Translated by Andrew Vanburen from a Chinese-language piece in First Financial

THE WORLD'S most famous investor Warren Buffett’s Berkshire Hathaway AGM has just wrapped up in Nebraska, with 400 Mainland Chinese investors in attendance.

You’ll recall that he bought around 10% of the struggling Chinese electric carmaker BYD a few years ago.

So what stocks if any was the “Oracle of Omaha” looking at in China?

Confidence in China

Before the Wall Street meltdown, Buffett was the world’s richest man. But his global ranking slipped to No.3 in 2011.

This “demotion” along with a recent cancer diagnosis haven’t tempered Buffett’s enthusiasm for finding investment opportunities around the world.

The 81-year old American said during the annual get-together in Omaha that he had “confidence” in his investments in the world’s second biggest economy.

During a Q&A session with his 88-year old business partner Charlie Munger in an auditorium full of investors from around the world, Buffett expressed no regrets about his well-publicized stock picks in China over the past few years.

Buffett pointed to the PRC’s top energy firm – state-owned oil and gas play China National Petroleum Corporation (CNPC) – as well as his and automobile company BYD, and he said he was optimistic about the outlook of Chinese stocks.

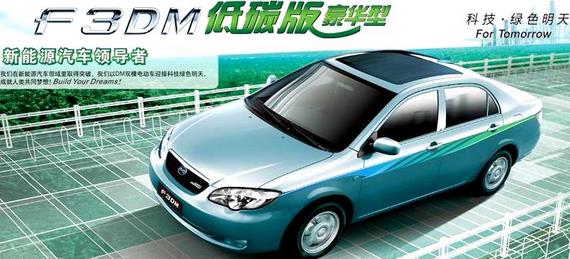

During the darkest days of the global financial crisis, Buffett’s investment firm pumped 232 million usd into Hong Kong-listed hybrid vehicle maker BYD Co Ltd (HK: 1211; SZA: 002594), giving him a 10% stake in the Shenzhen-based firm.

However, the automaker has seen slumping financial results over the past several years, a rapidly declining market share for its top-selling models, widespread accusations of pirating designs from rivals and the closure of several dealerships due to falling demand and overcapacity.

Buffett called his money’s performance in CNPC “very successful” so far, adding that Berkshire Hathaway had made around 3.5 billion usd from the pick, and his staff was on the lookout for similar opportunities in the world’s most populous country.

As for BYD, the “Oracle of Omaha” said that the story wasn’t over for the automaker.

But Buffett and Munger, for decades the master of the “value investing” game, said they were not by any means putting their eggs in one basket, but would keep a global outlook and pursue opportunities wherever they were to be found.

Munger himself said he was still upbeat on prospects in the Mainland Chinese auto market, now the world’s largest, despite a revved-down performance over the past few years.

However, the two said Berkshire Hathaway was not heavily interested in major Chinese investments at this point as the company favored opportunities that offered large scale capital investment potential.

When asked what he looked for in investment opportunities, Buffett said his Omaha-based firm used the same standard around the world when deciding where to place its money, with a premium placed on market advantages, competitive strengths, capable management and stable growth prospects.

He also offered guidance to investors by way of what he was not particularly interested in, namely major stake purchases of technology firms at this point.

Buffett said that despite his firm’s 13 billion usd stake purchase in IBM, that was more the exception to the rule as he felt the technology giant’s prospects were more easily understood that its peers in the industry.

He said his investment in CNPC was “essentially over,” having already made some 3.5 billion usd from the sale of the energy giant’s shares.

“I hope you can help me find similar opportunities in China,” he told a member of the PRC media at the annual event.

When asked to tell the secret to his success to the many investors from the PRC present at the meeting, he said they should start by reading a book he first read at the age of 19: Benjamin Graham's "The Intelligent Investor.”

See also:

Our Visit To Warren Buffett's Berkshire AGM: Wow!

WARREN BUFFETT: Our pilgrimage to visit the Sage of Omaha

BYD Pulling Out Of Auto Biz? Buffett May Too