Stock investors sometimes achieve financial freedom much earlier than their peers who don't invest. Being able to retire early, or semi-retire, may well be a good thing but not everyone is prepared for retirement, or know how to live well after leaving full-time employment. Here, a top professional, who retired at 52, shares his experiences and advice - there is much for everyone, whether a stock investor or otherwise, to learn.

Cheng Huang Leng

Cheng Huang Leng

I RETIRED in 2000 at age 52. I am now 63, thus I can claim that I have got more experience at retirement than most!

I thought I should share my experience for I have seen too many friends and neighbours who became so bored that they have become a nuisance to their spouses and children and to others!

A few of them have solved the problem by going back to work. They were able to do so because they have at least one skill/expertise that is still in demand. The rest (and many are my neighbours) live aimlessly or are waiting to die – a very sad situation, indeed.

I contend that you can retire only when you fulfil these 4 pre-conditions:

- Your children are financially independent (e.g. they got jobs),

- You have zero liability (all your borrowings are paid up),

- You have enough savings to support your lifestyle for the rest of your life,

And most importantly,

- You know what you would be doing during your retirement.

DO NOT retire till you meet all 4 pre-conditions. And of course you should not retire if you enjoy working and are getting paid for it!

The problem cases I know of are those who failed to meet pre-condition #4.

When asked, “What would you be doing during your retirement?” some replied, “I will travel/cruise and see the world”. They did that - some for 3 months and then ran out of ideas.

The golfers replied, “I can golf every day.” Most could not because they were no longer fit to play well enough to enjoy the game. Those who could needed to overcome another hurdle - they needed to the find the “kakis” to play with them.

It’s the same with mahjong, bridge, badminton, trekking and karaoke – you need “kakis”!

Most retirees cannot find 'kakis' who share their favourite game, and playing/singing alone is no fun. And when they do find them, a few of them found that they are NOT welcomed, like my obnoxious neighbour whom everyone avoids.

Thus if you are into group sports or games, you must form your groups before you retire. You need to identify your “kakis”, play with them and discover whether they “click” with you.

The less sporty “can read all the books bought over the years”. I know of one guy who fell asleep after a few pages and ended up napping most of the time! He discovered that he did not like to read after all. We do change and we may not enjoy the hobbies we had.

Routine Activities To Fill Your Week

Mr Cheng with wife Yam Wai Yee, who was an engineer with HP till they had their first child in 1975. She stopped working after that.

Mr Cheng with wife Yam Wai Yee, who was an engineer with HP till they had their first child in 1975. She stopped working after that.

Photo courtesy of HL Cheng

For most people, your routine work activities are planned for you or dictated by others and circumstances. When you retire, you wake up to a new routine – one that you yourself have to establish!

The new routine should keep your body, mind and spirit “sharpened”. A good routine would comprise:

- One weekly physical sport – you need to keep fit to enjoy your retirement. If you are the non-sporty type, you should fire your maid and clean your home without mechanical aids. Dancing and baby sitting are good alternatives.

- One weekly mind-stimulating activity – e.g. writing, studying for a degree, acquiring a new skill, solving problems or puzzles, learning or teaching something. You need to stimulate your mind to stay alive because the day you stop using your brain is the day you start to die.

- One weekly social activity – choose one involving lots of friends/neighbours. Get yourself accepted as a member of at least 3 interest groups. Unless you prefer to be alone, you do need friends more than ever as you get older and less fit to pursue your sport.

- One weekly community service activity – you need to give to appreciate what you have taken in life. It’s good to leave some kind of legacy.

With 4 weekly activities, you got 4 days out of 7 covered. The remaining 3 days should be devoted to family related activities.

In this way, you maintain a balance between amusing yourself and your family members. Any spare time should remain “spare” so that you can capitalise on opportunities that come your way like responding to an unexpected request to do a job or to take advantage of cheap fares to see places or to visit an exhibition.

Mind stimulating activities

Most judges live to a ripe old age. They use their brains a lot to decide on cases. I am sure MM Lee’s brain works overtime. He’s 80+ and still going strong.

In the “Today” newspaper, you would have read of 2 inspiring oldies. One is a granny who at age 60 learned to play the guitar to entertain her grandchildren. She’s 70+ today and those grandchildren have grown to play with her.

Another is an Indian radiologist who on retirement, qualified as an acupuncturist. He’s aged 77 and still offers his services (by appointment only), including free ones to those who have no income. I guarantee you that they are happy people who discovered a “second wind” to take them to the sunset with a smile on their faces.

Mind stimulating activities are hard to identify. They require your will to do something useful with the rest of your life, a mindset change and the discipline to carry it through.

