UNITED SQUARE in the Thomson area is known as a hub for education businesses in addition to being a shopping mall.

Up on the 28th floor of its office tower is the office of a business venture that is the only kind in United Square and, maybe even, Singapore.

There, we met up with Mr Woo Peng Kong, 58, the CEO of Renewable Energy Asia (REA) Group, recently.

He joined REA Group in Feb 2010 from KS Energy, where he was its managing director.

His entry into REA Group coincides with a transformation of the business, which was previously known as Superior Fastening Technology and is engaged in the design and manufacturing of metallic fasteners.

This fastening business, which is currently in the midst of being disposed of, was badly affected by the financial crisis.

In Aug 2009, Blue Ocean Group (a special purpose vehicle owned solely by Xu Jian, a PRC businessman in the steel structure and wind energy business; now executive chairman of REA Group) and Singaporean businessman Loi Peng Soon (who is in the cable business) came to the rescue. They injected S$12.6 million in exchange for 180 m shares and 180 m share options.

Some 1.5 years since that capital injection, REA Group has moved forward with its new business, which we learnt a lot of from our meeting with Mr Woo. We highlight 5 key points:

1. Renewable energy business.

REA Group is the only such listed business on the Singapore Exchange currently.

The Group has been granted concessions (or land for development, in simple terms) in China to set up wind farms that generate electricity from wind power.

Mr Woo said that land concessions, especially in Inner Mongolia, for developing 2.5GW of wind power have been secured in REA Group’s name – an exceedingly large capacity for the group to develop over the next five years or so.

Concessions for another 2.5 GW capacity are at various level of commitment by local governments, he said.

2. Renewable energy has a bright future.

Powered by Government stimulus, China’s wind power capacity has surged from 6 GW in 2007 to 26 GW in 2009.

The Chinese Government’s target is 150 GW by 2020.

Wind farm is an attractive renewable energy source compared to other alternative energy sources. The total installation cost for wind farms is about half that of solar farms, noted Mr Woo. And the technology is well-established.

3. REA Group revenue from its wind power concessions will surge from FY12.

Six months of initial contribution from the operations of its very first wind farm (49% owned, in Inner Mongolia) will be recognized in the current financial year ending March 2011.

This would be in the range of only RMB1.1 m, according to DMG & Partners’ forecast in a 14 Jan report.

It's a small sum as the rest of the FY11 profit (totaling RMB 40 m) will come from REA Group's other business arm: the manufacturing of wind farm equipment for the likes of Siemens.

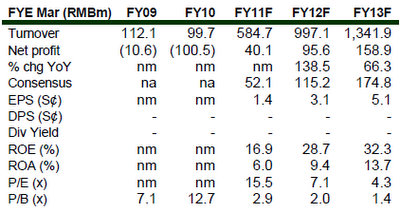

Profitwise, the wind speed will pick up fast from FY12, ie from March 2011. DMG forecasts a 10-fold and a 30-fold jump in FY12 and FY13, respectively, in net profit from wind farm concessions to RMB11.4 m and RMB30.9 million.

As a result, in FY12, total net profit for the Group more than doubles to RMB95.6 million (see table).

By then, REA Group will also enjoy revenue from a third division: engineering, procurement and construction (EPC) and maintenance of wind farms for third parties or JV partners.

4. Wind power concessions generate steady cashflow.

DMG & Partners says the internal rate of return for wind farm industry in China is 8%.

Mr Woo estimates that REA Group will do better than that (reaching double-digit IRR) because its projects will be funded by 80% debt at a preferred 10% discount from the People’s Bank of China rate.

This is possible because REA Group’s JV partner is China Datang Corporation Renewable, China’s largest state-owned power operator.

Like other wind farms, the sale of 100% of the electricity produced by REA Group is secured. The tariff is fixed by law and varies with the region the farm is sited.

In addition, wind farms pay no income tax for the first 3 years and 50% of the taxable income in the subsequent two years.

5. REA Group will need to raise funds for capex – and don’t expect dividends.

REA Group (recent market cap: S$136 million) is expected to need US$300 million to fund the development of the 2.5GW wind power capacity that it has been granted concessions for.

This is based on:

a) Capex of US$1.3 million for every megawatt of capacity,

b) 20% equity funding for the projects (80% debt financing), and

c) REA Group taking 49% stakes in joint ventures with China Datang.

Given the capex requirements, it is not surprising that Kim Eng Research and DMG do not forecast any dividend payout for FY11-13.

The respective analysts have a 'buy' call on REA Group with target prices of 35 cents and 36 cents.