KINGSWAY GROUP has initiated coverage on Comtec Solar Systems (HK: 712) with a BUY call and a target price of 3.09 hkd, which represents a 36% upside from the current valuation.

The Hong Kong-based financial services group said it is bullish on Comtec given its position in the lucrative solar sector.

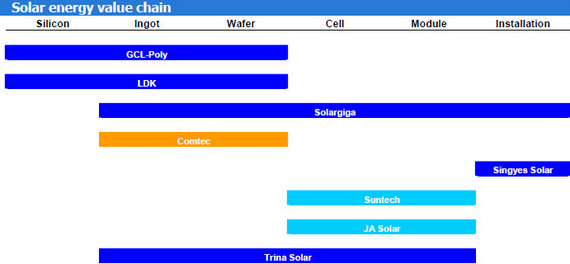

"While many other solar plays are pursuing a vertical integration strategy, Comtec focuses on the ingot and wafer business. We believe staying in the mid-stream of the value chain is appropriate for Comtec as it started as a semiconductor wafer maker. This also enables the company to maintain a long-term relationship with both polysilicon suppliers and downstream customers," said analyst Johnny Lau.

Pure Play Wafer Maker

Kingsway is impressed with Comtec's over decade-long experience in the wafer business.

"Comtec was established in 1999 as a manufacturer for semiconductor wafers, expanding into monocrystalline solar ingot production in 2004 and monocrystalline solar wafers in 2005, resulting in solar products replacing semiconductor products as the main source of revenue.

"Since the manufacturing of solar wafers is similar to semiconductor wafers in many aspects, including processes in growing ingots and slicing wafers, we consider the company to have had 10 years of experience," Mr. Lau said.

Comtec was also not planning to abandon its lucrative business model anytime soon.

And this set it apart from a very crowded field of potential competitors in the industry.

"Comtec is comparably focused in ingot and wafer production while many other solar companies are either forward integrating or backward integrating along the value chain. It is hard to evaluate at present whether the other companies are better off after integrating vertically but we believe the execution risk is much lower for Comtec to focus on its expertise in ingot and wafer," Kingsway said in the broker call.

Mr. Lau said this is reflected in Comtec's unit cost per watt, which decreased from US$0.67/watt in the first quarter of this year to US$0.60/watt in the second quarter.

Additionally, Kingsway said the Hong Kong-listed solar wafer maker has been able to maintain good relationships with suppliers and customers due to its strategic focus.

"However, the biggest risk to companies focusing on one or two steps of the value chain is that if vertical integration proliferates significantly in the industry, business opportunities of the former will decrease substantially as customers may no longer require external suppliers."

600 MW by Year End

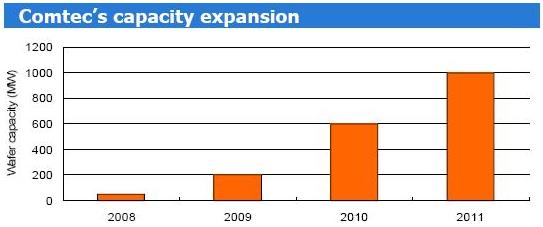

In 2009, Comtec successfully ramped up its capacity to 200 Megawatts from 50MW.

In the first half of this year, the company sold 85.3MW of solar wafers, a 328% increase from the 26MW sold a year earlier.

This month, the company is commencing installation of the relevant equipment and Kingsway expects Comtec to ramp up capacity to 600MW before year end. The company plans to further expand capacity to 1000MW in 2011.

"We estimate 2010 CAPEX to be 363 mln yuan and for 2011 – 345 mln yuan."

Sunny Solar Outlook

The spot price for polysilicon has risen to above US$55/kg in August and nearly US$60/kg in September due to strong demand from the downstream solar market.

Comtec procures most of its polysilicon from the spot market and only signs fixed price supply agreements for a small amount of its total needs.

"The company has a competitive cost structure. As long as polysilicon price does not go north to historical high of US$450/kg, we believe Comtec has the ability to manage fluctuation in the price of polysilicon," Mr. Lau said.

The unit production cost of Comtec's wafers continues to drop.

In 2009, their unit cost was US$0.81/watt, decreasing to US$0.67/watt in the first quarter and US$0.60/watt in the second quarter.

"Currently, the company is mass producing their wafers at 180 micron thickness and has successfully reduced polysilicon usage to approximately 6/g per watt. We see further room for improvement in the thickness of their products but it depends on the market's acceptance. With polysilicon costs at around US$50/kg, the polysilicon cost for wafers is around US$0.3/watt," Mr Lau said.

Non-polysilicon production costs for Comtec are currently around US$0.3/watt, down from US$0.38/watt in 2009 and US$0.52 in 2008.

"This is comparable to many other solar wafer companies, such as US$0.70/watt for LDK and US$0.56/watt for Renesola. Consequently, this is the main reason for Comtec's decent margins. By reducing material usage, automation, and improving process efficiency, there is still room to reduce cost and give the company cushion to absorb polysilicon and wafer ASP price volatility," Kingsway added.

See also: COMTEC: Thin Wafers, Thick Margins