Analysts: Dhruv Vohra & Jesper Gustafsson

China’s move to appreciate RMB will raise consumption, and improve global buying power of the Chinese.

However, immediate impact on Singapore listed companies is marginal, with only a handful seeing negative operational impact from the exchange rate reset.

In the longer term, expect gradual demand benefit for the tourism, gaming, and property sectors. Relative performance of SGD/RMB is key to determining the magnitude of this benefit, as SGD/USD will also appreciate.

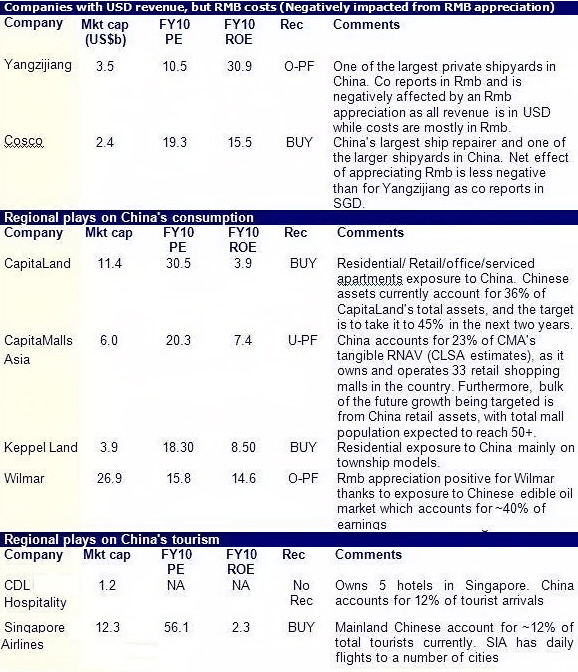

Overall, potential beneficiaries include CMA, Wilmar, Genting, CDL-HT, and the property developers. Expect a more challenging operating environment for Cosco, Yanzijiang, and the offshore marine sector.

Yangzijiang's revenue is in USD but reports in Rmb.

Slowly, and measured

q Over the weekend, China announced to resume gradual appreciation of the RMB. Our China strategist, Andy Rothman, believes that initial appreciation will be low (~ 0.2%/month), but will accelerate to 5-7%p.a. after Europe stabilizes.

q Immediate earnings impact on Singapore listed stocks is limited. Companies most exposed to USD revenue and RMB costs include Cosco Singapore and Yanjiziang.

More consumption, longer term

q Longer term, Beijing‘s move will improve consumption, and raise the global buying power of the Chinese.

q This will benefit demand outlook for companies like CapitaMall Asia (CMA), Wilmar, Genting Singapore, CDL Hospitality REIT, SIA, and property developers.

q Chinese already account for 12% of Singapore’s total tourist arrivals, and 4.5% of all private home buyers in Singapore (up from 0.5%, seen 10 years back).

A stronger SGD?

q Expect SGD/USD to also appreciate given policy directive, and the experience of July 05 – July 08, when SGD appreciated alongside RMB.

q Appreciating SGD benefits SIA, while Offshore & Marine companies (Sembcorp Marine & Keppel Corp) are the most negatively sensitive operationally.

Market valuations

q We continue to find market valuation of 13.2x forward earnings, as un-compelling. Retain our liking for tourism (inc. retail), divided, and business relocation themes.

q Impact from RMB appreciation will be gradual, but market is likely to be reward some underperforming sectors/stocks which are potential beneficiaries, like property developers with Chinese exposure, Wilmar, SIA, etc