Large sports and lifestyle brands are taking the cue from China's investments in sports facilities and its hosting of international sporting events such as the Guangzhou Asian Games 2010.

Li-Ning, for example, which had 7,000 points of sales as at end 2009, plans to increase 700 points of sales this year and another 800 the next.

“We believe the recovery will sustain at least until end of the year,” said China Taisan’s CFO Patrick Kan at its investor meeting last week.

Going by the company's strong order books of Rmb 247 million as at 13 May for performance fabrics, the management believes production utilization will stay above 85% in 2Q2010.

The supplier of knitted polyester performance fabric to large sporting brands such as Metersbonwe, Li-Ning and 361 Degrees has been selling increased volumes at higher selling prices.

1Q2010 sales volume rose 41.5% year-on-year to reach 5,080 tons compared to 0.7% for 4Q2009.

Average selling prices also edged up 1.2%.

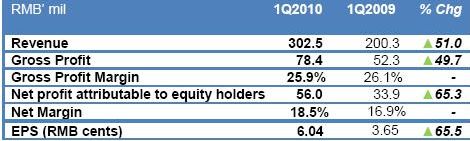

Even though gross margins slipped 0.2 of a percentage point year-on-year to 25.9% for 1Q2010 due to higher raw material costs, net profits were up 65.3% at Rmb 56 million, a reversal from the contraction of 11.4% for 4Q2009.

As the company has a net cash position of Rmb 359.3 million as at 31 Mar and has no capital expenditure plans this year, Mr Kan believes there will be a dividend for FY2010. However, the dividend rate is yet to be determined.

In addition to operating in fabric production, fabric processing and fabric finishing, China Taisan is also looking for downstream M&A opportunities.

It hopes to acquire 30% to 40% in a garment manufacturer, so as to offer not only fabric design, but also expand margins by offering apparel design.

Below is a summary of questions raised at the meeting and the management’s answers.

Q: To what extent is there price erosion?

Price erosion is about 2% every quarter for old products. New products are more lucrative.

To maintain margins, we try to roll out 3 to 5 new products each year through in-house R&D and collaboration with research institutes in Taiwan and in China. For example, we are investing Rmb 20 million with Wuhan University of Science and Engineering for them to develop 25 new fabric products over the next 5 years.

This works out to about S$1 million for each new product, but we expect revenues that will be generated from new products to be far greater. Wuhan University of Science and Engineering is one of China’s top textile universities. It has a track record of successful commercialization of innovative fabrics.

Q: How many new products did you launch last year?

We launched 3 products in 2009.

Q: How much did new products contribute to revenue?

More than 20% of 1Q2010 revenues came from products launched in 2009. These command higher margins.

Q: How much of your products are for export?

Based on the global quality standards required on our orders, we estimate that 10% are for the export market.

Q: Even though demand is going up, if there is a shortage in supply of raw materials, are your margins affected?

If there is a shortage of raw materials, we have to bargain for higher margins.

Related story: CHINA TAISAN, CHINA GAOXIAN, LI HENG: Riding high on industry recovery