Bocom: CONSUMER Sector ‘Outperform’

Bocom International says it is maintaining its “Outperform” recommendation on Hong Kong-listed consumer plays.

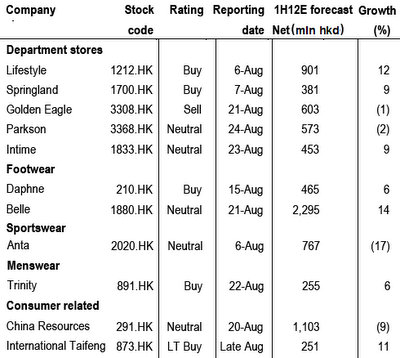

The sector will kick start the 1H12 reporting season next week, with Lifestyle and Anta to be the first to announce their interim earnings on Monday.

“Despite an imminent earnings growth slowdown across all segments, we expect footwear (with 1H net profit estimated to rise 6-14%) to fare better than department stores (estimated -2% to +12%) which were affected by increased commission rate pressure and higher new store start-up loss due to more aggressive expansion plans, while sportswear continues to be the poorest (with declines from 11% to over 50%) amid severe destocking pressure,” Bocom said.

The research house added that in its coverage universe, it expects Lifestyle to have the potential of earnings upside surprise, while Parkson may post a below-consensus profit.

“For CRE, we expect the 2Q decline to narrow considerably due to the strong beer growth, though the retail business remains the key share price overhang. Overall, the key focuses for the sector in 2H12E are SSS trend, retail discount pressure and new store expansion pace.”

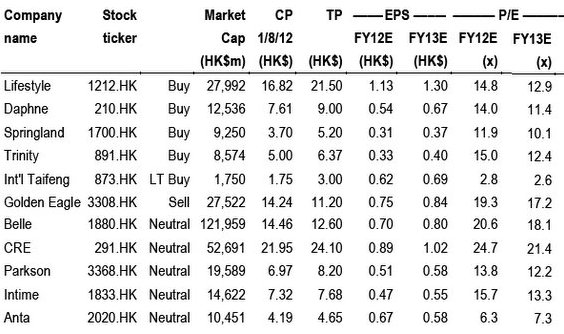

It is reiterating its key “Buy” on Prada (sector top pick), Sa Sa, Daphne, Lifestyle and Trinity; “Neutral” on Belle, CRE, Intime, Parkson and Anta; and “Sell” on Golden Eagle.

Footwear

Bocom expects Belle to report 14% growth in 1H12E net profit, led by 18% revenue growth (mainly on 6.7% footwear SSS growth and 20% new store increase) but partly offset by a slight OP margin decline due to increased promotional activities.

“For Daphne, we expect 1H12E net profit to grow 6%, led by 30% revenue growth on 17% SSS growth and 7% new store increase, but considerably offset by 2.9ppt drop in OP margin to 13.1% due to higher discounts and increased operating cost.

That said, despite the less exciting 1H results, Daphne remains its preferred stock in the ladies’ footwear universe due to its better longer-term growth story (FY13-14E EPS CAGR of 24% vs. 15% growth of Belle) underpinned by the margin upside potential (vs. Belle’s peaked margin trend).

"SSS growth, sales discounts and ASP trend are the sector’s key points to watch.”

Department stores

Bocom said it expects department stores' 1H earnings growth to range from -2% to +12%.

“Apart from slowed SSS growth (ranging from Parkson’s 4% to Springland’s 11%), higher new store start-up losses due to accelerating store expansion plans for most operators and margin pressure amid lower commission rate and increased promotional activities are the sector’s key adverse factors.”

It added that it anticipates Lifestyle will post the highest net profit growth (+12%) with PCD Stores, which issued a profit warning, to see the poorest growth.

“This is followed by Intime (+9%), Golden Eagle (-1%) and Parkson (-2%). Key points to watch include SSS growth, commission rate trend, breakeven period of new stores and potential delays for new store openings.”

It reiterates its “Buy” on Springland.

Sportswear continues to disappoint, with dismal results, the research house said.

“We believe the sector’s earnings downside risk remains the highest among all retail segments, due to mounting margin and sales pressure amid the industry’s sustained structural problems, plagued by price wars due to lingering destocking and over-expansion problems,” said Bocom.

Apart from Li Ning, China Dongxiang and Peak which issued profit warnings, the research house expects the rest of the sportswear names to post double-digit net profit declines, with its estimated -17% for Anta.

“We believe the persistently low visibility and negative newsflow will continue to cloud the sportswear market outlook.”

See also:

HK-Listed Electronics, Insurers, Property Developers, And Shippers: The Latest...

HK RETAIL RUNDOWN: Summer Of Shivers

Bocom: Healthy HEALTHCARE Sector

Bocom International said it is reiterating its “Market Perform” call on Hong Kong-listed healthcare plays.

“As for the interim results preview, drug products should maintain growth. The healthcare industry reported a YoY growth of 19.1% in total revenue in the first six months of the year, indicating a slowdown compared with the beginning of the year,” Bocom said.

Photo: TRT

It added that it believed the toxic capsule scandal earlier this year caused a short-term impact on the industry.

Net profit for the sector showed a faster growth of 17.4% compared with the beginning of the year.

“The difference between the growth of revenue and net profit gradually narrowed, indicating a margin recovery.”

Among the companies under Bocom’s coverage, Sino Biopharm (1177.HK, over 45%), Trauson (325.HK, 25%) and Tong Ren Tang (1666.HK, 28%) are expected to achieve net profit growth of over 25%, and Sinopharm (1099.HK, 20%); Sihuan Pharm (460.HK, 20%) and Lijun Int’l (2005.HK, 5%) are expected to achieve net profit growth of 0%-25%.

Meanwhile, China Pharma (1093.HK) should report a year-on-year decline in net profit.

Bocom also upgraded Lijun Int’l from “Sell” to “Neutral”, downgraded Sihuan Pharm from “Buy” to “LT-Buy” and Sinopharm from “LT-Buy” to “Neutral”, and kept the ratings of other stocks unchanged.

See also:

HK Market: CONSUMER, INSURANCE

Top 1H HONG KONG GAINERS: Property King Of The Hill