Excerpts from analyst reports...

UOB Kay Hian initiates Sino Oil & Gas BUY

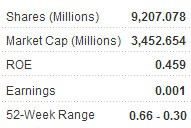

UOB Kay Hian has begun coverage of Sino Oil & Gas (HK: 702) with a ‘BUY’ call with a 0.78 hkd target price.

Sino Oil & Gas is engaged in oil and gas development in China. In 2H10, it acquired a 70% stake in Sanjiao CBM block and operating rights of Jinzhuang Oilfield.

CBM could be main source of gas. Despite its huge reserves of 36.8tcm, China’s CBM investment is typically capital-intensive with longer payback periods as low soil permeability makes drilling difficult. With rising gas prices, government subsidies and pipeline construction in place to pave the way for commercial production, China plans to raise CBM output significantly to contribute 25% of total gas supply in 2020.

Commercial production to surge After five years of exploration, SOG’s Sanjiao Block is expected to obtain the Overall Development Plan in mid-11. Thereafter, 50 more multi-lateral horizontal drilling wells will be drilled to boost CBM output volume to 30m cum this year via newly-built pipelines and compressed natural gas stations. In 2012-13, total commercial sales are expected to surge to 400m-800m cum, giving an earnings CAGR of 331.8%.

Competitive strengths Ties with government, drilling techniques. SOG’s management team members, hailing from the government or the CBM industry, could help solve administrative and technical problems and protect its interest from being infringed by its production sharing contract partner, PetroChina.

Initiate coverage with BUY and target price of HK$0.78 This implies SOG’s fair valuation is 39.4x 2012 and 16.5x 2013 PE, offering 59.2% upside.

Key risks include financing difficulties, as well as delays in pipeline construction and drilling programs.

See also: HK WEEKLY WRAP: Index Sheds 3.2%, 8.4% In June On Global Gloom

UOB Kay Hian says Samsonite enjoys economies of scale but may lack flexibility in fickle market

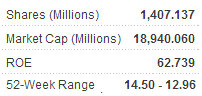

Last week, Samsonite (HK: 1910), the world’s No.1 luggage maker, raised 1.25 bln usd via the sale of 672.24 shares in Hong Kong, less than the 1.5 bln it had targeted provided shares sold at the top end of the indicative range.

The company plans to use 85% of the proceeds to repay borrowings, with the remainder dedicated to general working capital.

Samsonite, like Glencore and Prada, follows the recent trend of major western names seeking to raise capital in Hong Kong to tap into regional growth and boost recognition in the high-flying PRC market. But the Hong Kong stock market has been on a downward spiral of late, recently closing at lows not seen in nine months.

Background Samsonite International S.A. is the world’s largest travel luggage company by retail sales value in 2010, with a 100 year heritage.

The core brand, Samsonite, is one of the most well-known travel luggage brands in the world. In 2010, the products were sold in more than 37,000 points of sale in over 100 countries through a variety of wholesales and retail distribution channels.

Positives:

- The world’s largest travel luggage company with a category-defining brand and a 100-year heritage... a global leader with global scale

- Significant exposure to high growth geographies

- A strong track record of bringing innovative products to market

Negatives:

- Heavily depends on Samsonite and American Tourister brands

- May not be able to respond effectively to changes in market trends and customer preferences

- Ability to maintain sales growth depends on success of company’s growth strategies

See also: DAPAI: Minority Shareholders Want Dividend Payout And Expansion Via Fund Raising