CHINA HAS become the world’s largest auto market and Lizhong Wheel’s decision to bite the bullet during the financial crisis and continue its huge capex plan is now bearing fruits of sweet success.

China’s vehicle sales are expected to exceed 17 million this year, and reach 25 million in 2015, or 30% of the global market.

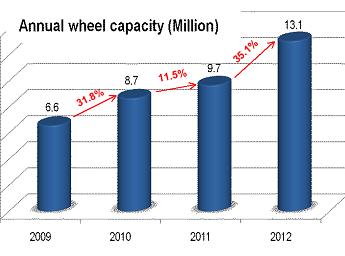

And Lizhong, which generates 75% of its top line from China, is on track to grow its annual wheel capacity to 13.1 million by 2012. (This amounts to a 65% market share in China based on back-of-the-envelop estimates).

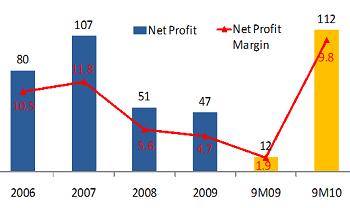

It posted year-on-year revenues surge of 77% to Rmb 1.1 billion for the first 9 months of 2010.

It has also redeemed all its convertible bonds, for which it managed to reap a gain of Rmb 62.4 million in other operating income.

Depreciation expense increased 11.9% to reach Rmb 37.3 million as a result of additional property, plant, and equipment for its new plant in Tianjin.

The company plans to increase capacity by 31.8% year-on-year to reach 8.7 million wheels by end 2010.

Net profit attributable to shareholders multiplied over 10-fold to Rmb 107.7 million.

Things were not always so rosy: Less than optimal utilization during the 2008-2009 financial crisis had cast a shadow on its goal, but unlike some other S-chips, Lizhong did not deviate from its announced plans.

Those were dark times for auto players, who found themselves in one of the worst hit sectors.

Today, China has excess wheel manufacturing capacity of 30%, but business is now so good for Lizhong it had insufficient capacity this year and had to outsource some low-end products to its associate.

As a result, gross margins slipped by 1.4 percentage points to 12.8%.

Other challenges remain: Protectionist measures, RMB appreciation and volatility in aluminum prices.

On 28 Oct, the European Commission imposed an anti-dumping duty of 22.3% on Chinese aluminum alloy wheels exported to the European Union. The policy will remain in force for 5 years from 29 Oct.

While only about 16.7% of the Group’s 3Q10 sales were for the European market, this has created some uncertainty in the business environment.

Its executive chairman, Zang Ligen, was in town today to meet analysts for an update on the tenacious Chinese aluminum alloy wheel maker. Below is a summary of questions raised at an analyst luncheon held at OCBC Center today and Mr Zang’s replies.

Protectionist measures

Q: How are you affected by Europe's anti-dumping measures?

We are not yet affected, as it was effective only from 29 Oct. Our contracts have been inked to seal prices until 2011. We will renegotiate contracts in the first two quarters next year, but the impact will be small.

To get around the anti-dumping measure, we will supply to Europe from our Thailand plant, which we are starting to construct in 4Q2010.

The plant will cost us THB 500 million (S$21.7 million), have annual capacity of 1 million wheels and will commence operations in Oct 2011. However, its cost of sales will be 10% higher as the workers there are not as productive as in China.

Q: How would the tariffs have affected gross margins on your exports to Europe if you exported from China?

It is not commercially viable to export directly from China to Europe. We set up the Thailand plant to deal with the long-term problem of China’s appreciating yuan. Also, there had been talk on the tariffs by Europe about a year before it happened.

Q: There is already excess capacity in China. With Europe's tariff, will the industry face a price war?

There has been fierce competition since 1Q2010, but we have been able to defend margins. As we supply OEM wheels, there is brand recognition of Lizhong wheels. The after sales market is not all about pricing. Auto workshops don't want to be hassled by returns on low quality wheels.

RMB appreciation

Q: Do you receive payment for exports in USD?

About 70% of our export sales is collected in USD.

Q: From where do you source raw materials?

China. Not only is China the world's largest aluminum producer, it is also cheaper. Commodity prices quoted on the Shanghai exchange are usually 2% to 3% lower than London Metal Exchange. There are times when it even trades at a 5% discount.

Volatility in aluminum prices

Q: How do aluminum prices impact you given that orders are placed in advance?

Orders for OEM wheels from automakers are placed 6 to 18 months in advance. Prices are dependent on the past 3 months' London Metal Exchange aluminum price, plus a premium for design customization.

Domestic customers use aluminum prices quoted by the Shanghai Metal Exchange.

Q: Why the large range in period of notice for orders?

When an automaker starts a program, it will invite all the suppliers. For example, a new Camry model for 2012 will be placed now. We may receive short notices of 3 to 6 months for mature models.

Capacity

Q: What was your order book as at 30 Sep?

We are fully booked, with utilization at its maximum threshold of 90% for 2Q2011. We leave some capacity to meet last minute orders from important customers. Large Japanese automakers like Toyota run just-in-time manufacturing processes.

Q: Can you stock up on wheels?

No. OEM customers require a high degree of customization and a single mismatched screw can render it unusable. We do not produce without orders. Instead, we hold a low inventory to meet demand for last minute orders.

Q: Why do you lack capacity when the industry has excess capacity?

China's wheel manufacturing industry is consolidating into dominance by 3 to 5 companies. The smaller players are struggling.

Q: Do you have M&A plans on the smaller players?

In China, most M&A of wheel factories have turned out to be failures.

Q: Will you see more companies approaching you for JV partnerships?

We will only co-operate with large companies.

Related story: Lizhong Wheel bought back convertible bonds