TENFU (CAYMAN) Holdings Company Ltd (HK: 6868), China’s top seller of tea, tea snacks and tea wares backed by a 1,200-strong store network across the PRC, continues to outsell its competitors in every category.

However, its share price is currently at around 5.3 hkd, below the IPO price of 6 hkd seen a full three months ago.

Speaking at a recent investor conference in Shenzhen sponsored by China Merchants Bank, a Tenfu Tea official explains that the firm is taking steps to “steep up” the share price.

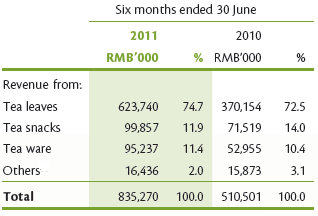

One of its biggest areas of improvement has been the top line.

“Beginning in 2008, we began shifting towards a greater percentage of self-owned shops as opposed to purely franchise- or third-party run. This strategic move has gone a great way towards boosting our operating revenue, and coupled with the fact that we are rapidly increasing our store numbers in China, I am very confident looking forward,” said Tenfu Tea Investor Relations Manager Tina Shi.

Ms. Shi is also excited about her new job and is eager to confront the challenges of representing a newly-listed enterprise.

“We listed on September 26 and I was hired by Tenfu just after that.

"In fact, this position didn’t exist when we were still private,” she said.

Indeed, her eclectic background seems to have well-suited her to the position.

A Canadian, she graduated from The University of British Columbia with a bachelors in cell biology, which can come in handy working for Tenfu – a firm which takes tea-making and the science thereof very seriously,

The firm operates its 2,000-student strong Tenfu Tea College in its home base of Fujian Province as well as the Tenfu Tea Museum).

And to round things off, Ms. Shi just received her MBA in Finance from The University of Hong Kong this summer – just in time for her new gig.

“This is an exciting time to work for Tenfu, especially as we plan to expand by around 150 stores per year over the next five years – both via self-owned and third-party stores,” she said.

"And we are also looking to improve our supply chain by targeting mainly upstream assets for possible M&As."

She said Tenfu’s decision to shift to more self-owned stores was clearly reaping benefits in its revenue growth.

Indeed, in 2008 when the still private firm began its transition away from franchised and third-party owned shops, its revenue for that year totaled 571 mln yuan, which jumped 21.3% to 692.7 mln the following year.

The increase was not thanks to a rapid uptick in store numbers, which rose slightly to 912 shops in 2009 from 876 the year earlier, but instead due to the gradual shift to self-owned outlets.

This trend was even more dramatic from 2009 to 2010, when store count figures rose to 1,042 from 912, while the top line jumped a dramatic 80% to nearly 1.3 bln yuan for the Jan-Dec 2010 period.

"And at last check, our SSS (same store sales) were up 13-15% on average," Ms. Shi said.

Photo: Aries Consulting

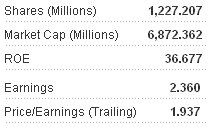

Tenfu was also encouraged by its September listing in Hong Kong, raising 1.25 bln hkd by selling 208.62 mln shares – 17% of its enlarged share capital.

Despite the economic uncertainty gripping markets worldwide and the investor unease in Hong Kong, Tenfu still managed at the time to successfully price its IPO at 6 hkd per share, at the higher end of an indicative price range of 4.80-6.80 hkd.

Pre-IPO investors also subscribed for its new shares at a total consideration of 30 mln usd.

Funds raised were used for the development of retail outlets in the PRC as well as general working capital.

Ms. Shi added that Tenfu’s growth strategy involved opening new retail outlets on high-traffic streets in central business districts (CBDs) of selected cities and in popular shopping malls.

“We are always strengthening our business relationships with major department stores and hypermarkets, and continue to renew and upgrade our stores to enhance the ambience and atmosphere of our retail outlets.

“And we are always focused on improving customer service quality through periodic sales training.”

The latter assertion I can attest to, with my experience chronicled in an earlier story compiled from visits to several Tenfu stores in Fujian and Guangdong, all characterized by staff who stood out for their genuine friendliness.

And despite the institution of tea being as old as China itself (perhaps five millennia?), Tenfu was not so wedded to tradition that it ignored evolutions in the trade.

“We are also, of course, constantly developing and introducing new concepts for tea-related products, and we believe our broad portfolio of products will help maintain a leading brand awareness and keep pace with constantly changing consumer trends.”

In short, Tenfu is tops in China by a long shot, with rivals lagging far behind in terms of number of branded shops and volume of tea sold.

Tenfu doesn’t mind being a bit lonely at the top of the market, but it wouldn’t mind a bit more attention from investors as it truly believes it has a lot more to offer than its share price would indicate.

See also:

TENFU: Tea For Two? Or Two Billion?

TENFU TEA: Top Tea Company Doubled Profit To RMB 220 M In 2 Years