This article was recently published on www.nracapital.com and is reproduced with permission

ASTI - Dragon Group its 61.6% subsidiary to sell 100% of Dragon Technology & Distribution for US$19.4mn, its NTA......what does this mean for ASTI ??

ASTI announced last night that its 61.6% listed subsidiary Dragon Group has entered into a sales and purchase agreement to divest its 100% stake in Dragon Technology & Distribution at its NTA of US$19.4mn.

In its half year ended June 2012, Dragon reported a 10% decline in revenue and a loss of S$1.23mn.

We don't have detailed numbers on Dragon Technology and Distribution but it would appear that most of the debt in the ASTI Group and Dragon come from this entity in terms of short term working capital debt and the sale is good for both Dragon and ASTI.

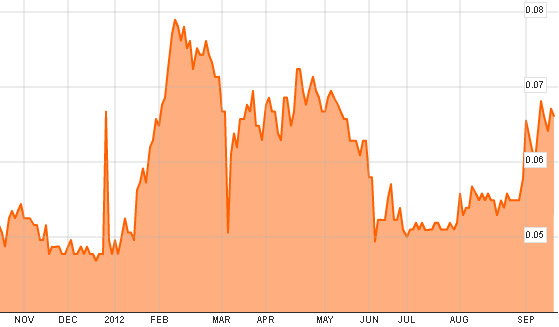

As of yesterday, the market capitalisation of Dragon Group was S$26.9mn.

With the sale, Dragon will now have cash of S$23.6mn - there will be no impact on Dragon's NTA as the sale will be at NTA.

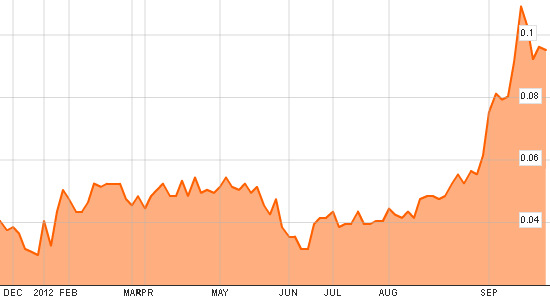

Chart: Bloomberg

For ASTI, its balance sheet will be strengthen at the consolidated level through Dragon.

ASTI's market capitalisation as of yesterday was S$45.7mn.

With the absence of the loss making Dragon Technology, ASTI's consolidated numbers will improve and its balance sheet will be in a stronger net cash position.

Depending on the profitability of its other businesses in particular its histroically profitable equipment business which is still contributing profits, ASTI is better poised for a market rerating.

Post its recent rights issue, ASTI's NAV is S$0.174 against its current market price of S$0.067.

Chart: Bloomberg

Recent stories:

KEVIN SCULLY: Takeaways from meeting with CEO of AEM

'OXLEY HOLDINGS - a decent set of FY2012 results but was disappointed in the stock split and rights issue'