Excerpts from latest analysts reports...

YUANTA initiates ALIBABA (HK: 1688) ‘BUY’ on B2B dominance

Analyst: Kelvin Ho

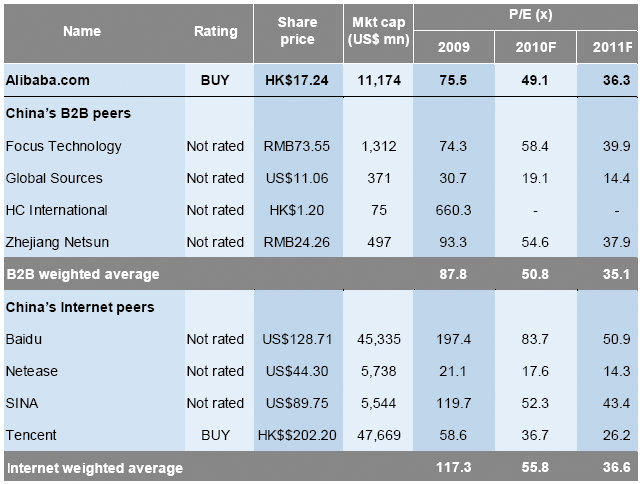

We are positive on Alibaba.com’s B2B prospects, including its market dominance, rising value-added services (VAS) contribution and robust rise in China TrustPass (CTP) members. In addition to B2B business, its cooperation with Taobao to explore B2C e-commerce for unbranded goods should provide another growth driver for Alibaba.com over the long term and lead to a re-rating for the stock. Our SOTP TP is HK$19.50 and we initiate with a BUY call.

B2B potential in China: A large and fragmented small-to-medium enterprise (SME) sector such as China’s is beneficial to Alibaba.com. Its first-mover advantage, economies of scale and high Internet traffic plus the rising adoption of Internet applications among SMEs suggests Alibaba.com should continue to appeal to buyers and sellers in both the international and domestic marketplaces.

Near-term growth slowing, but still solid: We do not deny slowing B2B revenue growth momentum in the short term due to the clean-up of fraudulent accounts and churning of Global Gold Supplier (GGS) members, as well as a price increase for China Gold Supplier (CGS) members from January 2011.

However, growth in CTP customer numbers and revenue should remain robust. Overall, we forecast strong ex-share base compensation (SBC) EPS CAGR of 28.5% from 2010-13F.

B2C potential: Recently, Alibaba.com and Taobao together launched a unique B2C platform called “WuMingLiangPin" for Alibaba.com’s domestic suppliers to conduct B2C e-commerce for unbranded goods.

We estimate that the transaction value for WuMingLiangPin could be as much as RMB12.5 bln in three years.

See also: SIHUAN PHARMA: Another Ex-Singapore Listco Headed For Better Pricing In HK

YUANTA starts TENCENT (HK: 700) ‘BUY’ on 630 mln-strong user account base

Analyst: Kelvin Ho

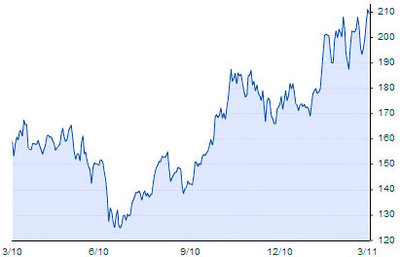

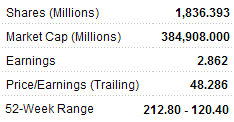

We like Tencent for its dominance in China’s instant messaging (IM) and online gaming markets, which have huge user bases primed for up-selling. The company has clearly demonstrated its ability to monetize its online community by up-selling premium IM products, online games, other Internet value-added services (IVAS) and mobile value-added services (MVAS). In terms of valuation, it trades at a discount to its peers in PEG terms, which we see as unjustified given its dominant online community.

Strong market position: Tencent has a strong foothold in China’s Internet market, with the largest online community, in excess of 630 mn active accounts, the largest social networking service (SNS), with 480 mn active users, the largest online gaming market share, of 29.1% in 2010, and it is a leading wireless portal operator, with solid traffic growth.

Tencent has proven its ability to monetize its online community with revenue CAGR of 61.2% for 2004-09.

Robust earnings growth: We expect Tencent to continue delivering strong earnings growth in the coming years, driven by its open platform strategy, strong online game pipeline, continued efforts to cross-sell MVAS to its IVAS users and buoyant online ad spending in China.

We forecast an ex-share-based compensation (SBC) EPS CAGR of 28.4% for 2010-13F.

Attractive relative value: The stock trades at a PEG of 0.92x, lower than 1.27x for Alibaba.com and 1.16x for Baidu.

Our TP of HK$244, is derived from the average of forward DCF and P/E-derived fair values.

Risk factors: Major risk factors include rising competition in online gaming, SNS and e-commerce markets in China.

See also: VODONE: China Net Broadcaster Reaching The Masses, 9 Mln A Day