TOP FUND MANAGERS from China have just visited Sapphire Corp to learn about its business exposure in China.

They were on a hunt for undervalued Singapore-listed stocks with exposure to China’s economic growth.

Sapphire trades at around 17 cents compared to its intrinsic value of 42.5 cents (as estimated by SIAS Research in a report in March 2012).

The fund managers learnt about Sapphire’s involvement in areas such as:

a. Iron ore production for making steel.

b. Vanadium pentoxide production for strengthening steel.

They also sought to appreciate the demand for its products in rapidly-expanding cities of Chengdu and Chongqing.

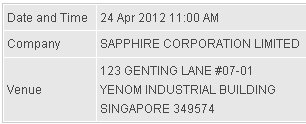

You can have an opportunity to hear from, and speak with, the management of Sapphire too, and improve your understanding of its business prospects, by attending its AGM on Tuesday, April 24.

In addition to shareholders, Sapphire welcomes observers to its AGM and thereafter to lunch at its office.

If you wish to attend, email your full name & contact number to Angeline Lim, Corporate Communications Manager:

Kindly email your particulars as soon as possible to facilitate lunch arrangements.

For the location map of Sapphire's office at 123, Genting Lane, click here.

Recent stories:

> SAPPHIRE's intrinsic value is 42.5 cts, SINWA's profit up 64%

> SAPPHIRE: Why vanadium is a sexy growth driver