In updating our table Target Prices (SG) recently, we noticed that a few stocks were assigned target prices in excess of 50% of the market prices by analysts. Wow! We publish excerpts of their reports here. Remember, these are the analysts' recommendations and other analysts covering the same stocks have different target prices, as you can glean from Target Prices (SG).

DMX Technologies: Recent price 20.5 cents, target price 32 cents

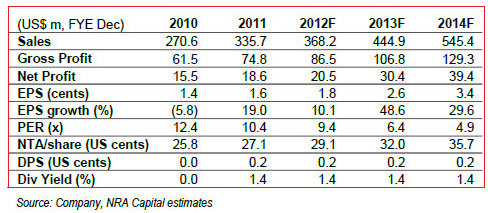

NRA Capital analyst: Jacky Lee

Spot on. DMX's 3Q12 net profit of US$5.8m (+9% yoy) was spot on with our expectation.

The key variances were lower-than-expected sales but offset by higher-than-expected gross profit margin. 9M12 results represent 62% of our full-year forecasts.

We kept our forecasts unchanged, given its 4Q is traditionally the strongest quarter for DMX (41%, 50% and 38% in 4Q09, 4Q10 and 4Q11, respectively).

Maintain Overweight. We raised our fair value by 5 cts to S$0.32 as we roll forward our base from FY12 to FY13, but at a lower 10x PER from 12x previously, still in line with its peer comparisons.

Given the 57% upside potential, we maintain our Overweight rating.

Still growing and optimistic despite an economic slowdown across Asia

The group is cautious with the uncertain global economic conditions which may impact its traditional infrastructure enabling business (ICT). However, the group is encouraged by the on-going positive developments projects for its digital media division.

Going forward the management will continue focus on the value added services for digital TV, according to the State Administration for Radio, Film and Television, the value added service fees expects to reach approximately Rmb55bn by 2015, which is almost equivalent to the basic digital cable TV fees.

We believe DMX should benefit from this new and upcoming opportunity as its Vision TV, Vision CEP and Vision TA software platforms are a few steps ahead of its competitors in China.

Recent story: DMX: Cloud computing to drive growth in IT spending

Sino Grandness Food: Recent price 47.5 cents, target 78 cents

UOB Kayhian analyst: Brandon Ng, CFA

Valuation

• At the current share price of S$0.475, it is trading at 2.3x2012F PE (ended Dec 12) and 0.135x PEG (2012-14F).

Currently, the fast-moving consumer goods peers in Hong Kong are trading at an average of 33.2x FY11 PE.

• We have a target price of S$0.78 which translates into 3.0x2013F PE, pegged to Singapore-listed peers’ average.

We note the potential upside of S$1.12/share if Garden Fresh obtains approval from an exchange to list assuming a holding company discount of 20% to Sino Grandness Food’s Garden Fresh stake and a 3.0x 2014F PE valuation to its remaining business.

Risks

• Volatility in raw material prices. Raw agricultural products accounted for more than 80% of total in-house production cost for canned F&B segment manufacturing. Any sharp movements in raw material prices would erode SGF's GPM if the group is unable to adjust the ASP accordingly.

• Failure to launch an IPO listing of Garden Fresh. As both CB1 and CB2 were issued on the premise for GF’seventual listing, SGF would have to redeem the bonds at an effective interest rate of more than 24% if the beverage business is unable to complete the IPO process.

Biosensors International: Recent price $1.14, target $1.80

Credit Suisse analysts: Lefei Sun, Jinsong Du & Iris Wang

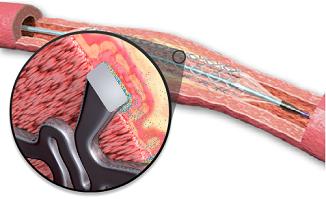

● Biosensors reported the 2QFY13 result, with a revenue YoYgrowth of 28%. Drug-eluting stent (DES) sales remained strong in Europe with double-digit growth, despite the global market size seeing a single-digit decline.

● Licensing revenue from Terumo declined 29% YoY but we are notconcerned. It seemed a temporary dip due to competing products launched in 1H12 but no more launches are expected in 2H12.

The renewed contract term with Terumo is better than before as it has downside protection plus unlimited upside.

● Gross margin increased from 80.7% to 83.7% on a YoY basis. DES will account for a higher portion of total revenue, and we expect the improvement in gross margin to be sustainable if it could continue the product mix changes.

● We maintain our OUTPERFORM rating. Our target price of S$1.80 is based on 20x FY13E EPS. It is trading at 12.5x FY13E EPS,still below peers.

Recent story: @ BIOSENSORS AGM: "Company in high growth, no plan for dividends"