Reproduced with permission from Musicwhiz's blog (http://sgmusicwhiz.blogspot.com/). Musicwhiz is a 30-something finance manager and a value investor.

Musicwhiz's avatar

Musicwhiz's avatar

I guess May can be counted as “exciting” and “thrilling”, if those words can be used to describe the roller-coaster ride in the stock markets around the world! The Greek crisis and the devaluation of the Euro had caused all major market indices to hurtle towards a major correction, and markets had dropped so swiftly that it erased all of 2010’s gains so far, and then some.

Strange thing was that the Greek crisis has been in the news for the past few months but investors seemingly chose to ignore it, till now! With the close to US$1 trillion bailout approved by Germany and other stronger European nations pledging to support the Euro and their weaker neighbours, there should have been ample confidence and stability; yet this was not so as Mr. Market’s pendulum swung from irrational exuberance to unjustified pessimism. The fear this time was that Greece’s debt would affect other weak nations in the Euro Zone such as Portugal and Spain and cause the entire Europe to derail, thwarting the global economic recovery.

While at this point in time it is unclear if the contagion will really spread across the world, what I can conclude with certainty is that companies will still continue to do business, and cash will still continue to flow; and perhaps everyone should just relax and continue buying good companies. I took the opportunity to deploy about S$25K in cash to bolster my shareholdings in Kingsmen Creatives (as mentioned in my previous post). By reviewing Kingmen’s business model and cash flows, the company has been consistently generating healthy FCF without the need for heavy investment in capex and without needing a lot of working capital; hence I can foresee that dividends should continue to be paid. Assuming the dividend remains unchanged for FY 2010, the shares will provide a potential yield of 6.2%; and this is in addition to potential growth as Kingsmen extends its footprint across South-East Asia and the Middle East. Since I had already reviewed Kingsmen in my last post, I shall not provide further details here.

Property prices

Property prices seem to be have hit another high in Singapore with buying momentum strong. However, on May 21, 2010, the Government announced that it had released 31 residential sites in 2H 2010, which can generate 13,905 private residential units. Most are located in suburban areas or the city fringes. With this inflow of supply, will it indicate that housing prices will begin to stabilize and perhaps dip?

Housing affordability is one big bugbear of mine, even though I already “own” an HDB flat, as some of my friends are having trouble affording an HDB flat as the COV is too high! Those who earn a combined income of more than S$8,000 are finding HDB resale flats too expensive, and condos are far worse of course. I will talk more about this in next month’s portfolio review, once the effects of this announcement have taken their time to seep into the property market.

Personal finance

Regarding personal finance, of which I blog about occasionally, there was a news article in the Straits Times on younger Singaporeans struggling with debt (May 21, 2010). The article mentions something shocking – 7.16% of those in the 21-29 age range defaulted on their credit card debt in 2009. Apparently, a lot of youths in this age group had just started work and could not manage their expenses and assets well; thus landing in trouble by racking up huge credit card bills. Paying only the minimum sum meant that the debt snowballed beyond control, and led to defaults. The main reason, says Ms. Chen Yew Nah (Managing Director of DP Credit Bureau, which compiled the numbers), was that youths like to acquire possessions “that signify they are successful”. By this I would automatically assume she is referring to iPhones, gadgets, cars, branded luxury goods and other material items. One should always be prudent with spending and avoid keeping up with the Joneses; in order to have enough savings to act as buffer and also for investment.

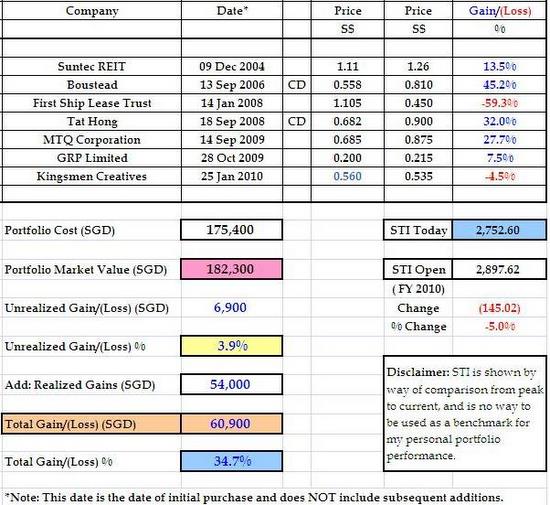

This month was a busy month as Kingsmen had released their 1Q 2010 results, and Tat Hong and Boustead also released their FY 2010 results (which will be reviewed later and posted up). Below is a snapshot of my portfolio and associated comments for May 2010:-