Your Bucket List

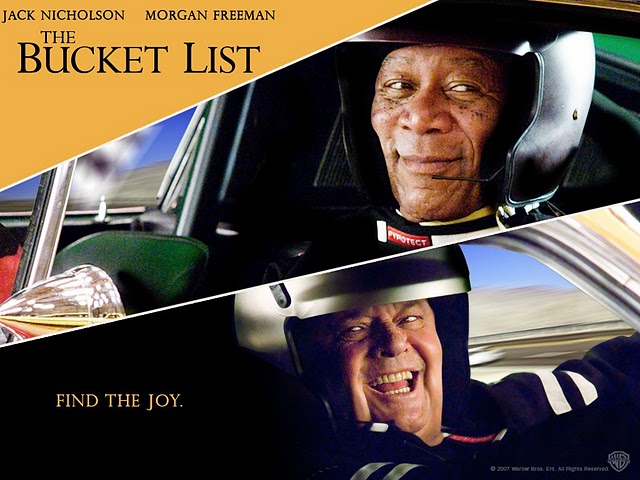

The Bucket List is a 2007 movie about two terminally ill men and their adventures. They had drawn up a wish list of things to do before they 'kick the bucket'.

The Bucket List is a 2007 movie about two terminally ill men and their adventures. They had drawn up a wish list of things to do before they 'kick the bucket'.

Despite your busy routine during your retirement, you will at times be bored. Then it’s time to turn to your Bucket List - a list of things to do before you kick the bucket.

They are not routine and are usually one-off activities. You need them to have something to look forward to.

These include anniversaries, trips (and pilgrimages), visits to friends and relations abroad, re-doing your home, attending conferences (related to your hobbies), acquiring a new set of expertise.

Four such activities that are spaced our quarterly would be ideal.

Retirement Is Serious Business

If you can afford to retire and want to, do prepare to live to your fullest. You need to be fit to enjoy it – therefore get into shape now.

You do not want to get up on a Monday and wonder what to do each week, therefore identify your set of weekly routine activities now and try them out to confirm that they are the activities that you will be looking forward to doing each week, week after week.

You bucket list of “rewards” or “projects” or “challenges” is needed to help you break away from the routine, thereby make life worth living. Start listing what you fancy and refine it as you chug along in your retirement. You will have so much fun, you would wish you were retired since your turned 21!

The bottom line is to be like Confucius who described himself as “a sort of man who forgets to eat when he tries to solve a problem that has been driving him to distraction, who is so full of joy that he forgets his worries and who does not notice the onset of old age”.

Cheng Huang Leng taught Marine Engineering for 9 years before he became a Deputy Principal of the Singapore Polytechnic. As Deputy Principal, he found the job challenging and exciting. He had a wide variety of portfolios under his charge - corporate development, campus development, computing services, consulting services, part-time education, campus maintenance and security. In other words, everything other than academic matters, personnel and finance. He was awarded the Public Administration Medal (Bronze) in 1981. After 9 years as Deputy Principal, he felt that he had enough of management and decided to return to his first love i.e. teaching.

He joined Singapore Technologies in 1990 to teach and provide consulting services in quality and management. He taught many courses, including Leadership, The 7 Habits of Highly Effective Leaders, Team-building, Time Management and Stress Management, TQC, ISO 9000 and Internal Quality Audit. During his 10 years in ST, he taught more than 7,000 managers and executives. He also led the Quality Management Development team, which prepared ST companies for their ISO 9000 certification. More than 50 companies were certified under his guidance. He also drove QUEST - Quality & Excellence in ST, which is ST’s productivity movement. While in ST, Mr Cheng was also a consultant to non-ST companies including NOL, several companies in the Keppel Group, HP, DE Consultants and Plimsoll Fleetwinch Pte Ltd.

On 1 January 2000, Mr Cheng set up QMD Services to offer consulting services in ISO 9000, SQA and quality-related areas, Balanced Score Card. Leadership and Management. He had been consultant to many companies since venturing out on his own, including Pacific Internet, SES, Pan United Shipyard, Police (CID), Asean Cableship, Keppel Group, HP and Wartsila, He is currently consultant to HP, Keppel Singmarine Shipyard, and CISERV. In addition to consulting work, he conducts ISO9000 audits on behalf of Lloyds Register Quality Assurance Ltd. He is a certified ISO 9000 Lead Assessor and has assessed more than 100 companies since 1993.

Mr Cheng was a Colombo Plan scholar. He obtained his B.Sc. and M.Sc. degrees in Marine Engineering and Shipbuilding at Newcastle University, UK in 1970 and 1971 respectively. He is a Professional Engineer (Singapore), was a Chartered Engineer (UK) and had been Productivity Activist (PSB). Outside work, Mr Cheng put in 16 years of service in the community centre movement and was awarded the Public Service Medal (PBM) in 1984.

In part 2 of this article, Cheng Huang Leng shares the questions he has received and answers he has. Click 'How much $ is enough for retirement' and other questions.....