Excerpts from latest analyst reports…..

Kim Eng Research reiterates 'buy and 75-c target for Gallant Venture

Analyst: Ooi Yi Tung

Gallant Venture’s share price has recovered 41% to $0.36 since our initiation report last month. We maintain our view that the company is undervalued but given its exposure to China’s property market, we are mindful of the policy risks.

However, our sensitivity analysis on the group’s exposure there suggests that even with a 20% drop in ASP for Gallant’s Shanghai project, the upside remains attractive.

Trading at a 30% discount to the understated book value, the current share price remains an attractive entry level.

Though policy risks in China may weigh on Gallant’s property project in Shanghai, they are unlikely to significantly affect its valuation as our conservative forecast has taken this into account.

In fact, we see further upside if prices were to exceed our assumed RMB70,000 psm. Reiterate BUY and target price of $0.75.

See readers' forum postings here.

CIMB highlights China Fibretech’s cash hoard that is 1.7X higher than stock price

• This morning (Dec 14) we saw interest in Chinese fibretech companies – Li Heng (+6.8%), China Sky Chemicals (+4.3%) and China Gaoxian (+6.1%).

• Apart from recent share price catalyst from China Gaoxian’s KDR listing, we believe there could be growing interest in cheap Chinese fibretech companies due to a potential turnaround in the Chinese fibretech industry.

We believe that earnings could have bottomed out, and companies may resume strong yoy earnings growth in 2011. We highlighted these in our AM Trader on 30 Nov, and stated that buying Chinese textile companies as a potential rewarding bet.

• Of the incumbents in the Chinese textile industry, we would like to highlight China Fibretech as a potential outperformer. 4Q10 performance is expected to pick up. At S$0.085, the stock’s net cash per share of S$0.145 is 1.7x higher than its existing share price.

China Fibretech is also trading at 0.43x P/BV. The strong net cash per share offers a high margin of safety for investors, as China Fibretech will be able to withstand external shocks with a strong cash balance. At such attractive valuations, we expect China Fibretech to receive strong interest from the market going forward.

Recent story: TEXTILE S-CHIPS' earnings rebound but stocks like Taisan and Gaoxian still undervalued

Kim Eng Research highlights SINO GRANDNESS’ valuation of only 4.6X

Analyst: Eric Ong

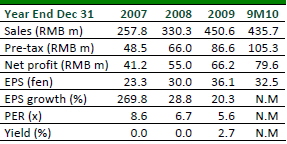

9M10 earnings already exceeded FY09 results. Sino Grandness recorded a net profit of RMB79.6m for January‐September, up almost 75% YoY from a year ago. This came on the heels of a 75.3% YoY jump in revenue. The strong performance was mainly driven by its beverage products, such as canned herbal drinks and bottled juices, following the successful promotion of its new products through sustained expansion of its distributor base.

Positive shift in product mix. Over the past three years or so, the group has shifted from being an export‐oriented canned food company to one with a more balanced business model due to growing contributions from the domestic market (31.6% of total revenue in 9M10) and the higher‐margin beverage segment (26%).

Capacity expansion to drive organic growth. In October 2010, Sino Grandness successfully raised S$6.7m from the issuance of 20m new shares at S$0.35/share. About S$2m of the proceeds will be used to fund the initial construction costs for its new plant in Hubei Province, China.

The remaining S$4.7m will be utilised as working capital in line with the rapid expansion of the group’s business in China.

Committed to pay at least 20% of net profit as dividends in FY10. The stock (39.5 cents) currently trades at consensus 4.6x FY10 and 4.2x FY11 PER, which appears compelling. Key risks are expected RMB appreciation and rising A&P expenses.

Recent story: SINO GRANDNESS: Growth stock with low PE