Translated by Andrew Vanburen from a Chinese-language blog piece in Sinafinance

MARKET SENTIMENT can get bearish in a hurry when the bourse fails to have an upside week.

And the same can happen when too many positive weeks start accumulating, and pessimists start worrying that it's time to let some air out of the tires before they blow.

In other words, just when we were enjoying a sustained run on the A-share markets on the Mainland, some malcontented miscreant market-watchers want to rain on our parade by deconstructing the dais.

But it’s not all gloom and doom these brokerage bigshots have to offer.

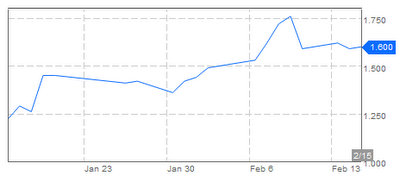

West Securities says that in looking at the current uptrend in A shares, it would seem that the ceiling is drawing near as the two most recent mini-bulls added around 8.3% and 10%, respectively.

This current upswing has already accumulated over 11%. So investors should expect the next nine days to see the Index stuck within a narrow range as it searches the landscape for more drivers, unless there is more good news from Beijing.

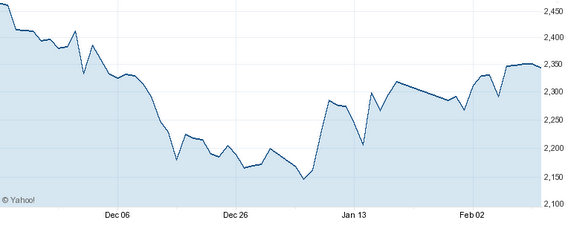

Dongwu Securities says that since the market stared into the abyss a few months ago, we have seen a slow but sure rise in the Shanghai Composite. In fact, the main board has enjoyed a run of four consecutive gaining weeks, with this currently being week No. 5.

The brokerage feels that with some of the unappreciated counters getting more attention from the pool of laggards, there is still the potential for further rebounds.

Galaxy Securities said the current gyrations in the benchmark Shanghai Composite Index should be likened more to a corkscrew than a choppy sea. The ride may be rough, with a lot of twists and turns, but at the end of the day the general direction is consistently upwards. The only worry should be if the corkscrew gets upturned and the downward spiral begins – or if the corkscrew isn’t long enough.

At the same time, investors cannot ignore the rocking boat along the current run, and should be wary of any signs of an approaching waterfall. These could be on the policy front or – more likely at this time of the year – could emanate from the earnings barrage as reporting season for 2011 is fast approaching, which makes the second quarter one of the most potentially volatile.

One excellent warning buoy for approaching eddies or, worse yet – waterfalls – is a sudden spike or plummet in daily trading turnover. And as for trading volume for individual counters, it is important to remember that too much daily interest – or a sudden sense of being ignored by investors – is a sure sign of trouble on the horizon.

Therefore, it is just as important for shareholders to monitor the “rhythm” of shareholder interest in their counter as it is to monitor the price movements.

Jinzheng Consulting says that the benchmark Index (which tracks A- and B-shares in both Shanghai and Shenzhen) is still trending above its 60-day moving average which should provide sustained upside support and help maintain a generally positive sentiment for investors.

The consultancy would closely monitor any possible macroeconomic policy shifts from Beijing – in the form of altered reserve requirement ratio or prime rate moves – especially after the surprising inflation figures from last month.

See also:

Just As In Gambling, Self-Control Equals To Research For Investors

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us