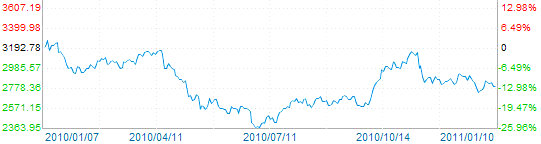

CHINA’S A-SHARES plunged 1.7% today to 2,791.81 on profit-taking after the strong showing on Friday -- exacerbated by relatively low export figures -- made bargains irresistible to many investors.

Financial and property counters led the downward charge.

Lingering concerns of imminent rate hikes also contributed to a bearish start to the trading week.

Traders took flight after learning that China’s exports grew 17.9% from a year earlier, down considerably from the 34.9% leap recorded in November.

New share issue plans by three major banks -- Industrial Bank, Agricultural Bank of China and Minsheng Bank -- also dampened spirits.

China Merchants Bank (SHA: 600036) lost 1.7% to 13.02 yuan following a 2.7% jump on Friday.

Meanwhile, Industrial & Commercial Bank of China (SHA: 601398) lost 1.4% to 4.24 yuan after leaping 3.4% on Friday.

Real estate firms also saw widespread selloffs in part due to a report in the official media yesterday that said Chongqing -- a major municipal government -- would levy a new tax on high-end residential units by end-March.

The country’s largest listed developer, China Vanke (SZA: 000002), lost 1.7% to 8.74 yuan while Gemdale Corporation (SHA: 600383) dropped 2.0% to 6.89 yuan.

See also:

CHINA SHARES Shed 1.9% After Rate Hike