Venue: Suntec City International Convention & Exhibition Centre

Venue: Suntec City International Convention & Exhibition Centre

Time & date: 10 am, Apr 30

TECHCOMP Holdings’ stock has shot up from 30 cents at end-2009 to 64 cents yesterday (May 3), giving a solid 117% return.

The big boost to the stock came with the company's announcement of a record US$7.4-million in earnings for FY09.

The stock now trades at close to 10X last year’s earnings, giving the company a $100-million market capitalization.

The dividend which will be paid out next month is 1.2 cents a share.

The shares traded cum 1-for-2 bonus issue until yesterday. Adjusting for the bonus issue, the stock price of 64 cents becomes 42.7 cents.

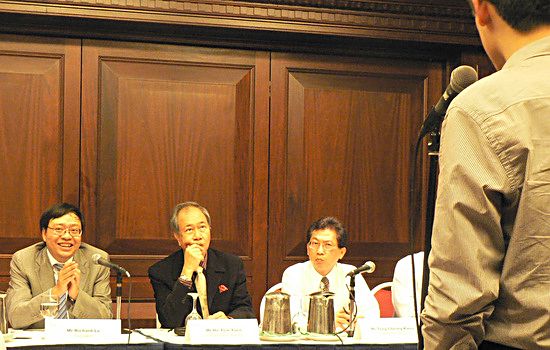

Here are highlights of the management’s Q&A session with shareholders at the AGM:

Q: Any plan to dual-list Techcomp shares in Hong Kong, for example?

Richard Lo (president & CEO): The management’s role is to run the company and grow it in a healthy way. The liquidity of our shares is not so good in Singapore but this is out of our control. Management is always looking for opportunities to bring the best value for shareholders. So we are open to all kinds of alternatives including a dual-listing in some other place. When we have some plan, we will announce to the public.

Q: How will Techcomp deal with an appreciation of the RMB?

Richard Lo: As our operations are in China, we are constantly faced with this uncertainty. The key point is, in order to survive, we always have to improve our efficiency. We have done a good job in past years and we believe our efficiency has improved more than the effects of the RMB appreciation.

In general, our competitiveness is increasing, as demonstrated by our results in the past few years.

Q: Is Techcomp involved in any M&A currently?

Richard Lo: Management is always looking for opportunities to expand our business to the global market. There are a few in the pipeline, and when they mature, we will report them to the public.

Q: What is the replacement cycle of your scientific instruments?

Richard Lo: In some ways, it is similar to mobile phones. So although their physical life can be 15-20 years, we don’t use them for that long. Similarly for our instruments. A customer may replace the instruments in 5-7 years for better functions, better software, better applications to improve efficiency.

More important is more funding from the government. So normally, the average cycle is 5-7 years, depending on the economy of the country. For Singapore, it’s 5 years. For China and India, it’s 5-6 years.

Q: Techcomp has made acquisitions in Europe recently. Lately, the euro has fallen. What is the impact on the company?

Richard Lo: I view the slowdown in Europe as being good to us. In our industry, companies are valued at 20-30X PE. I am not talking about Techcomp’s share price since different markets give different valuations and we have to perform in order to get the correct valuation.

In a recession, a company may have operational problem such as being unable to get bank loans or the future is uncertain. If you look at our announcements, we paid a very good price for the two European companies.

In the near future, before the economy fully recovers, there would be good opportunites for us, which is why we maintain resources – more cash on hand – and I apologise if you are not happy with the dividends we have proposed for FY09.

Recent story: TECHCOMP: What recession? 2009 was a record year!

The following is an excerpt of DMG & Partners’ report dated Apr 29. The analyst is Terence Wong, CFA.

Who we met: Lo Yat Keung (President)

Management’s Tone: Optimistic

Key takeaways:

(1) Techcomp is actively seeking to penetrate the global market especially the European market through a series of acquisitions and JV. Notwithstanding the recent acquisitions of Europe-based HCC (Jul 09) and Precisa (Feb 10), Techcomp is contemplating on one to two more European acquisitions.

(2) Techcomp, the medical and laboratory manufacturer cum distributor, intends to create synergies between its Asian and European operations by leveraging on the cheaper manufacturing costs in Asia as well as the technological strengths of the acquired European subsidiaries.

(3) As the European subsidiaries begin to contribute, the revenue contribution from China (~80%) as of FY09 will fall going forward.

(4) Net margins are expected to decline in the short term before rebounding as the acquired European subsidiaries are currently non-profitable.

(5) Techcomp will also be looking to hedge its currency exposure to prevent a repeat of FY08when the rapid appreciation of JPY eroded Techcomp’s profitability.

Valuation: Techcomp closed at S$0.65 on Friday, representing 7.6x FY10 earnings.