AJISEN CHINA Holdings Ltd (HK: 538) saw its 2010 net profit shoot up 42% to 447 mln hkd on top-line growth of 35%, beating expectations all around.

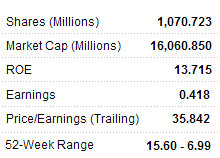

On Thursday, the noodle restaurant chain’s Hong Kong-listed shares rose over 13% and Friday they closed up another 2.04% at 15.0 hkd, producing a sky-high P/E of over 35 times!

UOB Kay Hian said the Japanese-style noodle chain’s bottom line beat a consensus estimate of 425 mln hkd.

“The earnings surprise mainly came from faster-than-expected revenue growth and margin expansion,” the brokerage said.

Ajisen China, which operates in both Hong Kong and the PRC, added 110 stores last year to boost the total count to 508, representing a robust 28% yoy expansion rate.

“Adding to revenue growth was improved sales efficiency per store. Due to market recovery, SSSG reversed from -1.3% in 2009 to 8.7% in 2010, and sales per sqm grew by 11% yoy to Rmb50. Average spending per capita also grew 6.4% yoy to Rmb38.3.”

Ajisen declared a total dividend of 0.23 hkd per share, including 0.105 of final dividend and 0.125 of special dividend, translating into a dividend payout ratio of 55% for 2010, up from 50% for 2009.

"After 10 years of development, Ajisen has reached the critical mass where the existing store count is large enough to cover the substantial fixed costs (e.g. the four production bases, logistics system, advertising and marketing) and support the opening of more stores without reliance on external financing. In tandem with increasing scale, net store additions could soar from 90 in 2007 to >150 in 2011,” UOB added.

SinoPac Securities has maintained its BUY rating on Ajisen China, thanks to the restaurant’s growing focus on the PRC market.

“The Chinese government is eyeing consumption-driven economic growth in its 12th Five Year plan and is vigorously promoting tourism for 2011, which in our view will be significantly positive to the food & beverage industry.

In the next three years, Ajisen will execute store expansion mostly in Mainland China focused on costal eastern cities and central areas,” the brokerage said.

It added that Ajisen expects its 2011 SSS to grow by 5.0% in Mainland China and by 2.0% in Hong Kong.

See also: AJISEN: Gross Margins Were 69% Last Year!