BOCOM: NVC Lighting in strong position

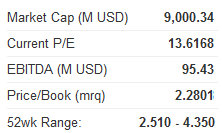

Bocom International said that NVC Lighting Holdings Ltd (HK: 2222), China’s top lighting products supplier, still deserves a ‘Buy’ recommendation due to the Hong Kong-listed firm’s strong value chain positioning.

“The formation of a joint venture with LED firm Shenzhen Refond Optoelectronics Co Ltd (SZA: 300241) will allow NVC Lighting to well position itself in the value chain with quality middle stream packaging technologies, cooperation with chip vendors and a strong distribution network,” Bocom said.

The brokerage added that LED adoption rates in general lighting, in particular commercial lighting and household lighting, will continue to climb, largely on competition between upstream LED chip/substrate suppliers and price drops.

“We expect NVC Lighting to report an EPS of HK$0.23 (‐2.7%)/0.28 in FY11/12E, respectively.”

Bocom said that on the demand side, LED backlighting for large display applications is still the largest end market for LED at this stage.

“LED lighting, which has massive market potential, has gradually gained market attention. The drop in the prices of upstream sapphire substrate and LED chips would reduce the total cost of LED lighting products, narrowing their price premium over conventional lighting products.

“The LED street lighting market is developing primarily due to government support, and China is the largest market at this stage.”

See also:

NVC LIGHTING Sees Brighter, Greener Future

VST Holdings: IPads, China Market Propel 1H Sales

KINGSTON: SAMSONITE eyeing big PRC expansion

Kingston Research said its target price for Samsonite International SA (HK: 1910), the world’s top travel luggage maker, is 15.3 hkd, representing a 6.3% upside.

“The Group’s recent strategy focuses on the development of emerging markets, especially in China. The Group hopes to open 300 stores in China this year, making a total of 1,800,” Kingston said.

Samsonite is the world's largest travel luggage company. On top of its core brand – Samsonite -- which aims at high-end users, the earlier acquisition of American Tourister helps the Group attract mid-range customers, the brokerage added.

Kingston’s Buy-in Price for Samsonite is 13.5 hkd and the Stop Loss is 12.5 hkd.

“With the enhancing wealth effect in China, the Group expects the China market to become its major source of revenue in 3 to 5 years.”

Samsonite plans its first dividend payout in March of this year.

See also:

SAMSONITE: What Analysts Now Say...

DAPAI: Minority Shareholders Want Dividend Payout And Expansion Via Fund Raising