss of the natural gas segment. The stock is trading at 10.6x 2013 P/E, the most expensive in the sector.”

See also:

9 things to know about RH PETROGAS, the largest exploration & production company on SGX

Photo: Company

Bocom: SINOPEC Target Hiked

Bocom International said it is raising its target price on Sinopec (HK: 386) to 8.50 hkd from 8.00 (recent share price 8.25), while maintaining a “Buy” call on the energy giant.

“Sinopec had good results overall, with Q3 revenue at 677 billion yuan, up 5.5% y-o-y and flat q-o-q,” Bocom said.

Thanks to a turnaround in refining operating profit, operating profit (28.76 billion yuan) and net profit (18.3 billion) were down 1.9% and 8.5%, respectively, y-o-y, but up 51% and 65% q-o-q.

“Sinopec’s share price has risen 28.3% since our July 11 upgrade and designation as top sector pick, outperforming the HSI index by more than 17%.”

The hiked target price of 8.50 hkd is based on 9x 2013 P/E.

See also:

RH PETROGAS: Big Moves And News To Come