Bocom: Staying 'Outperform' on HK-listed Retailers

Bocom International said it is reiterating its “Outperform” recommendation on Hong Kong-listed retail/consumer stocks.

“Hong Kong’s August retail sales growth slightly rebounded, but a sluggish growth trend is expected to linger,” Bocom said.

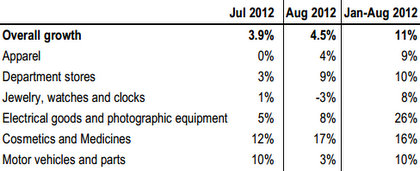

Hong Kong retail sales grew 4.5% in August, slightly rebounding from 3.9% in July but lower than the consensus estimate of 5.8%.

For the January-August period, the average retail sales growth was 10.8%.

The key segments showing improvements were department stores (to 9% vs. 3% in July), followed by cosmetics (to 17% vs. 12% in July), apparel (to 4% vs. 0% in July) and electrical goods (to 8% vs. 5% in July).

On the other hand, the key segments registering slowdowns were motor vehicles (to 3% vs. 10% in July), and jewelry & watches (to -3% vs. +1% in July).

“While we believe the sustained strong Chinese tourist arrival growth trend (+28% in Aug and +23% Jan-Aug 1H12) will help to provide support to the sector growth, the continuing sluggish consumer climate will dash hopes for a major recovery,” Bocom said.

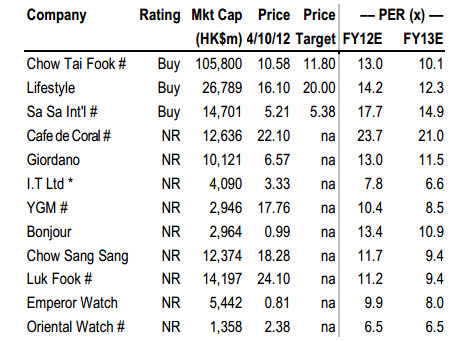

The research house is reiterating its “Buy” on Sa Sa (HK: 178) and Lifestyle (HK: 1212) in light of their “better growth defensiveness.”

See also:

CHOW SANG SANG Initiated ‘Buy’; HSBC Hikes Jeweler’s Target

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept At ‘Buy’, HK Property Initiated ‘Outperform’