Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

CHINESE RESEARCH HOUSES may be fierce rivals when it comes to attracting new clients and competing to put out the most influential market reports.

One brokerage thinks property will lead the next charge, while another says individual counters of all sectors will begin to rise to the surface.

But one thing both agree on is that things are looking up.

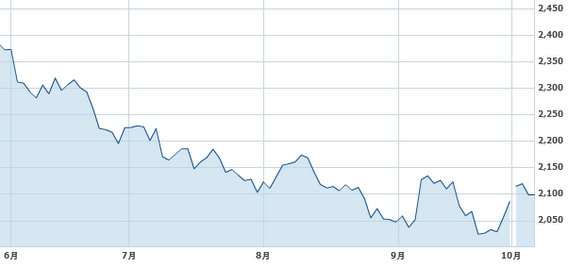

In late September, the benchmark Shanghai Composite Index – chief tracker of A- and B-shares listed in Shanghai and Shenzhen – was down 14% from a year earlier.

However, October has been kinder to investors in China’s capital markets, rewarding shareholders with a gradual recovery over the past four weeks with the benchmark index now down a more palatable 9.5% or so from 12 months ago.

So where to the most looked-to market watchers see things headed for the rest of a rocky 2012?

Gosunn Securities said Mainland China’s listed property developers would continue to provide that spark necessary to ignite a possible market rally going forward.

After Beijing opened its purse a bit wider recently with a major spending stimulus, and inflation growth figures surprised a bit on the downside, real estate plays had two new reasons to smile.

As one of the most capital-intensive industries on the bourse, with robust cash flow and cheap credit both musts to pounce on advantageous land bank accretion opportunities, developers thrive when money is not necessarily a problem.

“From many angles, the recent market climb-back is showing signs of a certain staying power. We feel property plays and securities firms are still good buys and can provide further buoyancy,” Gosunn said.

It advised investors not to be spooked by volatility in the sector’s share prices as many shareholders will be looking to make profits after any sustained climb.

“There’s still some wind left in the sails for the sector.”

Xiangcai Securities said that no one sector was outperforming of late, nor did any particular industry show signs of a near-term breakout run.

“The main board at present seems to be torn between throwing off the underperforming ballast stocks, or putting more effort into the stocks with untapped potential. The result is not a lot of movement in either direction.”

But it said that value investors might want to wait a bit longer to see which cream if any begins rising to the top.

“Once the market figures out its strategy going forward, the winners will be a lot easier to spot,” Xiangcai said.

See also:

CHANGING FACES: Five Sectors Turning Bullish

China Shares No Compass For Economy

Roadshow Reveals Growing Interest In China Shares

BEHIND THE SCENES: Top China Funds Faceoff In Beijing