Excerpts from latest analyst reports.....

NRA Capital initiates coverage of Broadway Industrial ($1.22) with $1.95 target price

Analyst: Jacky Lee

A leader of both actuator arm and protective packaging. Broadway is one of the leading suppliers of actuator arms with an estimated 20% global market share. Its more than 40 years of industry experience in foam plastics has made them a leader in the protective packaging business for computer related and consumer electronics products. All foam materials manufactured by Broadway are recyclable.

Data storage is a key element in the digital transformation of content creation, including HD TV and Video on demand. In addition, the new generations for HDD - launched by Seagate in May – is a hybrid drive (HHD) which combines the HDD and SSD module and created a product for both modules to survive.

Expansion for its non-HDD component business. Broadway recently completed an acquisition for its non-HDD component division, adding some 40% to its non-HDD annual capacity. It will commence operations in 4Q2010. The group has been trying to diversify into non-HDD industries over the years, this segment mainly targets the semiconductor, automotive and medical industries (mostly involved in the production of consumables and parts used in equipment).

Foam business is stable and profitable. The group’s packaging business was affected by the slowdown in the electronics industry in early 2000 due to the internet bubble burst. In 2002, the group divested its South-East Asian packaging business to focus on China. Since then, sales have recovered steadily and net margins have held at around 10% since 2006.

Recent story: BROADWAY, JAYA HOLDINGS : What analysts now say....

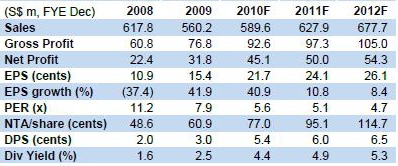

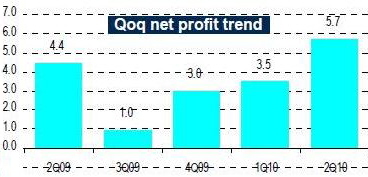

CIMB says Innotek is attractively valued at just 0.6 price-book

Analyst: William Tng

• Quarter on quarter, we suspect that there could be a slight profit decline given the recent weakening of the USD and the stronger RMB.

• How to improve valuation?

1. Innotek has too much cash on hand. What is the Company going to do with these cash?

a) First priority is to grow the business. This means capacity expansion and acquisitions. Innotek has mentioned M&As for quite a while and this is something that investors are keeping a watch on.

b) Dividend payout. We believe 5cts is still doable for FY10. However, 5cts DPS is not cast in stone as management is working to grow the Company.

c) Meagre interest on cash. On share buy backs, the Company is close to the 10% limit and since the treasury shares are earmarked for use in M&A, the quantity of shares that Innotek can buy back further is limited. However, given the paltry interest being earned by the cash, it might make sense for Innotek to consider parking some of its cash in higher yielding instruments that are liquid.

d) Dual listing? TDR, KDR etc? We sense that Innotek is focused on identifying opportunities to grow its business. Unless there is a huge M&A opportunity, dual listing or depository receipts are unlikely.

Recent story: ROXY-PACIFIC, INNOTEK, ASTI: What analysts say now....