Translated by Andrew Vanburen from a Chinese-language piece in Securities Daily

IT HASN'T BEEN a pretty summer for China shares, with a net outflow of funds from the market so far this month.

But some 12 billion yuan has been chasing after bargains in August.

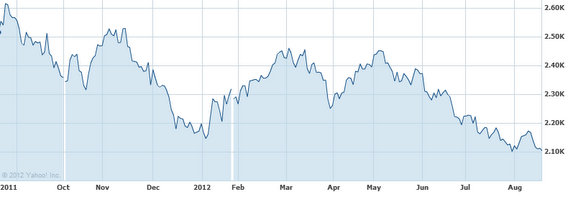

Since the start of the month, the Shanghai Composite – the benchmark index that tracks constituent A- and B-shares in Shanghai and Shenzhen – has fluctuated rather erratically in and around the 2,100 level.

It also hasn’t been a particularly good month in terms of attracting funds.

Since August 1, the net fund outflow from A-shares has reached 35 billion yuan.

But what seems to have happened is the overall market has taken the 2,100 level to be a launching pad for new activity.

When the benchmark index hovers below this level for any appreciable period, trading activity spikes, new funds usually pour in and brokers make a killing with commissions.

For the month to August 22, some 814 stocks have seen a net inflow of funds totaling just over 12 billion yuan.

Among them, ferrous metal plays have received 58.8% more fund interest, telecoms 54.5%, electronics 50.4%, home appliances 43.1% and biopharmaceuticals 42.0%.

While other sectors are represented in the August net positive fund inflow category, these five industries are leading the charge this month, primarily due to perceived undervalued counters in the sectors in question.

And a more detailed look at some of the counters in play here reveals not only true intrinsic and potential value underachievers, but also quality shares worthy of broader investor interest.

Ferrous

For the month of August so far, 20 ferrous sector stocks have displayed a net fund inflow, making it the best performing sector by this measure, with seven firms getting over 10 million yuan apiece.

They include Hebei Steel Corp (SZA: 000709) and Wuhan Iron & Steel (SHA: 600005), who have each garnered over 20 million yuan in new fund inflows this month.

The remainder have all garnered at least 10 million yuan apiece and include Shanxi Taigang Stainless Steel (SZA: 000825), Xining Special Steel (SHA: 600117), steel products distributor Luyin Investment Group (SHA: 600784), stainless steel pipe play Zhejiang Jiuli Hi-tech Metals (SZA: 002318) and Beijing Shougang Co (SZA: 000959).

Since July, steel prices have seen sharp, continuous falls and are already down to early-2010 levels.

And most analysts expect price declines to continue into the foreseeable future.

However, with prices for iron ore – the chief raw material for steel mills – languishing near recent-year lows, many market watchers expect steel plays to be attractive options, especially if an anticipated stimulus from Beijing surprises on the upside.

It will almost inevitably lead to more infrastructure spending on public works as well as housing.

And given the number of firms engaged in pipe steel operations, newly planned petrochemical projects in places like Xinjiang will provide major upside potential.

The other four sectors on the positive receiving end of fund attention this month are telecommunications, electronics, home appliances and biopharmaceuticals.

As opposed to ferrous metal plays – mainly steelmakers – these four industries are not part of the capital goods category per se and are much more prone to consumer spending trends than anything economic planners in Beijing might have up their sleeves.

Therefore, the fact that funds are pouring into these four consumer/retail oriented sectors might say something about Chinese domestic economic recovery, and the speed thereof.

New tablets, televisions, washing machines and major pharmaceutical purchases are not typically made when households feel the stress of economic uncertainty.

China Unicom (SHA: 600050) tops its sector, winning over 254 million yuan in new funds so far this month.

Could recent fund interest in these plays be a sign of an imminent economic recovery at home?

It is a development certainly worthy of monitoring.

See also:

FALLING STARS: Yao Ming Among Idols Not Immune To Malaise

PROPERTIES, PREMIUMS, PIERS: Three China Sectors Scrutinized

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?