The following post is excerpted from the newly launched Secrets of Singapore Property Gurus, and is based on an interview with Dennis Ng, Director of Leverage Holdings.

IF YOU READ any Personal Finance books from the bookstores, one “recurrent” advice they have is “be debt free as soon as possible”. I have seen many people quickly pay off their debts, including their housing loan, after reading such books, which to me is unwise.

They forget that there is GOOD debt and there is BAD debt. Bad debt is any debt for consumption. Thus, to me car loans, personal loans, credit card debt are ALL bad debt and a person should avoid such debts or aim to pay them off as soon as possible.

Actually, if there’s a way you can be “debt free” and yet enjoy the benefit of leverage that debt provides wouldn’t it be better?

It can be done, let me show you how.

Personally, my Housing Loan is $x amount. What I have in cash is more than 2x. So am I debt free? Actually on a NET basis, I am.

However, I’m retaining the Housing Loan debt because it makes financial sense to do so. In my opinion, the problem is most people only have a limited knowledge about finance and debt so they just stick to concepts such as “be debt free as soon as possible” without looking at the issue deeper.

They never think how you can be “debt free” but still enjoy the Leverage that debt provides (just like what I’m doing). Isn’t that better? It’s like having your cake and eating it too.

Not doing what I am doing is “shortchanging” yourself.

As I mentioned, as long as a person does not over-borrow, (i.e. have a Debt Service Ratio of less than 35%), he can just aim to pay off his Housing Loan by age 55 and not hurry to pay it off.

Why? Here’re the reasons:

1. A Housing Loan is the cheapest loan a person can ever get

Currently, the Housing Loan interest rate is about 2%, compared to 7% for car loans, 14% for personal unsecured loans and 24% for credit cards!

2. Paying off your Housing Loan does not increase your net worth

Let me use an example to illustrate:

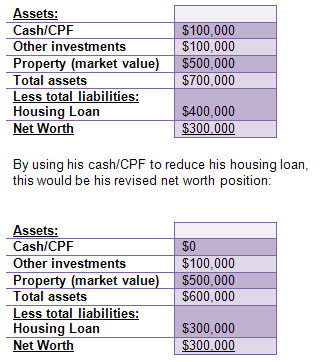

Mr. A owns a condominium with a market value of $500,000. He has an outstanding housing loan of $400,000 and no other liabilities. He has other investments worth about $100,000 and has $100,000 in cash/CPF Ordinary account balance.

He is considering to use the $100,000 in cash/CPF fully to reduce his housing loan from $400,000 to $300,000 after reading books that “teach” him to be debt-free as soon as possible. Will doing so really improve his net worth?

As you can clearly see from the example, by using his cash/CPF to reduce his housing loan, he is simply reducing his asset to reduce his loan. The net result of doing so makes no difference in his net worth position, which remains as $300,000.

3. By reducing your Housing Loan, you’re actually reducing your “Financial Security”

What are the three worst things that can happen to anyone?

They’re death, disability, and retrenchment.

In all three scenarios, for the person who did not use his cash/CPF to reduce his loan, his dependants would actually be in a better financial position.

If he took up mortgage insurance, his housing loan would in fact be paid off by his insurance in the event of death and total permanent disability. Thus, by reducing his loan, he is just reducing his own benefit from mortgage insurance.

4. Opportunity cost of using cash to pay off Housing Loan

If there is a stock market crash I would be able to benefit from a “crisis” because I have cash to invest when prices are low. People who use cash to reduce their loan have NO cash to take advantage of opportunities in a crisis.

People say “crisis is an opportunity”.

That’s wrong. A crisis is only an opportunity to those who have cash. A crisis is NO opportunity for people who do not have cash to invest. When a crisis comes, I can easily make 50% to 100% returns. Just take a look at past crisis e.g. SARS in Singapore in 2003 and you would know that what I say is the truth.

5. You can easily get 3% to 4% annual returns even if you don’t know how to invest

For people who say they don’t know how to invest their money as the reason they use cash to reduce their loan, my reply to them is to just take up a 20 year single premium endowment and you can easily get annual returns of at least 3.5% per year. Just get a quotation from any insurer in Singapore and again you will know that I’m speaking the truth.

6. The interest paid on your loan can be deducted from income tax

This will increase your Return On Investment (ROI).

7. You can take up an “Interest Offset Loan” instead

By doing so, you’re not paying interest since the interest earned on your cash offsets the interest you pay on your loan. You enjoy the same advantages as paying off your loan, but have the liquidity of your cash which you forgo if you use cash to reduce your loan.

Thus for the reasons above I believe that your housing loan is the last loan you should ever pay off.

In Secrets of Singapore Property Gurus, Dennis Ng also shares:

* Are banks still willing to do property lending?

* His top property financing (and refinancing) tips

* How to maximize your chances of getting a loan

* Whether it’s easier to get rich via stocks or properties

* Whether you should get mortgage insurance

* His personal investment philosophy

* The worst and greatest property investments he has heard of

To get your copy (at S$28 only), pay through PayPal (button below) and we will send it to you by ordinary mail free of charge (only for Singapore addresses).

After making the payment via PayPal, please send a note to

Overseas buyers, please drop us a note at

I doubt the 'greatest investment' is a matter of super investing skills. It was pure luck -- unless he had insider info of the govt purchase.

On hindsight, the investor looks so smart. At the time of his purchase, he was probably no different from anyone else who bought units in the property development. It was just luck --- and luck is something we don't acknowledge enough of in our investment results.