AUSGROUP HAS posted excellent FY2012 results, with all the key financial indicators trending in the right direction.

Group revenue was up 5.0% at A$632.0 million, gross margins have expanded by 2.8 percentage points to 12.4%, and net profit attributable to shareholders was up 88.1% at A$23.3 million.

Net cash from operations was A$41.0 million compared to a negative A$11.6 million in the previous year.

Cash and cash equivalents stood at S$32.8 million, up 23.5%.

In view of its strong financial position, it announced a special cash dividend of 0.36 cents per share in addition to its final cash dividend of 0.64 cent.

The total dividend of one Singapore cent is 56% higher than what it previously paid.

Based on its closing price of 38 cents on Wed, it has a dividend yield of 2.6%.

Its orderbook as at 29 Aug was A$324 million, with A$792 million of new contracts secured in FY2012.

‘Order books have been increasing year-on-year for the past four years. We expect our order book to keep on increasing as there is a strong pipeline of multi-billion dollar projects well under way that we can provide services to,’ said CEO Laurie Barlow at its results briefing on Wed evening.

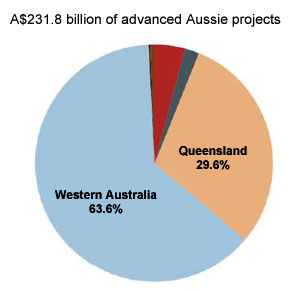

The demand for AusGroup’s manufacturing, construction and asset maintenance services for the mineral resources and oil & gas industries has been fueled by the boom in capital expenditure in Australia’s mining industry.

A survey in July by the Australian Bureau of Statistics points to a rise of 41% in mining investment in 2012/13, after rises of 33% in 2009/10 and 75% in 2010/11.

The company intends to expand into the Queensland natural resources sector, where its coal seam gas industry has grown rapidly over the past 15 years. Annually, the number of wells drilled increased from 10 in the early 1990s to almost 600 in 2010–11.

Natural gas extracted from coal beds has in recent decades become an important source of energy in the US, Canada, and other countries.

”Queensland has abundant coalmines. Coking coal, together with iron, is needed to produce steel. So wherever there is demand for iron, there will be demand for coal. Our services in Western Australia can be duplicated in Queensland,” said executive director Stuart Kenny, who was also at the meeting.

Below is a summary of questions raised at the investor briefing and the replies provided by the Mr Barlow, Mr Kenny and CFO Anthony Hardwick.

Q: How much will headcount increase in the year ahead?

Headcount is proportional to order intake (projects won) because our people generate our revenue. We had more 3,000 people during the year. Labor forms a large portion of our cost of sales.

Q: Do you face labor shortage problems?

We have not had any major problems securing skilled labor to service our projects. We have a very good people capital group that keeps track of people as they move on and off projects.

We had cases when we brought specialist welders in from the UK, we also have the ability to bring people in from the Philippines.

When we bring in someone, it's a thorough process. We interview them. We reference check them. We test their skills. We give them a medical test, including on drug and alcohol. When they join us, we give them induction and training for the project.

Labor management is a barrier to entry in our line of trade. Unless you do all of the above, you end up with a workforce that is unsafe, untrained, unskilled and inefficient.

Q: Do you face pressures in cost of labor?

We have very good industrial relations unions in our business. They help us get very good outcomes in how we treat our workers and clients. This is done via side agreements that last through the life of the project and that locks in wage growth and employment conditions.

Q: You had a fantastic 4Q. Can you sustain the margin increase?

We are bidding at the same margins, but we are working hard on project delivery in terms of how we maximize efficiency and minimize risk. I would like to say margins would go up, but it’s really all about delivering the projects. We are working towards net margins of 5% to 6%.

We plan to deliver consistent and stable quarter-on-quarter growth.

Q: What is your hit rate for project tendering?

Historically, the hit rate has been about 50% but that has come off because the projects have grown much bigger. Right now, it is about 20% to 30%.

Q: There is a lot of talk about the capex cycle peaking in the resource sector in two years. How does this affect you?

Yes, there is a lot of talk about the capex cycle peaking in the mining sector. The projects that BHP turned off were still in their early stage that would not hit us until 6 or 7 years later. There are many projects in the pipeline in the next 3 to 4 years.

Having said that, our business is very well positioned to service the oil & gas sector, which has multi-billion dollar projects in the pipeline. These include LNG projects in Western Australia that have yet to come into their construction cycle.

We are moving into Queensland, where there are a lot of coal projects. We can do a lot of work in coal, as well as base metals. We feel confident about the future.

Q: What is your borrowing cost?

We borrow cash for working capital. We also have about A$7 million to A$8 million of performance guarantees that we have to pay when we have a big facility made available to us.

In Singapore, our borrowing cost is about 4% in SGD. In Australia, it is about 7% on the Aussie dollar.

Q: What is your dividend policy?

Dividend payout is usually 10% of net profit. However, for FY2012, we had a special dividend of 0.36 cents in addition to the regular dividend because we performed exceptionally well financially.

Related story: AUSGROUP's New CEO Has Track Record As Strong Business Builder

See also July press release AusGroup outlines vision for $1billion growth