1) Boustead Holdings Limited – Boustead announced their FY 2010 results on May 26, 2010 and it was followed up by an audiocast similar to FY 2008 and FY 2009. Revenues were down 15% year on year, while gross profit was down just 7%. Net profit attributable to shareholders decreased 28% to S$43.1 million (largely due to absence of a S$22.7 million gain on sale and leaseback of an industrial property), while net profit margin was about 10% and ROE about 20%. A final dividend of 2.5 cents/share was declared, and in addition a special dividend of 1.5 cents/share was also declared, making it a total of 4 cents/share. I will be doing a detailed review of Boustead’s FY 2010 results, and will also be transcribing and posting up the question and answer session with Mr. FF Wong from the audiocast like I did for FY 2008 and FY 2009.

2) Suntec REIT – There was no news from Suntec REIT for May 2010. The dividend of 2.513 cents was received on May 27, 2010.

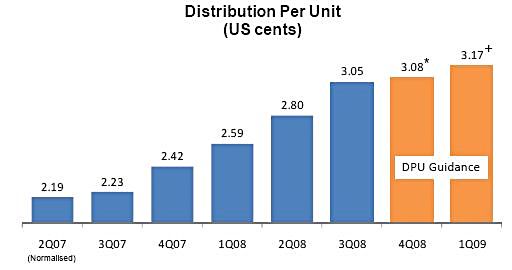

3) First Ship Lease Trust – There was a big negative whammy for FSL Trust this month, and it came in the form of a payment default by Groda Shipping, one of FSLT’s lessees. As a result, FSLT have to take re-delivery of their two vessels Verona I and Nika I. The vessels are now under contracts of affreightment with Rosneft, and the Trustee-Manager is exploring alternative solutions which will reduce risk of cash loss, while assuring (hapless) shareholders that no trigger of event or default and that there is no interest cost impact. Sadly, the 2Q 2010 DPU guidance of 1.5 US cents is now under review, and this may mean another DPU cut as cash flows get even thinner. The shipping crisis is far from over and this has been one of the most nerve-racking investments I have made so far; this mistake will reverberate for many years I think!

4) Tat Hong Holdings Limited – Tat Hong released their FY 2010 results on May 24, 2010. FY 2010 revenue was down 22% to S$495 million, while gross profit was down 21% to S$190.8 million (there was a slight improvement in gross margin). Profit attributable to shareholders was down 44% though, as the Company was hit by higher admin expenses and poor contributions from associates and joint ventures even though gross margin improved. A final dividend of 1.5 cents/share was declared on both ordinary and RCPS. I will be scrutinizing the numbers and facts and coming up with an analysis of Tat Hong’s FY 2010 results in due course.

MTQ's facility in Pandan Loop, Singapore

MTQ's facility in Pandan Loop, Singapore

5) MTQ Corporation Limited – Since I had already written Parts 1 and 2 of MTQ’s analysis, I won’t say anymore on MTQ as there was no news for May 2010 anyway. Look out for Part 3 which I am working on to be released some time in June 2010.

6) GRP Limited – Unsurprisingly, there was no news from GRP for the month of April 2010. In other words, shareholders are still waiting with bated breath to find out what Management intend to do about their cash stash!

7) Kingsmen Creatives Holdings Limited – I had already written a post on Kingsmen’s 1Q 2010 results, and hence will say no more here. There was no news from the Company for the month of May 2010.

Recent story featuring Musicwhiz: JUST ASK: 'Should cash-rich companies pay special dividends?'