THERE ARE at least five reasons why valuations for China’s A-share listed firms are likely to hit a rough patch over the short term, according to a recent Chinese language article in the China Securities Journal.

Among issues that concern watchers of China’s Shanghai and Shenzhen-listed A-shares are weaker than expected January industrial figures and inflationary concerns.

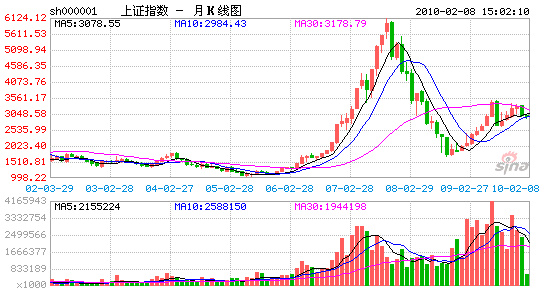

Chinese A-shares have been slipping and sliding of late, and last month saw no January thaw for the Shanghai Composite.

The benchmark index has fallen by some 10% since January 1, weighed down by worries over a tighter monetary policy to nip inflation in the bud and ease speculation, especially in the red-hot property sector.

Meanwhile, the Hang Seng China Enterprises Index has shed 9.2 over the same period.

The article said that several market players contacted were concerned that Chinese A-shares could be entering a bearish cycle, and institutional investors were generally of a mind that the Shanghai Composite was entering a period of volatility, citing five reasons for their newfound lack of optimism.

Let me count the ways…

First, bullish sentiment has been moderated. Inflationary worries at home and abroad were likely to result in a less lax credit environment, which would remove one of the capital market’s main drivers: asset price speculation.

This meant that investors were willing to bet the Index could dip even further over the short term, and this was making buyers a minority in the current market.

Second, just-released monthly data is providing more visibility on the economic front. January’s PMI (Purchasing Managers Index) fell for the first time in eight months.

Last week, global stock markets registered hefty losses, with purchases of durable goods showing continued sluggishness.

This makes it quite possible that the ex-China consumption story over the next few weeks could soften even further, while here at home it is still expected that shoppers over the most important of Golden Week holidays – Chinese Lunar New Year – will still help line retailers’ pockets and keep consumer stocks afloat.

But with this raft of lackluster news from abroad, it is unlikely that China’s A-shares will be getting any upside momentum from non-intrinsic sentiment or forces.

Fourth, financial counters are likely to be hit by the likelihood of tighter credit this year in China.

Analysts also don’t expect there to be any short-term adjustment in listing regulations for IPOs on China’s bourses.

Yet the country’s holiday tradition of transferring wealth from elders to youth via red envelopes will likely neutralize any newfound ability of the investing public to pump new capital into the equity markets.

Finally, institutional bubbles are rising to the surface and both expert and novice investors are finally beginning to take notice.

The A-share markets have still recovered a lot of their value last year. But excluding financial sector counters from the Shanghai and Shenzhen A-share markets, the average price-to-earnings ratio (P/E) stands at around 46 times, suggesting that overvaluation is an endemic possibility.

This is even more pronounced a potential hazard for the small- and medium-boards in the country, notably the fledgling GEM Board (aka: ChiNext) in Shenzhen, where many P/Es hovered in triple-digit territory for much of November and December.

All these various potential deflators to the markets recently prompted some brokerages to update their guidance on Chinese shares over the near term.

A-shares may dip even further before reaching a nadir of sorts in April or May as money supply growth tapers off and policy risks rise, said JPMorgan Chase in a note to investors.

The brokerage cut its December 2010 forecast for the MSCI China Index, tracking mainly Hong Kong-traded mainland company shares, to 62 from 78.

The note said there could be additional “harsher” credit tightening moves by the People’s Bank of China in the coming months, as China's CPI is expected by many to continue its ascent until summer before eventually tapering off.

“MSCI China has yet to fully price in the current tightening cycle in China," the note added.

The benchmark Shanghai Composite Index closed today down 4.23 points, or 0.14%, to 2935.17 points, after losing 1.87% Friday -- the lowest level since it ended at 2,970.53 points on Oct 14 – weighted down by energy and commodity shares.