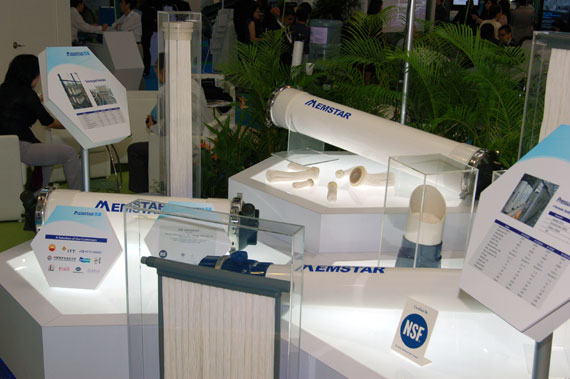

Photo by Sim Kih

TRADE SHOWS are a great place to meet customers, suppliers, business partners and keep oneself abreast of the latest industry developments and trends. Last but not least, it is also a place to size up the competition.

I visited the Singapore International Water Week, and spoke with two SGX-listed market leaders for water treatment using membrane technology: Memstar and United Envirotech.

“Trade shows are good for branding building,” said Ms Pan Shuhong, the executive chairwoman of Memstar, a leading manufacturer of membrane products used in water treatment plants.

Memstar is also a founding sponsor of Singapore International Water Week, which showcases more than 650 companies and organizations from around the world.

The focus of the Water Week was the emerging global industrial water sector. United Envirotech happens to be a market leader in designing and building plants for wastewater treatment using membrane technology.

It designed and built Singapore's largest industrial wastewater treatment plant for SembCorp.

The industrial water and wastewater equipment market is expected to grow at 7.5% a year over the next five years to reach a total value of S$22 billion in 2016. Demand for equipment is expected to grow fastest in the oil and gas sector, at an annual rate of over 24% (Global Water Intelligence forecast).

Organized by Singapore’s Ministry of the Environment and Water Resources in our nation’s bid to be a global water hub, Singapore International Water Week was into its 5th year and was held from 1 to 5 July at the Sands Expo & Convention Center, Marina Bay Sands.

Over 13,000 delegates from about 100 countries viewed the gamut of cutting edge technology that showcased practical and sustainable water solutions.

Venture capitalists, angel investors, private equity fund managers and institutional investors with industry representatives also got to check out start-ups and technology inventors for possible technology commercialization opportunities at its TechXchange Workshop.

A place for engaging business partners

"Customers appreciate the trade show because it maximizes their valuable time by providing a one-stop platform. Here, they can engage potential business partners and view the latest solutions that technology has to offer for the management of water scarcity,” explained Ms Pan.

Some customers, especially those in the civil service, are not as technically savvy as suppliers in the commercial sector, and Memstar has done its part in raising the understanding of membrane applications among governments and corporations in China, the Middle East and Singapore.

Memstar's long time customer, Dr Lin Yucheng, CEO of SGX-listed United Envirotech, was at the trade show. His deputy CEO, Mr Lee Li, was also present.

"Industrial wastewater is much more difficult to treat compared to municipal waste because of the complexity of its highly toxic chemical content. For example, pesticides are designed to destroy life," explained Mr Lee.

Endorsement from top membrane player

"We have used Japanese products, but found them overly costly. We have used Chinese products, but found the quality unreliable. Few manufacturers can produce quality membrane products at a reasonable price. Many water treatment players are using Memstar as an OEM supplier because they provide very good value for money," said Dr Lin.

"We hope all membrane technology players can work together to develop the industry," said Memstar CEO, Dr Ge Hailin.

If every player does well, the industry market pie will grow bigger for everyone.

Dr Ge had a suggestion for the trade show organisers: China's increasing importance in the global economy makes it an important market for any water hub and he looks forward to seeing more Chinese state-owned consultancy firms at the trade show.

Currently, there is a lack of presence from the Chinese consultancy firms that design the technical specifications used by industrial and municipal players in China's water industry.

These firms are highly influential because the nation has yet to license international water players and it would certainly be exciting to have a platform for presenting one’s innovations to the folks who decide which standards would be used across China's huge market, he said.

Related story: MEMSTAR: Another Target For Private Equity Investors?

More photos of the trade show by Sim Kih.

china would not support hyflux as it is malaysian ceo and sg company but memstart got higher chance.

Seems silly but china is a communist country and may go to war with neigbours and they need to know their water supply is intact.

Membrane technology is the future way to go as it is cost effective vis-a-vis filtration and evaporator systems which are high in energy consumption.

Actually, if you have extra cash in hand, Ezra Holdings offers very good potential in capital appreciation. It is now trading at a 3-year low of around 1.09. The oil & gas industry is breathing life and is on the rebound, which makes this counter very attractive in terms of price. This is also a counter very much favoured by the fund managers.

I Have a bit doubt on hyflux on whether they can manage the big project. Recently they raise a few times of money by issuing new share or bonds. And margin was low, and they developed so fast, fundamentally they were a membrane company only. To me, hyflux was not yet proved., I would prefer Semb Ind, at least their track record was good, and utility part was growing.

United enviro profit lower this year was due to higher financial cost from convertible bonds.management already invest a few waste water plant with these money. profit will be 3acts++/share for the next few years. And only can be better.

Sorry, dividend for Hyflux for 2011 should read as 0.0102 Sorry for the typo error.

Maybe the following statistics can help you in your decision making process if you are looking at investing in this industry :

a) Hyflux 3 year High $3.40 (Jun '10) Low $1.03 (Dec '11) Dividend '12 = 0.021 (yield = 0.0142) Dividend '11 = 0.0069 (yield = 0.0069). Upside potential based on current price $1.475 = 230 %

b) United Envirotech 3 year High $0.515 (Sep '10) Low $0.29 (Aug '11) Dividend '11 0.003 (yield = 0.0092) Dividend for '12 not declared yet but probably same as in '11. Upside potential based on current price $0.325 = 167 %

c) Memstar 3 year High 0.09 (Aug '10) Low 0.055 (jun '10) Dividend 0.0004 (yield = 0.0061). Upside potential based on current price $0.065 = 138 %.

Based on the above statistics it is quite obvious that Hyflux offers the best option available bearing in mind that it has an order book of about S$1.8bn currently at hand.

I have not yet invested in this counter as I am currently already deeply vested in other counters.

For the benefit of our readers, contrary to the impression inferred from the comment by "shARK" above, Hyflux is also deep into wastewater treatment. It has a contract with Zunyi City (Guizhou Province, China) for the building and operation of a wastewater treatment plant with a 150,000 cubic metre capacity to be operated over a 30 year period. I believe this plant alone already surpasses the capacity of United Envirotech's plant in Guangzhou which has only 100,000 c.m. as pointed out by "shARK". Also it has several other wastewater treatment plants elsewhere in other parts of China, although these are of smaller capacity, such as the Changshu plant (in Jiangsu) with 30,000 c.m. capacity; the Langfang plant (Hebei) 80,000 c.m.; Liaoyang plant (Liaoning) 30,000 c.m.; and the Mingguang plant (Tianjin) 30,000 c.m. As you can see, it is not just doing desalination water works alone.