Excerpts from a monthly investment outlook by Financial Alliance (FA) sent to its clients recently.

In November 2008, Financial Alliance (www.fa.com.sg) became the first and only Financial Adviser Firm in Singapore to achieve both the Singapore Quality Class and the People Developer status.

Key points:

We believe that the market has yet to fully price in this so-called “global synchronised slowdown” and will continue to underestimate it.

While we do not believe that the slowdown will lead to a collapse in equity markets, we feel that it will keep markets in a soft patch as earnings growth come under pressure and sentiment remains weak.

• Despite this, we recently asked clients to start accumulating equities or to re-build their equity positions. Clearly, we see the present environment, where we expect equity markets to remain volatile for the next 6 to 12 months, as an opportunity. We actually believe that equity markets will emerge stronger over a 12 to 24-month time horizon.

• We are confident that, as the developed world mends itself, Emerging Markets will be the beneficiaries of the huge availability of liquidity in the global system presently.

The fact that both bonds and properties have limited upside after strong rallies over the past few years makes equities the clear asset class of choice for the future.

Q. How bad can it get?

FA: If you believe the man they call “Dr. Doom”, Nouriel Roubini, then it could get quite bad. Roubini says the “perfect storm” scenario he forecasted for the global economy earlier this year is unfolding right now as growth slows in the U.S., Europe as well as China. In May, Roubini reportedly predicted four elements – stalling growth in the U.S., debt troubles in Europe, a slowdown in emerging markets, particularly China, and military conflict in Iran - would come together to create a storm for the global economy in 2013.

And to make matters worse, Roubini highlighted that policymakers are “running out of rabbits to pull out of the hat”, adding that it is becoming apparent that there is little global policymakers can do to arrest what some describe as a global “synchronised slowdown.”

For the record, we have been arguing a similar case for some months now. While we do not believe that the slowdown will lead to a collapse in equity markets, we feel that it will keep markets in a soft patch as earnings growth come under pressure and as sentiment remains weak.

Q. Is this a threat or an opportunity?

FA: This is probably not the first time we have been asked this. First and foremost, our predictions that the Eurozone situation will take some time to work itself out and that the slowdown in global growth is being underestimated are unfolding.

Despite this, we recently asked our clients to start accumulating equities or to re-build their equity positions. Clearly, we see the present environment, where we expect equity markets to remain volatile for the next 6 to 12 months, as an opportunity.

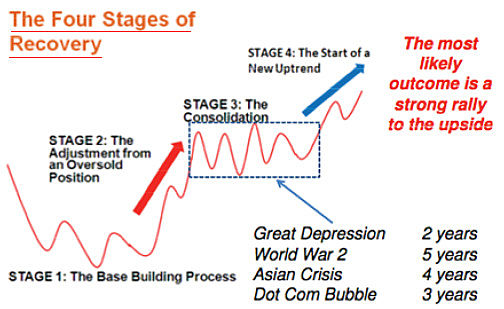

We actually believe that equity markets will emerge stronger over a 12 to 24-month time horizon. This view is based on our 4-Stage Recovery Model (see diagram 1) that many of our readers will be familiar with as we have referred to it regularly.

The 4-Stage Recovery Model states that after a huge crash, like the one we saw in 2008, the market will recover in 4 stages: a base building stage (Stage 1), a rally from an oversold position (Stage 2), the consolidation (Stage 3) and a new rally (Stage 4).

The four big crashes in equity markets over the past 80 years (namely, the Great Depression of the 1930s, World War 2, the 2000 Dot Com bubble and the Asian Crisis of 1997) were accompanied by recoveries according to these 4 stages.

We believe that equity markets are now generally in Stage 3. In this stage, markets have historically consolidated for a period of time, before rallying sharply in the final stage (Stage 4).

Such consolidations have varied from the Great Depression’s two years to World War 2’s five years.

We have strong reasons to believe we are now at the tail end of Stage 3. As such, we are positioning clients in preparation for Stage 4 as we expect a strong rally in equities in the next 12 to 24 months.

Q. What will be the catalyst for this expected Stage 4 rally?

FA: From the fundamental viewpoint, we believe that “the tin can that has been kicked down the road” due to the repeated injection of liquidity, is now reaching the end of the road.

This is the scenario which Roubini had envisaged.

This means that governments and central banks can no longer avoid a typical and traditional recession from taking place – an outcome they have successfully limited through fiscal pump priming and loose monetary policies in recent years.

Such a recession will now entail restructuring and bankruptcies, as deleveraging take hold. In fact, we have already started to see this happening in many parts of the world, notably Europe.

On the other hand, we believe that the U.S., which was the epicenter of the 2008 Great Recession, has yet to fully undergo the necessary structural adjustment and thus remains in a vulnerable state.

As such, in the years ahead, Emerging Markets could remain the only area where one can find decent and respectable growth. The Institute of International Finance projects that in 2012 and 2013, mature economies will post mere growth levels of 1.4% and 1.7% respectively.

These pale in comparison to what Emerging Economies are expected to post: 5.2% and 6.0%, respectively. And even within Emerging Markets, it is the Asia-Pacific economies that are expected to power ahead with growth rates of 7.0% and 7.6% respectively.

This is an important point because the fact of the matter is that the world continues to remain flooded with liquidity which will sooner or later find a place to go to.

The amount of liquidity injected by the three major central banks of the world, the U.S. Federal Reserve, the European Central Bank and the United Kingdom’s Bank of England, has over the past 18 months exceeded the amount injected at the height of the Great Recession (to avoid what seemed to be a world on the brink of a depression).

To date, much of this massive liquidity has made its way into the bond and property markets, spurred by the fact that interest rates worldwide are at historical lows.

However, one has to question the assumption that rates will remain low indefinitely. We sense that inflows into these two asset classes have also slowed down as it is clear that the upside is limited but the downside risk is far greater.

On the contrary, excess liquidity has not made its way into equities in any sustained manner. Inflows have been in spurts, starting in periods which see promising rallies but quickly give way to outflows as these rallies peter out.

Yet, we are confident that, as the developed world mends itself, Emerging Markets will be the beneficiaries of this huge availability of liquidity. The fact that both bonds and properties have limited upside after strong rallies over the past few years makes equities the clear asset class of choice for the future.

Recent story: SANI HAMID: "2H economic data will be negative -- time to buy stocks!"

The world is swimming in the ocean of money, greenback , euro and yuan. Like Dr Doom said, the story is unfolding. Consumer spending will decrease. Just how many Iphone or smart phone or cars or house one can own?

STI's high is 3800 in 2007, about 700 for recent high.

Not so sure if equities are the perfect investment to have now?