THERE IS an 80% probability that Asean stocks would move up this year, according to CIMB-GK report released yesterday (Jan 5).

Even if the markets have been buoyant from year-end till now, an entry now may be rather early given the severity of the financial and economic crisis.

That’s why CIMB-GK said 2Q09 “could look a more conservative bet.”

”After a 52% hammering the MSCI Far East ex-Japan index received in 2008, things should start to look up. The year of the castrated bull seems appropriate given our expectations for 2009,” wrote Toh Hoon Chew, the CIMB-GK analyst who authored the report.

Compelling valuations

Even if we assume that the bear market phase has yet to reach its conclusion, the risk-reward ratio looks enticing, wrote Hoon Chew, who is based in Kuala Lumpur.

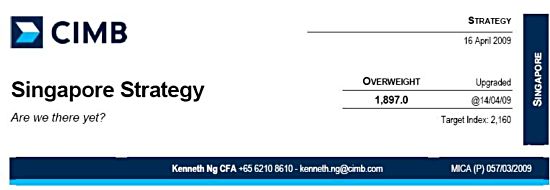

”Valuations look compelling and will be the main driver. Just as valuation compression had the far bigger impact on equity prices than earnings per share revisions in 2008, valuation expansion should work to investors’ favour in 2009, as the true extent of the downturn is gradually and fully priced in sometime in the next few months.”

With a current 80:20 probability of upside to downside in P/BV valuations for the MSCI Far East ex-Japan index, the risk-reward ratio is indeed enticing, wrote Hoon Chew.

Put another way, the MSCI Far East ex-Japan Price/Book Value valuations have an 80% probability to move up and a 20% probability to move down from current levels, based on the normally distributed P/BV data since 1996.

”At 80:20, the risk-reward ratio does indeed look attractive.”

Entry point

“We believe that 1H09 will still be a time to digest the ongoing weak economic data points that have yet to let up.

”We fancy the chances of significant 6 to 12-month returns for those with holding power, with an entry sometime in 2Q09.”

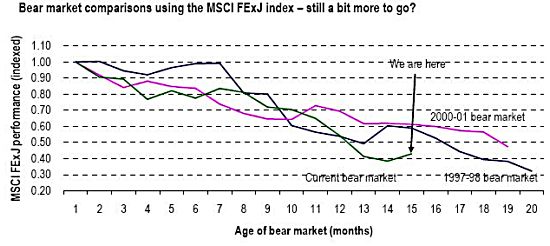

This is based on the assumption that the previous bear markets in 1997 and 2000 provide a good guide to the timing of entry into equity markets. Both the previous bear markets have lasted 19-20 months, while the current bear market has just passed the 14th month mark.

”If one believes that the current bear may take a little longer to be put to sleep, then a 2Q09 entry could look a more conservative bet.”

Recent stories:

Survey: 72% of money managers believe US equities are undervalued

UBS Investment Research: Top 9 stock picks